Bipartisan, Bicameral Legislation Would Boost Investment in Rural and Distressed Communities

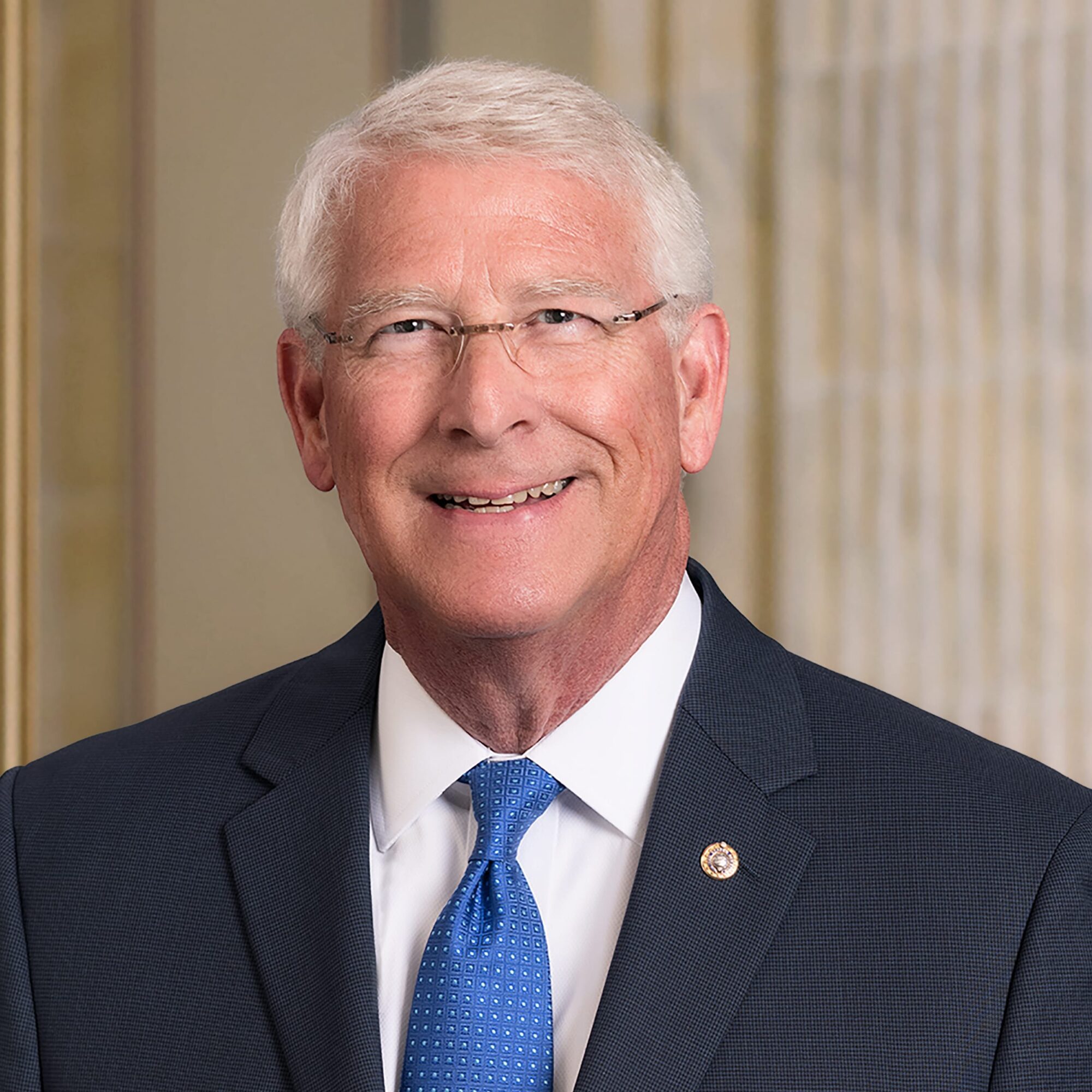

WASHINGTON – U.S. Senators Roger Wicker, R-Miss., Mark Warner, D-Va., Shelley Moore Capito, R-W.Va., and Ben Cardin, D-Md., along with U.S. Representatives Terri Sewell, D-Ala. and Jason Smith, R-Mo., today introduced the “Rural Jobs Act” in the U.S. Senate and House of Representatives. This bipartisan, bicameral legislation would build on the success of the New Market Tax Credit (NMTC) by bringing hundreds of millions of dollars in private investment to some of the poorest rural communities in America.

“The Rural Jobs Act would be an important addition to the successful New Market Tax Credit program, which has spurred tens of billions in private investment in many distressed communities across America,” Senator Wicker said. “The legislation we have introduced today would help boost these investments in rural areas and ensure that every community is receiving a proportionate share of the benefits of the NMTC.”

“During my time as Governor and in the Senate, I’ve supported initiatives to help create jobs and boost economic opportunity for all Virginians. There’s a lot happening in parts of Southwest and Southside Virginia, but we still have more work to do to ensure that no part of Virginia is left behind. That’s why I’m proud to introduce this legislation to set aside additional tax credits for rural and underserved regions,” Senator Warner said.

“The New Markets Tax Credits program has played a vital role in helping economically distressed communities in West Virginia attract the private capital needed for economic development investments,” Senator Capito said. “The Rural Jobs Act expands upon this already powerful tool by ensuring these investments occur in the communities that need them the most. I’m proud to support this legislation that I know will go a long way in providing the boost these areas of West Virginia need.”

“In Maryland, the New Markets Tax Credit has been deployed throughout our state on a diverse range of infrastructure and community development efforts. I am pleased to support this bipartisan legislation, which will further the reach of the program to low-income rural communities, creating jobs and stimulating our economy across Maryland and across America,” said Senator Cardin.

“Alabama’s 7th District knows from experience that the New Market Tax Credit is a proven, cost-effective incentive that spurs investment in areas like Aliceville, where the credit helped transform the Huyck Felt brick plant into a new wood pellet manufacturing facility, creating 275 jobs, and Selma, where the program helped create 55 jobs at a biomass processing facility,” Rep. Sewell said. “Too many small towns are struggling to survive, which is why it is critically important that we expand the NMTC to incentivize investment in rural areas and, especially, persistent-poverty rural areas like many of those in the Black Belt to help ensure these communities are not left behind.”

“The Rural Jobs Act will allow for new economic opportunities in the areas of our country that need it the most,” Congressman Smith said. “By building on the success of the New Markets program, the Rural Jobs Act will bring investment to rural communities with persistent poverty and high migration. It is too often that rural communities are overlooked by Washington. This legislation is a targeted approach that will encourage investment in rural America.”

The Rural Jobs Act would expand upon the NMTC program, which provides a modest tax incentive to private investors to invest in low-income communities. NMTC projects have spurred over $42 billion in private investment and generated over 1 million jobs since 2000. However, less than one in four NMTC jobs have been created in rural communities.

The Rural Jobs Act would help to close the job creation gap by designating $500 million in NMTC investments for “Rural Job Zones,” which are low-income communities that have a population smaller than 50,000 inhabitants and are not adjacent to an urban area. Under this new definition, Rural Job Zones would be established in 342 out of the 435 congressional districts across the country.

The bill would also require that at least 25 percent of this new investment activity be targeted to persistent poverty counties and high migration counties. There are approximately 400 persistent poverty counties in the United States, 85 percent of which are located in non-metro or rural areas.

Read the full text of the Rural Jobs Act here.