The actual math doesn’t work in the Magnolia State.

To hear the Mississippi legacy media and Democratic Party stalwarts tell it, “only a fool would not take the money” that the federal government is offering to bribe states to expand Medicaid. The talking heads are practically hyperventilating over the prospect to the point where you’d think members of the media have something to gain from it. Nearly every outlet in the state, both on op-ed and “news” (lite op-ed) pages, is hammering the notion that the Medicaid expansion math is irrefutable.

Let’s first state the obvious. Health care is expensive. The delivery system is broken (for a lot of reasons). With all of its intervention, the government has not made health care less expensive. In fact, it’s probably as screwed up from a pricing/delivery perspective as it has ever been.

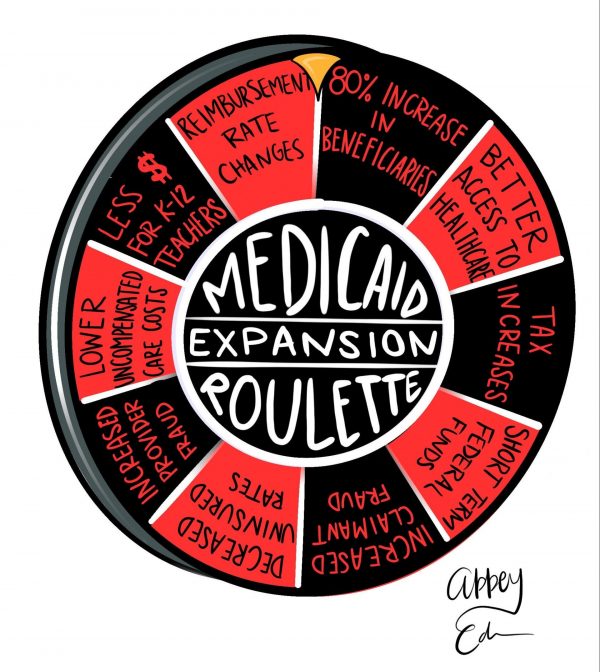

But the truth is, Medicaid expansion math is a sketchy proposition – at best. Here’s why:

-

- In other states that have expanded Medicaid, the number of projected additional beneficiaries has always proven to be low, upwards of 50% of what the final number turns out to be when the damage is done. Therefore, ongoing cost estimates have tended to run half as much as they end up, straining state budgets in the long run.

- Long term, Medicaid is not a “transitional” benefit as people tend to stay on the program a long time. Hence, Medicaid will only continue to grow in scope. In May 2011, total Medicaid/CHIP enrollees in Mississippi was 705,000. Ten years later, it was 816,000.

- The macroeconomic impact projections are overly optimistic and it is hard to look at any state whose economy has been “transformed” in retrospect after five years in the expanded program.

- Expansion will inevitably increase claimant and provider fraud as proven true in other states.

- The five year fiscal outlook says Medicaid expansion is a state budget buster unless taxes are increased or cuts are made elsewhere.

Everyone knows the Mississippi Hospital Association is pushing for a possible ballot initiative to force the Republican-led Legislature to do their bidding and expand Medicaid mainly out of self-preservation. There’s no doubt it would be good economics for hospital pocketbooks. But that move would invariably involve tax increases down the road, putting them squarely at odds with the majority of state elected officials as most are Republicans. Voters in Mississippi have shown they do not support tax increases.

There are some larger business interests, too, that look at offloading the costs of caring for employees onto the state and federal government. That would mean Medicaid expansion could easily be viewed as thinly veiled corporate welfare, something Republicans and Democrats alike tend to disdain.

Governor Tate Reeves and Speaker Philip Gunn have not budged from their opposition to Medicaid expansion. The two have repeatedly expressed their unwillingness to explore the thought, having had it squarely in their laps over the past 10 years in the Legislature. The state Senate, however, may be showing signs of weakening on the issue.

While expansion advocates, Democrats, and the media would like nothing more than to paint Republicans and Medicaid expansion opponents as heartless and uncaring, the truth is Medicaid expansion math simply does not work in Mississippi. It hasn’t for over a decade and it continues to not work for the Magnolia State, that is unless Republican lawmakers are willing to raise taxes or cut other budgets to offset the long term costs associated with expansion.

Latest from Y'all Politics Editorial Cartoon Contributor Abbey Edmonson: The Trojan Donkey. Read more: https://t.co/cMZnStL3RM pic.twitter.com/Eru45cGX8i

— Magnolia Tribune (@magnoliatribune) May 24, 2021

The good news for Mississippi is that our Medicaid program is well-run. Former Phil Bryant top staffer Drew Snyder has done an amazing job at the helm of the Division of Medicaid. But more of it doesn’t mean better. Claimant and provider fraud is an inevitable result in massive rapid increases in a government program, just ask Auditor Shad White. Neighboring Louisiana has seen more than its share.

For Republican policymakers and elected officials, supporting Medicaid expansion is like paying the cannibals to eat you last. Even entertaining such a move can and will be used against them by political opponents wherever they land on the issue.

In nextdoor Louisiana, Governor John Bel Edwards in a spat with the Legislature over Medicaid funding scared claimants by sending termination letters to build leverage on lawmakers during a budget funding crisis in 2018.

Medicaid expansion for Republican lawmakers is akin to handing someone a bigger bat to hit you with while asking the assailant, “Please, sir, may I have another?”

A May 2020 Commonwealth Fund issue brief noted that several states have explicitly raised taxes and fees to cover their share of Medicaid expansion. Other states already had provider taxes or fees that grew naturally with expansion.

“According to the most recent 50-state Medicaid Budget Survey, 11 states fund the state portion of expansion with new or expanded taxes or fees,” the brief notes. “However, nearly every state has at least one type of provider fee used to pay for Medicaid, and several have expanded or changed these taxes/fees since Medicaid expansion (such as California, Oregon, and Illinois). These taxes or fees are often explicitly tied to Medicaid expansion.”

In Louisiana, taxes were raised on health maintenance organizations (HMOs) to offset their state’s increased share.

In 2016, Louisiana initially projected their Medicaid expansion to cover 306,000. In April 2019, that number topped 500,000. It declined slightly because the Louisiana Department of Health removed tens of thousands of ineligible individuals from the rolls that were wrongly receiving benefits (claimant abuse/fraud). However, as of June 2021, the Medicaid expansion enrollment now sits just under 650,000.

Here in Mississippi, the initial predictions for Medicaid expansion was a population of roughly 170,000 people. Using other states like Louisiana as a guide, that number for Mississippi could be realistically pushing 400,000 or more new Medicaid enrollees.

Then real question, then, is what the net effect of the state’s portion of the Medicaid spend per year will be after the increased federal match ends in two years?

The answer is more than the MHA, the media or Democratic Party is willing to confess to because Mississippi could only afford it through tax increases or perhaps cutting K-12 education.

According to the numbers, Mississippi’s current non-federal share for Medicaid is roughly $1.4 billion annually. The Mississippi Division of Medicaid accounts for nearly $900 million of this while the other comes in through provider taxes and other agencies.

Under the daydream math of the MHA and legislative Democrats, Mississippi stands to make money (or at least “break even”). While projections show that the first two years of expansion would be either a net gain or a wash for the state because of the 5% Federal Medical Assistance Percentage (FMAP) “sweetener” for 8 quarters that was inserted into the American Rescue Plan for new expansion states, year three and beyond would prove to be quite costly for Mississippi taxpayers.

Again using Louisiana as a guide and assuming the rate of medical inflation coupled with the regular federal assistance, in years 3-5, Mississippi’s non-federal share would likely grow $300-$400 million over current levels. That’s enough money to pay K12 teachers $5,000 per year or more.

Despite what you’re being told by the media, those who own hospitals and Democrats that seem insistent on a massive increase in the number dependent on the program, Medicaid expansion is not the panacea it’s being made out to be… and if you pay taxes in Mississippi, you could soon find out exactly what it will cost you should those special interests get their way.