- In Part 3 of a series on modernizing PERS, The Reason Foundation’s Mariana Trujillo writes that Mississippi’s municipalities face a harsh reality: Pay more now or pay even more later.

Around 10% of Mississippi’s population is a member of the state’s Public Employee Retirement System (PERS). Yet, the pension plan has only enough funds to cover about half of the retirement benefits promised. A new law, Senate Bill 3231, aims to address the underfunding by mandating a moderate increase in municipal pension contributions, but the increase prescribed will not be sufficient to resolve the underfunding accumulated over decades. Mississippi has consistently pushed the true costs of its retirees’ pensions into the future—a future that has now arrived. To protect the retirement security of Mississippi PERS members, maintain the state’s creditworthiness, and shield taxpayers from further burdens, this unsustainable approach must end. Municipalities should plan to contribute the appropriate amount to fulfill the pension promises made to their public employees.

As of their 2023 actuarial valuation, Mississippi PERS is over $25.5 billion in debt, only 56% funded. In response to Mississippi’s rising public pension debt and management challenges, S&P Global Ratings shifted the state’s credit outlook from stable to negative on March 1. This is a clear warning to the state that it will see a credit rating downgrade if concerns regarding the adequacy of its pension funding are not addressed. A potential downgrade puts Mississippi at risk of increased borrowing costs and limited ability to issue bonds and raise funds from private credit markets.

As part of its proposed solution, the PERS board of trustees is asking to incrementally raise the employer contribution rate by 5% over the next three years until it reaches the contribution rate actuaries estimate is necessary to afford the benefits and eventually eliminate its unfunded pension liabilities. Mississippi municipal leaders have not received this proposal well arguing the local government’s portion of the contribution would have a dire impact on city and county budgets. Local school districts and state entities have sounded the alarm, suggesting increased PERS costs could lead to job cuts. The Mississippi Municipal League (MML) lists “PERS reform to lessen the unfunded mandate of increasing the employer contribution” as its first legislative priority of 2024. As Hattiesburg Mayor and president of the Mississippi Municipal League (MML), Mayor Toby Barker expressed, “We just see this whole thing, including this first year, this 2% increase from 17.4 to 19.4 as a start-up of an unsustainable trend on how we’re going to fund the retirement system and an unfair shifting of the burden to the employers.”

Unfortunately, the increase to 19.9% set by SB 3231 is just the beginning. With Mississippi’s public employee retirement debt piled up to historically high levels, decades of pension neglect call for an unavoidable fiscal reckoning.

The Fiscal Reckoning

In 2023, the employer contribution rate for Mississippi’s PERS plan was contractually set at 17.4% instead of the 25.17% rate actuaries determined was necessary to afford the benefits promised to retirees. Based on PERS recommendations, the 2028 employer contribution rate should be over 36% of payroll. As this gap continues to grow year over year, PERS will continue to accumulate billions in unfunded pension benefits.

MML leaders voiced extreme concerns about the financial impact of decisions made by the PERS Board of Trustees regarding employer rates, especially when those decisions are made unilaterally by a group with no financial stake in their implementation.

Ninety percent of municipalities that responded to a recent survey from the MML indicated that to fund additional employer contributions to PERS, they will be forced to make budget cuts, including staff reductions or not filling open positions, including those in public safety. Some have gone so far as to indicate that they will be forced to increase their millage rates.

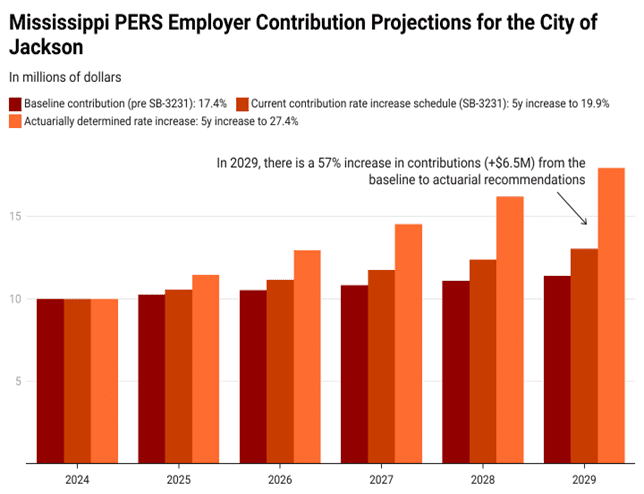

As an example, the figure below shows the difference in pension contributions between what the largest city in Mississippi—Jackson—had planned to contribute and what it needs to contribute to appropriately fund its employee’s pensions.

As things stand before the 2025 legislative session, the PERS actuarially determined employer contribution rate is forecasted to reach $17.9 million for the city of Jackson in 2029—about two-thirds of its 2021 fire department budget. The gap between the current and appropriate pension contributions will exceed $6.5 million by 2029. The difference itself is larger than the city’s combined spending on its parks and recreation department and library system, which were $2 million and $1.7 million, respectively, according to its most recent financial report.

For the city of Hattiesburg, as another illustrative example, the actuarially determined pension contribution schedule forecasted for 2029 will demand $8.7 million from the city—equivalent to about 90% of its fire department budget or 70% of its police department budget, representing 14% of its 2021 budget of $61 million. The difference between the baseline contributions and the actuarially determined amount is forecasted to be $3.2 million, more than its combined land development administration, animal control, airport, and cemetery budgets.

Mississippi’s municipalities must plan to reserve more funds than expected to fulfill the constitutionally protected retirement benefits promised to their public employees. There is no other way out. While it is unfortunate that a significant share of municipal budgets must be diverted to paying off past debt, the consequences of failing to address pension debt are worse. As demonstrated by S&P Global Ratings’ credit outlook downgrade, delaying necessary increases would further damage Mississippi’s reputation in financial markets, leading to higher borrowing costs while making the states and the municipalities less attractive for external businesses.

The longer it takes to pay a debt, the more expensive it becomes. The longer municipalities continue to delay reckoning with their pension obligations, the more interest expenses they incur—both because pension debt diminishes municipalities’ ability to issue bonds and get loans from private markets and to compensate for the forgone investment returns that the funds allocated to the pension decades ago would have yielded by now.

Neglectful pension funding policy has landed Mississippi governments on an unsustainable path of growing pension costs. Unfortunately, Mississippi’s municipalities face a harsh reality: Pay more now or pay even more later. The only way out is paying. It is time for Mississippi’s municipal and state entities to reckon with their reality.