Gov. Phil Bryant has signed legislation that creates a first-in-the-nation tax credit for targeted investments in Mississippi’s foster care system.

Sponsored by Rep. Mark Baker (R-Brandon), The Children’s Promise Act (HB 1613) will provide concrete assistance to nonprofit organizations working on diverse problems around the state, including human trafficking, opioid addiction, and autism.

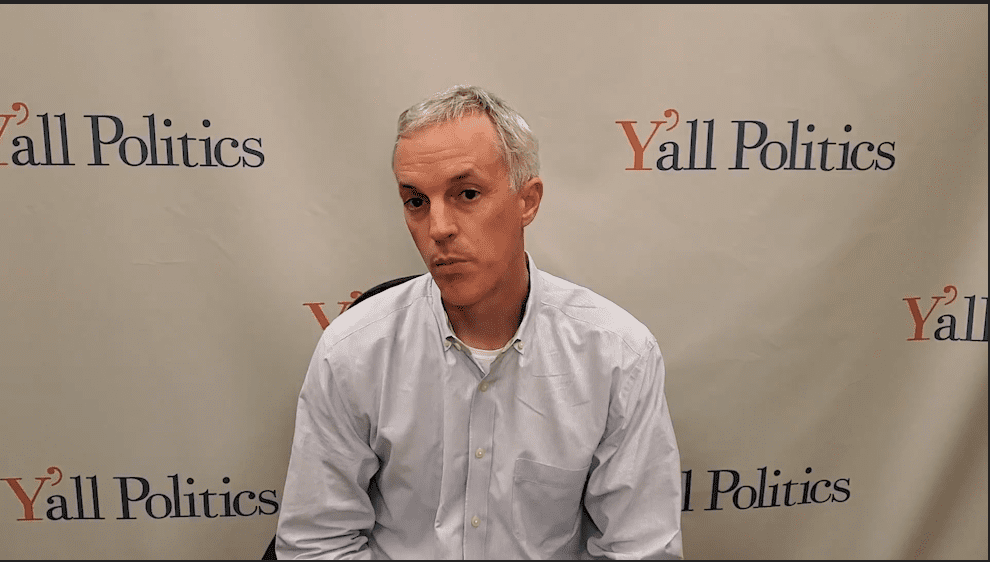

Dr. Jameson Taylor, Vice President for Policy with the Mississippi Center for Public Policy explains why this legislation is so important: “No one person or entity has all the answers when it comes to foster care. This tax credit will crowdsource the solutions by inviting new donors to support the development of much-needed services to children and families in crisis.”

According to the National Council of Nonprofits, tax incentives for charitable giving generate as much as a 5 to 1 return. Some of the Mississippi nonprofits eligible for this credit receive no government money, meaning that every child they divert from foster care saves money for the state.

One of these is Baptist Children’s Village. Others, like Canopy Children’s Solutions, are leveraging modest grants into multimillion dollar savings for the state. In addition, these nonprofits are generating significant long-term savings by helping to break cycles of abuse, poverty and welfare dependency.

“Due to changes in federal funding, foster care providers are being forced to reorient their services,” said Taylor. “Some of them are closing certain facilities, others are facing closure altogether. The Children’s Promise Act creates an innovative funding model that will help foster care nonprofits proactively work with the Department of Child Protection Services (CPS) to continue to address the challenges raised by the Olivia Y lawsuit.”

In 2018, the legislature passed a $1 million tax credit for individual donations made to nonprofits working with foster care kids, disabled children, and low-income families. This program was based on a successful model in Arizona. HB 1613 expands this individual credit to $3 million. The Children’s Promise Act also creates a $5 million business tax credit targeted toward nonprofits working directly with CPS. Mississippi is the first state in the country to enact a business tax credit for donations to foster care providers.

“This new law will encourage game-changing investments in foster care,” concluded Taylor. “Mississippi is continuing to lead the way in transforming lives and communities by passing best-in-the-nation welfare reform and, then, empowering the private sector to work alongside government in addressing generational poverty.”

The Children’s Promise Act is endorsed by the Mississippi Center for Public Policy, the Mississippi Association of Child Care Agencies, and the Governor’s Faith Advisory Council.

Mississippi Center for Public Policy Press Release

4/22/2019