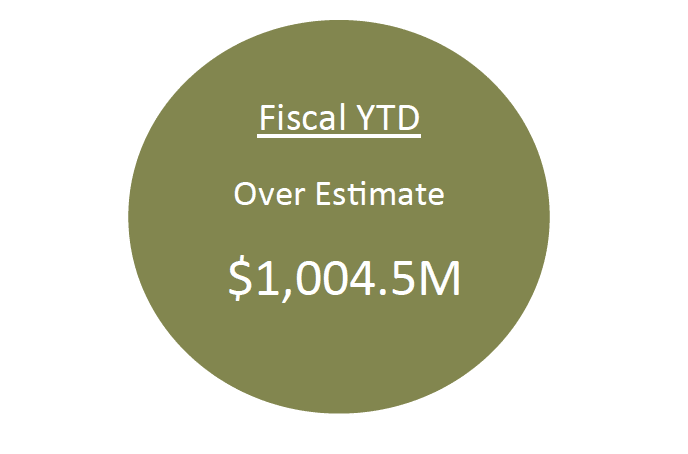

Mississippi revenue report totals $1,004.5 million, or $1 billion over sine die estimates year-to-date.

The May revenue report was released on Wednesday and reported an overage of over $1 billion for the entire year up until this point, and over $200 million just for the month of May.

“We are in the best financial shape, the best fiscal shape the state has ever been in,” said Governor Tate Reeves regarding the current financial status.

He said to be in this place in Mississippi after already enacting the largest tax cut in the state’s history five years ago is incredible. He said he hopes to see revenue reports continue to increase as the federal unemployment benefits are cut in two days and more people return to work.

Reeves said the overage is due to sales tax collections and individual income tax collections but does not federal dollars that were awarded to the state over the last year.

“The revenue numbers are certainly encouraging, which puts us in a strong position to eliminate the income tax. Although, we have to realize that a lot of the excess revenue we’re seeing now is due to the billions of federal stimulus and unemployment monies that flowed into our state. Once the stimulus ends we anticipate we will return to a pre-COVID revenue trend,” said Speaker of the House Philip Gunn.

Total revenue collections for the month of May FY 2021 are $200,291,078 or 44.56% above the sine die revenue estimate. Fiscal YTD revenue collections through May 2021 are $1,004,457,836 or 20.10% above the sine die estimate. Fiscal YTD total revenue collections through May 2021 are $951,071,539 or 18.84% above the prior year’s collections. The FY 2021 Sine Die Revenue Estimate is $5,690,700,000.

The graph above compares the actual revenue collections to the sine die revenue estimate for each of the main tax revenue sources. The figures reflect the amount the actual collections for Sales, Individual, Corporate, Use and Gaming taxes were above or below the estimate for the month and fiscal year-to-date. The graph also compares fiscal year-to-date actual collections to prior year actual collections, as of May 31, 2021.

May FY 2021 General Fund collections were $194,195,855 or 42.62% above May FY 2020 actual collections. Sales tax collections for the month of May were above the prior year by $50.2M. Individual income tax collections for the month of May were above the prior year by $137.3M. Corporate income tax collections for the month of May were below the prior year by $17.0M.

FY 2021_ Revenue Report_05-31-2021 by yallpolitics on Scribd