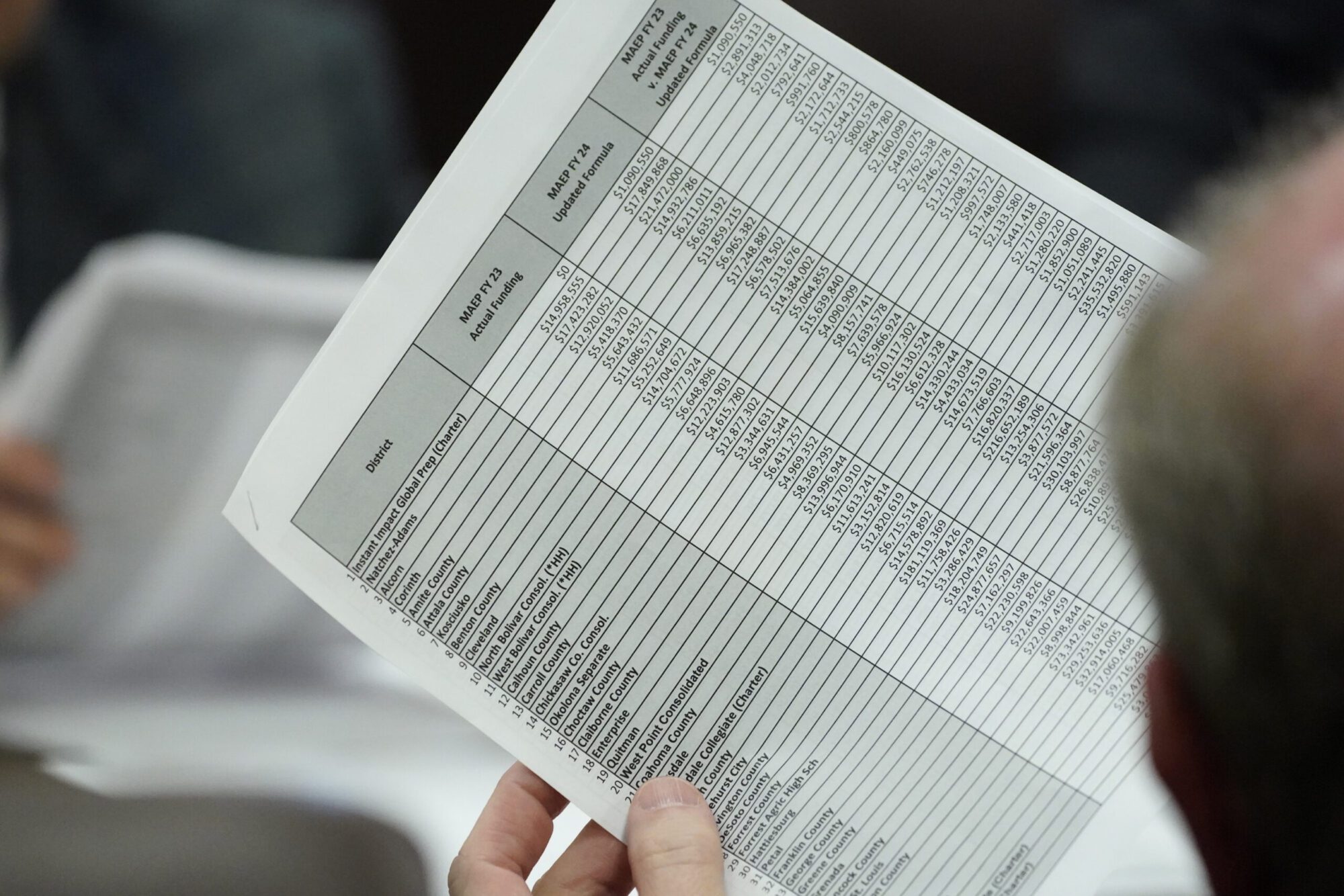

A Senate Appropriations Committee member reviews proposed legislation at the Mississippi Capitol in Jackson. (AP Photo/Rogelio V. Solis - Copyright 2023 The Associated Press. All rights reserved.)

- Current law caps property tax rates for local school districts. MDE officials told lawmakers changes to the student funding formula may require lifting the cap to increase rates.

The Mississippi Legislature made a bold move during the 2024 legislative session, ending the decades-old Mississippi Adequate Education Program (MAEP) in favor of a new funding formula, the Mississippi Student Funding Formula (MSFF).

The MSSF created a series of new “weights” that increased per student funding for low income, special needs and English language learning students, among other special categories. Advocates for the change argued the weights will ensure students are funded based on their unique needs, instead of treating all students the same.

The new formula went into effect in July. Ahead of the 2025 legislative session, lawmakers on the Senate Education Committee received an update from the Mississippi Department of Education on how the new funding formula is working thus far.

Sparsity Funding

While the new formula led to an overall increase in education funding of nearly $200 million, representatives with the Mississippi Department of Education told lawmakers there were areas where funding could potentially decline for certain school districts.

Chief of Operations Dr. Felicia Gavin explained that a shift from the transportation component contained in MAEP to the MSFF sparsity calculation could mean less transportation funding for more heavily populated districts once a three-year hold harmless provision expires.

The hold harmless provision in the legislation ensured districts would not receive less funding than the previous fiscal year.

According to Dr. Gavin, about 60 school districts in the state did not receive sparsity funding.

“In FY 24 [under MAEP], the transportation piece accounted for about $89 million, for transportation in FY 25 the component based on sparsity is about $40 million,” Gavin explained.

Senate Education Chairman Dennis DeBar (R) asked Dr. Gavin if the districts not receiving sparsity funding still received transportation funding. Gavin explained that while the affected districts did not receive specific transportation funds, the total amount received in these districts was higher under the new formula than under MAEP.

The Mississippi Department of Education offered additional explanation to Magnolia Tribune on how the hold harmless provision is working.

“MDE calculates each component of the funding formula to determine a district’s allocation. If a district’s funding is calculated to be lower than the previous year’s, the hold harmless provision allows for additional funds to be added to the allocation so the district will receive the same amount of funds as it did the previous year,” MDE stated. “The additional amount is not distributed among calculation components but is allocated in a lump sum to be used as needed by the district.”

Senator DeBar reminded the committee that the hold harmless provision was added to give districts with declining populations, and therefore declining budgets, time to acclimate to the anticipated reduction in funding.

The hold harmless provision expires in Fiscal Year 2028, according to HB 4130.

MDE Wants CTE Program Weight Expanded to Lower Grades

Another of the weights discussed with Senators was the career and technical education (CTE) part of the new funding formula.

MDE noted that school districts offering CTE courses to 7th and 8th grade students were not receiving additional funding since MSFF only focused on providing funding for CTE courses offered to students in grades 9 through 12.

Dr. Gavin suggested lawmakers consider expanding the weight to include CTE classes in the lower grade levels.

It’s unclear what additional expense would be generated by expanding the CTE weight to middle schools. When asked how much it would cost to provide weighted funding through the MSFF formula for CTE classes in the 7th and 8th grades across the state, the department told Magnolia Tribune, “MDE doesn’t have the funding information as it is not something that we have calculated.”

According to information provided by MDE through a public records request, a majority of the state’s 138 school districts – over 100 – currently offer some version of CTE courses to students in the 7th and 8th grades.

The information MDE provided shows that one of the more prevalent courses offered by public schools in grades 7 and 8 is Cyber Foundations, which helps students become computer proficient while building certain life skills. Cyber Foundations I includes coursework on keyboarding, word processing, spreadsheet applications and block-based programming. Cyber Foundations II follows up on that instruction with coursework on personal finance, physical computing and interactive games and animation.

Computer Science and Engineering is offered at close to 30 districts.

Some of the other courses offered in a lesser number of districts include Principles of Agriscience, Resource Management, Child Development, Exploring Careers, Exploring Computer Science and Nutrition and Wellness.

Local School Districts Face Additional Costs Under New Formula

Dr. Gavin also told Senators that school districts would like the Legislature to consider increasing the 55-mill cap on locally generated revenue through ad valorem tax collections (property taxes) for schools.

Gavin said 41 districts in the state are “capped out,” with the remaining districts collecting between 20 mills and 40 mills.

According to information from the Department of Revenue, the five lowest millage rates for Mississippi public school districts during the 2023 fiscal year were:

- Western Line School District (16.75)

- South Delta Schools (29.84)

- Marshall County Schools (30.20)

- Carroll County School District (33.86)

- Kemper County Schools (34.73)

The five districts with the highest millage rates in that year were:

- Jackson School District (86.73)

- Hinds County School District (70.62)

- New Albany School District (70.30)

- Clarksdale School District (69.18)

- Lafayette County Schools (68.70)

Under MS Code 37-57-104, school districts can request more than 55 mills under certain circumstances, including for the purpose of “payment of the principal and interest on school bonds or notes.”

Dr. Gavin explained that under MAEP, “the add-on programs were not included in the funding for local contribution, but under the new funding formula, total funding is included in how local contribution is calculated.”

“So, local contribution was significantly higher under the new formula,” she added.

According to information provided by MDE, the top five districts most affected by increases in local contributions were:

- Rankin County +$7.7 million

- Madison County +$5.5 million

- Tupelo +$4.5 million

- Vicksburg-Warren +$4.1 million

- Jackson County +$3.9 million

Still a handful of other districts saw marginal decreases in the amount of local contributions, such as:

- Richton ($15,395)

- Reimagine Prep Charter School ($20,572)

- Water Valley ($21,890)

- Booneville ($72,484)

- Clarksdale ($97,839)

The total increase in local contributions across the state was reported as $114,532,454.

Gifted, Special Education and Other Funding

Other specialty weights were also mentioned as potential areas of concern as funding shifts.

Under the MSFF gifted funding weight, various districts reported receiving less in teacher units than under the previous MAEP formula. When reached for clarification, MDE provided the following explanation.

“When the funding formula changed, it became student-based instead of being based on teacher units,” MDE stated, pointing to MDE’s gifted guidelines at Gifted Education Program Regulations, which refers to the statute that requires gifted instruction for grades 2 through 6 and is optional for 7 through 12. “MDE’s recommendation is for 8-12 students but no more than 15 students, so the number of teachers needed for a gifted program would depend on how many students are identified for gifted services.”

Special education and Title I funding to districts under the hold harmless provision in the new MSFF were also points of contention for affected districts.

Dr. Gavin said when the hold harmless provision expires in Fiscal Year 2028, districts fear they will be at risk of not meeting federal Maintenance of Effort regulations.

Maintenance of Effort guidelines state that recipients of federal grants are required to provide level amounts of local or state funding in a related category. According to the U.S. Department of Education’s guidance report, Maintenance of Effort requirements apply to recipients of the Elementary and Secondary School Emergency Relief (ESSER) Fund, the Governor’s Emergency Education Relief (GEER) Fund, Coronavirus Aid, Relief, And Economic Security Act (CARES), and other forms of federal funding.

“For purposes of establishing the (Local Educational Agency) LEA’s eligibility for an award for a fiscal year, the (State Educational Agency) SEA must determine that the LEA budgets, for the education of children with disabilities, at least the same amount, from at least one of the following sources, as the LEA spent for that purpose from the same source for the most recent fiscal year for which information is available,” the Code of Federal Regulations states.

Dr. Gavin told lawmakers that from the federal government’s standpoint, “you can’t spend less than you did the prior year, or you’re at risk of not meeting your maintenance of effort.”