SUN HERALD | Editorial: Let’s not encourage pushing Mississippi deeper into debt

State Treasurer Lynn Fitch says her recently released “Debt Affordability Study” is “a critical tool” to help policymakers assess Mississippi’s debt. It could also be called a warning.

According to Fitch, Mississippi could borrow nearly $2 billion over the next five years and state revenue might increase enough to cover the cost.

But just because the state could borrow so much money does not mean it should. And though we hope her revenue predictions are correct, they are forecasts, not certainties.

Indeed, the study includes the fact that Fitch Rating Services (no relation to the treasurer) has revised its outlook for Mississippi from stable to negative. “Of particular concern,” according to the debt study, “are (Mississippi’s) unfunded pension liabilities being among the highest of the states and the continued reliance on one-time revenue sources to fund ongoing operations.”

The report also uses such cautionary terms as “expected,” “estimates,” “projected,” “risks” and “uncertainties” when discussing state finances.

What is certain is bonded indebtedness soared from more than $2.2 billion in 2000 to more than $4.1 billion in 2012.

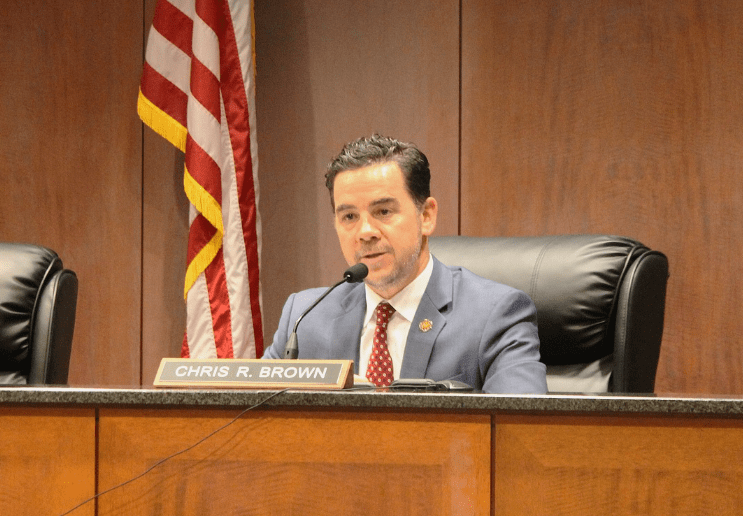

It has been declining since then, due in large measure to Fitch’s predecessor as state treasurer, Lt. Gov. Tate Reeves. As the presiding officer of the state Senate, Reeves has championed lowering, rather than raising, the state’s bonded indebtedness.

We support Reeves in those efforts.

Unlike the federal government, state government must operate under a balanced budget. So the state does not have the equivalent of the federal “debt ceiling.”

But the state can go into debt by issuing bonds, and there is a limit to bonded indebtedness.

The Mississippi Constitution of 1890 limits such debt to “one-and-one-half times the sum of all the revenue collected by it for all purposes during any one of the preceding four fiscal years, whichever year might be higher.”

In 2000, when the bonded indebtedness was $1.268 billion, it was 29.68 percent of the constitutional debt limit of $7.643 billion.

In 2012, even though the bonded indebtedness had nearly doubled to $4.131 billion, it was just 33.04 percent of the debt limit because state revenue had also increased significantly, pushing the constitutionally permissible debt limit to $12.505 billion.

So legally, the Legislature could put the state approximately $8 billion deeper in bonded indebtedness.

But the $4 billion Mississippians already owe bondholders costs taxpayers some $375 million each year. Tripling that amount to $12 billion would, of course, cost taxpayers considerably more.

The consequences, according to Reeves’ spokeswoman Laura Hipp, should be obvious: “Every dollar Mississippi spends to pay off debt is a dollar that cannot fund education or health care or public safety. Paying debt service is the second highest cost in the budget, and Lt. Gov. Reeves is committed to bringing that number down. … The days of just ‘bonding’ every project every state agency wants are over.”

As well they should be.

Sunherald

3/22/14