Gene Taylor’s Costly Beach House Bailout

Just about anyone can find a reason to hate the “Multi-Peril Insurance Act” that the House of Representatives will vote on this week. The bill, which would turn the federal government into an insurer for just about every hurricane-prone house in the country, is a beach house bailout with enormous costs and no real benefits. Quite simply, it can’t work and would do enormous environmental damage. But it still has a chance of passing.

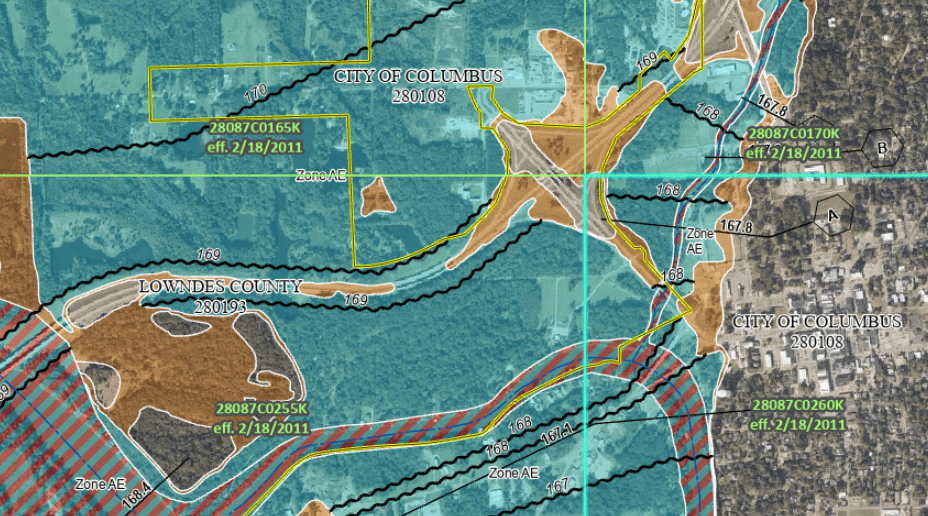

Some background first: Rep. Gene Taylor, the law’s chief sponsor, lost his house in the 2005 hurricane season and has been on a crusade to change the insurance system ever since. The way he tells it, insurance companies use flood coverage (a government program since 1968) to avoid paying wind claims when both wind and water damage a building. Since many people neglect to purchase flood coverage, furthermore, some homeowners’ who suffer total losses end up with nothing. Thus, he wants the federal government to cover both water and wind through the existing National Flood Insurance Program and thereby remove private industry from any substantial role in insuring against hurricane prone properties. His bill, furthermore, contains lots of reassuring language that seems to make the wind insurance program self-sustaining.

FrumForum

7/23/10