Legislature’s tax measures a mixed bag

People toiling to have their income-tax returns done by Wednesday’s deadline can look ahead to a variety of changes the state Legislature recently made for Mississippi’s tax structure.

Most of the legislation impact sales taxes and take effect in July.

Among the new laws are a sales-tax holiday and a broadened sales-tax exemption on home-medical supplies for Medicaid and Medicare recipients. Another law makes sure people pay sales taxes on downloaded music and video bought through the Internet.

The Legislature approved a bill to provide an income-tax credit for furniture makers, but it was vetoed by Republican Gov. Haley Barbour.

Bills that died include measures to expand the homestead-tax exemption and cut the business-inventory tax.

The Legislature convened its annual session in January and recessed April 1 to return later to pass the state budget.

Still in flux this legislative session: a cigarette tax increase, the state’s diminishing car-tax reduction fund and a hospital tax to help plug up a Medicaid budget deficit.

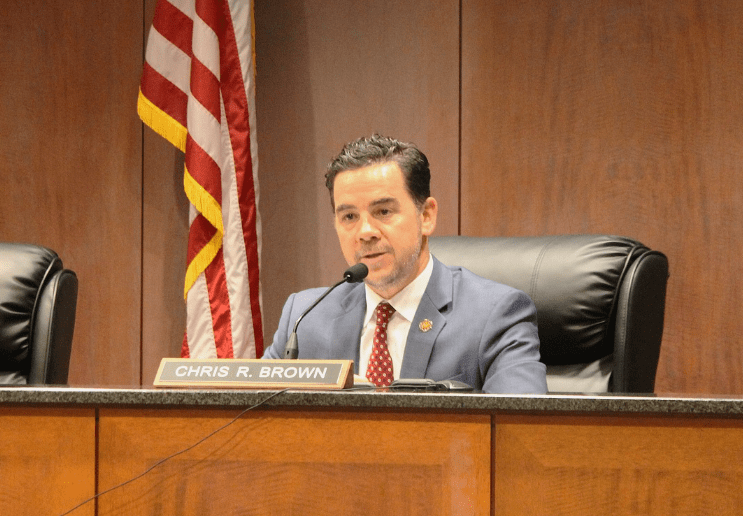

Lt. Gov. Phil Bryant said the tax reductions passed by the Legislature are among the top achievements of the 2009 session.

“Targeted tax cuts were a central theme in my common-sense agenda. In this tough time, these tax cuts will help stimulate Mississippi’s economy,” said the Republican Senate president.

That was the impetus behind the furniture-industry tax break that passed the Legislature but which Barbour vetoed.

Commercial Dispatch 4/15/9