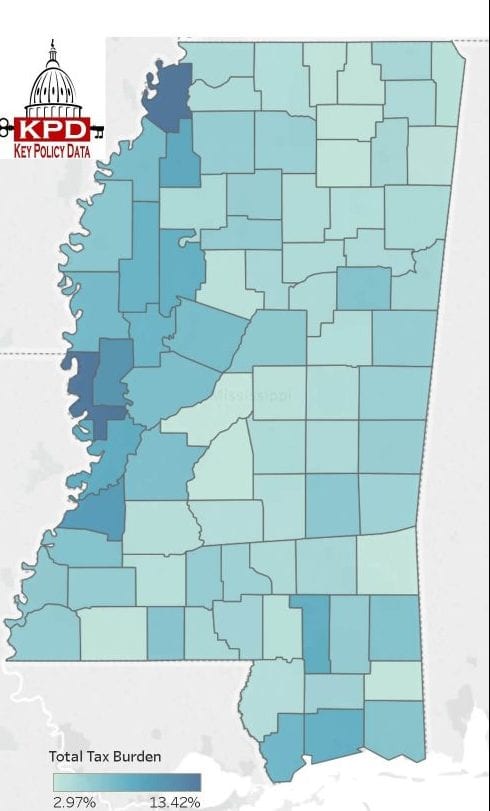

According to Key Policy Data, Mississippi showed collections of $10.8 billion in state and local taxes for Fiscal Year 2016. that averages out to be about $3,623 for every resident. The question is, what does that tell us about about the average Mississippi taxpayer and are they being taxed too much?

Results in Mississippi suggest that the responsibility of creation of new wealth and income comes from the private sector, therefore having a higher tax burden is ultimately hurting the states private sector when compared to other states.

“The report is just additional confirmation of what we have said for three years running. The narrative that Mississippi government is small and that it is tax starved is categorically false. Our reliance on big government is stifling private growth and the taxman’s take makes it harder for families to meet basic needs. That’s why AFP has and will continue fighting for taxpayers across the board,” said Russ Latino with Americans for Prosperity.

The report compares tax burden and looks at it in a unique way, by comparing tax burden with the ability to pay or private sector economic output.

In the charts below you’ll see the impact of taxes on Mississippians over the last several years.

The 20 Mississippi counties with the highest local government tax burden include:

- Tunica County, MS (13.4 percent)

- Issaquena County, MS (13.1 percent)

- Sharkey County, MS (10.6 percent)

- Claiborne County, MS (10.0 percent)

- Quitman County, MS (9.0 percent)

- Warren County, MS (8.5 percent)

- Forrest County, MS (8.4 percent)

- Leflore County, MS (8.3 percent)

- Harrison County, MS (8.1 percent)

- Sunflower County, MS (8.0 percent)

- Humphreys County, MS (7.7 percent)

- Hancock County, MS (7.6 percent)

- Washington County, MS (7.4 percent)

- Holmes County, MS (7.1 percent)

- Coahoma County, MS (7.1 percent)

- Yazoo County, MS (6.9 percent)

- Hinds County, MS (6.9 percent)

- Jefferson County, MS (6.6 percent)

- Greene County, MS (6.5 percent)

- Oktibbeha County, MS (6.5 percent)

The 20 Mississippi counties with the lowest local government tax burden include:

- Marshall County, MS (3.9 percent)

- Pearl River County, MS (3.9 percent)

- Smith County, MS (3.8 percent)

- Simpson County, MS (3.8 percent)

- Copiah County, MS (3.8 percent)

- Lincoln County, MS (3.7 percent)

- Lamar County, MS (3.6 percent)

- Tishomingo County, MS (3.6 percent)

- Leake County, MS (3.5 percent)

- Carroll County, MS (3.5 percent)

- Itawamba County, MS (3.4 percent)

- Amite County, MS (3.3 percent)

- Tippah County, MS (3.3 percent)

- Benton County, MS (3.3 percent)

- Pontotoc County, MS (3.3 percent)

- Union County, MS (3.2 percent)

- Rankin County, MS (3.2 percent)

- George County, MS (3.1 percent)

- Wayne County, MS (3.1 percent)

- Madison County, MS (3.0 percent)