COCHRAN PRAISES HOUSE PROGRESS ON FLOOD INSURANCE REFORM MEASURE

WASHINGTON, D.C. – U.S. Senator Thad Cochran (R-Miss.) today praised the passage of legislation in the House of Representatives that, like a Senate-passed bill he helped write, would protect homeowners, businesses and communities from unreasonable flood insurance premiums without jeopardizing the stability of the National Flood Insurance Program (NFIP).

Cochran said the Homeowner Flood Insurance Affordability Act (HR.3370) that the House of Representatives approved (306-91) Tuesday evening, would achieve the primary goals of the Senate-passed companion bill he helped author to address problems exposed with implementation of the Biggert-Waters Flood Insurance Reform Act of 2012 by the Federal Emergency Management Agency (FEMA).

“The prospect that families and property owners who have played by the rules could be priced out of their homes because of flood insurance costs is real and a threat to the future of the flood insurance program,” Cochran said.

“I am pleased that the House, much like the Senate, has reached an agreement to protect homeowners, businesses and communities. It is a plan that would hold FEMA accountable and continue reforms that will maintain the viability of the National Flood Insurance Programs. I am optimistic we can resolve our differences with the other body and get a bill signed into law that is responsible and responsive to the needs of the people,” he said.

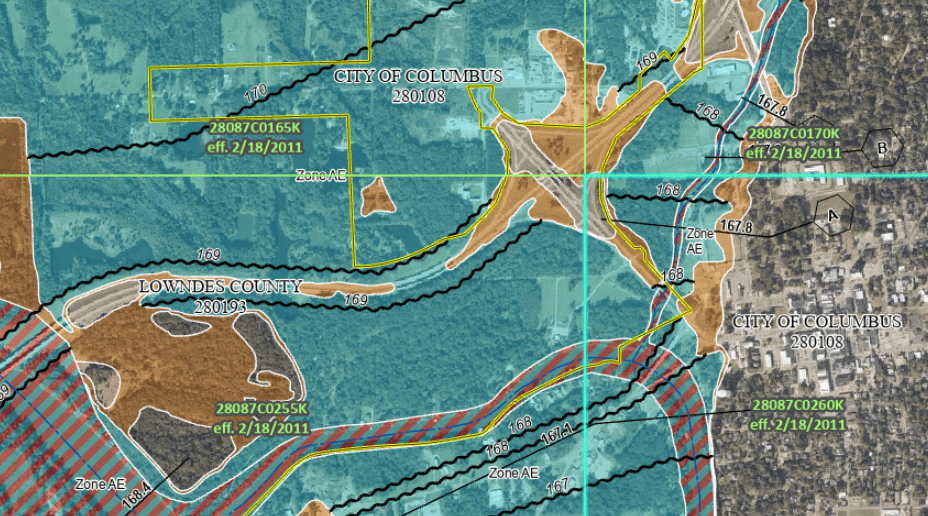

The House bill includes offsets for the costs of modifying Biggert-Waters, the reform law that threatens NFIP policyholders in Mississippi and across the country with unaffordable premium cost increases. The House measure, among other things, would limit annual policy rate increases, force FEMA to certify its mapping methodology, and set milestones for FEMA to carry out a flood insurance rate affordability study.

Cochran, who serves on the Senate appropriations subcommittee with jurisdiction over FEMA, has been one of the Senate’s leaders on flood disaster policy in recent years, helping to restore the Gulf Coast following Hurricane Katrina, build flood control infrastructure throughout Mississippi that minimized damage from the Mississippi River flood of 2011, and reforming the way FEMA considers flood control infrastructure when setting insurance premiums.

Wicker Statement on House Passage of Flood Insurance Bill

U.S. Senator Roger Wicker, R-Miss., today issued the following statement after the House of Representatives passed H.R. 3370, the “The Homeowner Flood Insurance Affordability Act:”

“Today’s vote in the House signals strong bipartisan and bicameral support for providing relief to homeowners and businesses from drastic flood insurance premium hikes. Millions of Americans are facing massive increases in flood insurance rates, which would threaten livelihoods and communities nationwide. I am hopeful that we can reach a swift compromise between the Senate and House versions of this critical legislation. We need to get a bill to the President to sign.”

In February, Wicker voted to pass a bill, S. 1926, to delay flood insurance premium hikes until the Federal Emergency Management Agency’s (FEMA) mapping methods are certified as technically sound and an affordability study is completed.

Palazzo on Passage of House Flood Insurance Bill

Congressman Steven Palazzo, (MS-4), today praised House passage of H.R. 3370, The Homeowner Flood Insurance Affordability Act. The bill passed with overwhelming bipartisan support by a vote of 306-91.

In remarks on the House floor, Palazzo stated:

“Our bill is the result of extensive bipartisan, bicameral work over the past year. This bill is both compassionate and fiscally responsible. From the start, my priority has been to ensure that flood insurance remains affordable and available – in Mississippi and across the country. Our bill meets those goals.

“Many of the people who are now facing unrealistic, overnight increases followed all the rules. They went to great effort and expense to build back to FEMA standards after storms like Hurricane Katrina.

“Congress never intended to punish responsible homeowners. Yet, that is exactly what FEMA is doing as it implements the law with flawed maps and procedures. These actions are threatening individuals and entire communities. I’m not talking about wealthy waterfront homeowners. In South Mississippi, I’m hearing from teachers, veterans, fishermen, people who work at the shipyards in support of our U.S. Navy. Many live 100 miles inland.

“Our bill holds FEMA accountable and provides real, responsible relief and lasting reforms. I urge my colleagues to join me in strong support of this bill.”

The bill passed with wide bipartisan support following weeks of work by Palazzo and House leaders to craft a balanced package. In previous statements, Palazzo noted that H.R. 3370 “reflects South Mississippi concerns,” and makes several key changes to the existing Biggert-Waters Act of 2012 without adding to the deficit.

It would repeal Section 207 of the law and restore grandfathered rates, making permanent Palazzo’s delay that was recently signed into law as part of the omnibus budget bill. Under Biggert-Waters, homes lost grandfathered rates once a property was sold or maps were changed, resulting in drastic, overnight rate increases in some cases. The new legislation does away with home sale triggers, retroactively refunds home sale increases on pre-FIRM properties, and ties premiums to properties, not people. The House plan would also ensure that FEMA does not move the goal posts on those who built back to code after storms like Hurricane Katrina.

Palazzo pushed for inclusion of several other measures to hold FEMA accountable. Those measures include requirements that the agency certify its mapping methodology, expedite an affordability study, reimburse policyholders who successfully appeal FEMA maps, and establish a flood insurance advocate. Under Palazzo language submitted in 2011, the Technical Mapping Advisory Council, which would certify FEMA maps, must include adequate representation from the Gulf Coast. FEMA would also be required to notify communities of remapping as well as which models are being used in the mapping process. Further, FEMA will also be required to provide an affordability framework within 18 months after the affordability study is completed.

The new House bill would also push FEMA to restrict rates to equal no more than one percent of home values, with yearly increases for individuals capped at eighteen percent of the previous year’s policy. The difference in rate calculations could mean thousands of dollars in annual relief for South Mississippi homeowners.

Senate flood insurance leaders, such as Senators David Vitter and Mary Landrieu, have also expressed support for the House bill.

Below is a list of local entities, industry experts, and national stakeholders that have endorsed the House bill:

Jack Norris, President, Gulf Coast Business Council: “H.R. 3370 provides long-term sustainability to the National Flood Insurance Program while balancing the need to provide certainty in the market place to continue to attract and grow businesses along the Mississippi Gulf Coast. … We appreciate your focused efforts on this issue, and we look forward to the passage of H.R. 3370.”

Mayor Billy Hewes, City of Gulfport: “Passage of H.R. 3370 is critical to the City of Gulfport and other shoreline communities across the country. Coastal communities are the economic engines of the country, and certainly in the State of Mississippi, contributing an estimated $6.6 trillion to the nation’s gross domestic product. I applaud your exhaustive efforts and leadership in the U.S. House of Representatives as well as the work of Senator Cochran and Senator Wicker in the U.S. Senate to pass relief measures.”

Marty Milstead, Executive Vice President, Home Builders Association of Mississippi (excerpted): “You are to be commended on your efforts to get this critical legislation to the House floor for a vote. H.R. 3370 will provide much needed relief to homeowners, real estate professionals, and our communities, and we appreciate your role in ensuring Mississippi priorities were included in the final version of the bill.”

Janice Shows, President, Mississippi Association of REALTORS (excerpted): “In just the short time since its enactment, the Biggert-Waters Act has led to numerous failed real estate closings and threatened to freeze the real estate markets across Mississippi and the rest of the nation. H.R. 3370 reverses these devastating effects and serves as a lifeline to homeowners…Again, we offer our gratitude for your tireless work toward flood insurance reform over the last year.”

James Ballentine, Executive Vice President for Congressional Relations and Political Affairs, and J. Kevin A. McKechnie, Senior Vice President and Director, Office of Insurance Advocacy, American Bankers Association (excerpted): “The American Bankers Association and the American Bankers Insurance Association strongly supports H.R. 3370, the Homeowner Flood Insurance Affordability Act being taken up by the House of Representatives this week. This important bill addresses National Flood Insurance Program (NFIP) affordability issues and corrects other unintended consequences resulting from earlier reform efforts.”

National Association of Federal Credit Unions “Thank you for scheduling a vote on the Homeowner Flood Insurance Affordability Act of 2014 (H.R. 3370). We are already hearing reports from our member credit unions that sharp rises in premium increases are materializing and time is of the essence in addressing this issue.”

Mr. James Tobin, III, Senior Vice President and Chief Lobbyist, National Association of Home Builders (excerpted): “We are especially concerned about unaffordable premiums and inaccuracies in FEMA’s new flood maps. These issues are seriously impacting the construction, remodeling and sale of homes throughout the country at a time when the housing industry is beginning to recover. The Homeowner Flood Insurance Affordability Act as amended, resolves these issues by providing a more affordable rate structure for policyholders, and repeals point-of-sale rate increases… These provisions will help prevent undue hardship on the recovering housing market, protect home values and increase the viability of the NFIP.”

Mr. Steve Brown, 2014 President, National Association of REALTORS® (excerpted): “On behalf of over 1 million members, the National Association of REALTORS® strongly urges you to vote for H.R. 3370, the Homeowner Flood Insurance Affordability Act with an amendment. The bill as amended would resolve most of the unintended consequences and uncertainties created by implementation of the Biggert- Waters law and still raise revenue. It would correct the unintended consequences by repealing key provisions that are driving the most excessive and inaccurate rate increases imposed on recent home purchases. It would also require that the Federal Emergency Management Agency (FEMA) refund excessive premiums to those who already bought a home but were not warned by FEMA of the increase before purchasing the property.”

Mr. Michael Hecht, President and CEO of Greater New Orleans, Inc., on behalf of the Coalition for Sustainable Flood Insurance: “The legislation proposed by the House of Representatives achieves many of our most important goals. The bill should both protect property owners who have played by the rules and settle real estate markets, while preserving the intent to offer flood insurance at true risk rates. Our coalition will work towards bi-partisan passage of this legislation: ensuring flood insurance remains affordable, while protecting the solvency of the NFIP.”

Mr. Camden Fine, President and CEO, Independent Community Bankers of America (excerpted): “On behalf of the 7,000 community banks represented by ICBA, I write to express our support for the Homeowner Flood Insurance Affordability Act of 2014 (H.R. 3370), introduced by Rep. Michael Grimm, which would provide relief from flood insurance premium ‘shock’ that is depressing home values and freezing the market in certain communities. Importantly, H.R. 3370 will provide this relief while ensuring the actuarial soundness of the National Flood Insurance Program (NFIP).”

GREGG HARPER STATEMENT OF SUPPORT FOR FLOOD INSURANCE BILL

Good evening–

The House passed a bill earlier this evening to address steep hikes in flood insurance rates facing many Mississippi homeowners and businesses.

Superstorm Sandy and last year’s flooding out west were brutal reminders of what Hurricane Katrina did to Mississippi in 2005. These tragedies demonstrate the need for a strong flood insurance program to help innocent victims of natural disasters across the country.

Since the last reauthorization of the National Flood Insurance Program, an unintended consequence has arisen where many homeowners and businesses nationwide will see astronomical increases in their premiums. Some could see their costs rise to such unaffordable rates that it would jeopardize their ability to get or maintain a mortgage.

This is not what Congress had in mind when we reauthorized the program.

Today’s bill made a number of reforms to strengthen the future financial solvency and administrative efficiency of the National Flood Insurance Program, while providing more transition time and protection for current homeowners. From refunding excess premiums to completing an affordability study, this bill helps Mississippians.

Our end goal is to make sure that folks impacted by natural disasters are paid on time. We also want to see the program stand on its own, saving taxpayers money. We are not there yet. But this bill, championed by my good friend Steven Palazzo, puts us on that path.

I am committed to ensuring that an affordable safety net is in place when Mississippians are affected by natural disasters.

God Bless,

Gregg Harper

Member of Congress

Press Releases from Respective Congressional Offices

3/4/14