- In Part 2 of a series on modernizing PERS, The Reason Foundation’s Steven Gassenberger examines recent legislative efforts to improve the sustainability of Mississippi’s public retirement system and some of the flaws in current proposals for a fifth tier of beneficiaries.

In 2001, the Mississippi Public Employee Retirement System (PERS) had an unfunded liability of $2.3 billion and sat at 87.5% funded. Today, PERS is $25.5 billion in debt and has only 56.1% of what is needed to meet long-term obligations.

Leading up to and during the 2024 regular legislative session, PERS administrators and Mississippi lawmakers responded to these challenges with different ideas, ultimately choosing a holding pattern for the time being while legislative leaders take a deeper dive into the issue.

However, without a holistic funding solution and new pension tier for future hires, PERS will continue to fester in members’ minds, mayors’ budgets, and taxpayers’ pocketbooks.

At the heart of the matter is what has plagued nearly all public pensions for the last two decades. Pension systems like PERS are built on a financial model that uses assumptions, such as future investment returns and how long members will live, to determine how much needs to be saved today to honor obligations to members decades later. If the return assumption is lowered, the amount needed to save today will increase.

As the PERS board, like nearly every public pension plan in the U.S., gradually reduced the system’s rate of return assumption, the need for higher contributions became more acute.

PERS assumed an 8% investment return for much of the 20th century without any real funding issues, save for the occasional unfunded pension benefit increase. But after a dot-com bubble, great recession, and pandemic lockdown, major state public pension systems like PERS adjusted expectations in response to shifting global investment markets.

PERS now relies on a 7% return on its investment assumption, putting it slightly above the national average of 6.91%.

PERS Board of Trustees Proposal

The PERS Board of Trustees resolved before the 2023 legislative session to increase the employer contribution rate from 17.4% to 22.4%—the largest such increase on taxpayers and local employers since 2005. The rate increase on state agencies would have amounted to an additional $265 million per year toward their employees’ retirement, while local governmental entities were responsible for the remaining $80 million annually.

In addition to the increase in annual costs, the PERS board officially recommended the legislature approve a new Tier 5 for any member who joins the system on or after July 1, 2025.

According to the board’s recommendation, this new tier would have a four-year vesting period, as opposed to the current eight, and would stipulate that any future cost-of-living adjustment (COLA) be capped at 3%, granted only at the discretion of the PERS board and tied to inflation and the plan’s funding level. New tier members would also have a 7% employee contribution rate, rather than the current 9%, due to removing a guaranteed COLA from the base benefit.

2024 Legislative Response to PERS Recommendations

At the beginning of the 2024 regular session, mayors and city budget writers from around Mississippi descended onto Jackson to voice their strong opposition to the PERS rate increase, stating that such an increase would directly lead to staff cuts and/or property tax increases.

Legislators reacted quickly, introducing measures that limited the board’s ability to dictate rate increases to employers. To their credit, House and Senate leadership quickly realized that stopping the rate increase entirely would be detrimental to the system. By the end of the 2024 session, the legislature had effectively revised the PERS contribution rate to phase in the board’s contribution recommendations.

An additional supplemental state contribution of $110 million ensured that the rate increase’s impact on local budgets would be minimal. Along with the additional funding, the legislature also mandated that all PERS board meetings and materials be made public for all future meetings. In the end, the issue of a new benefit tier was effectively paused to allow for more deliberation among stakeholders.

Where Things Stand with PERS Heading into 2025

Now that both the PERS board and the legislature have responded and the 2024 legislative session set new contribution rates, it is now possible to see where PERS sits going into the next year.

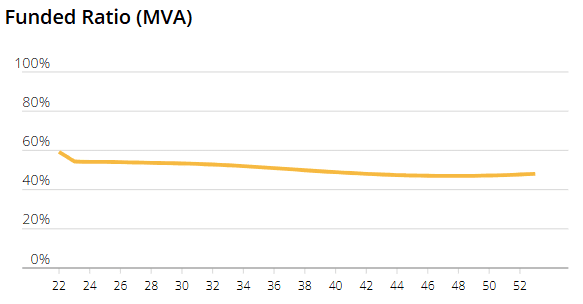

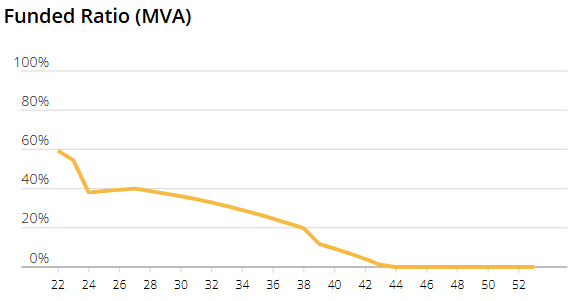

Folding in the revised employer contribution rate and a supplemental $110 million cash infusion from the 2024 Regular Session, the Pension Integrity Project PERS model shows the system’s funded ratio flattening in the short term but continuing to fall, even if all current assumptions prove accurate. (Figure 1) This indicates that even with the updated contribution rates and supplemental payment, PERS is still not on course to eliminate the expensive debt that will be imposed on future taxpayers.

If the system, as it is post-2024 regular session, were to experience two recessions over the next 30 years (Figure 2), PERS is projected to go insolvent, meaning the plans assets will be exhausted, and pension benefits will have to start coming directly from state and local budgets. This outcome would be devastating, as it would explode annual costs well beyond anything experienced up to this point.

Lawmakers and PERS administrators have both acknowledged that the status quo is not sustainable. A new Tier 5 design and funding policy will be needed by the end of the 2025 legislative session.

The Tier 5 recommendations published by the PERS board in December 2023 are the only set of recommendations out to date, and they address another major challenge facing effective reform: the PERS 3% compounding COLA.

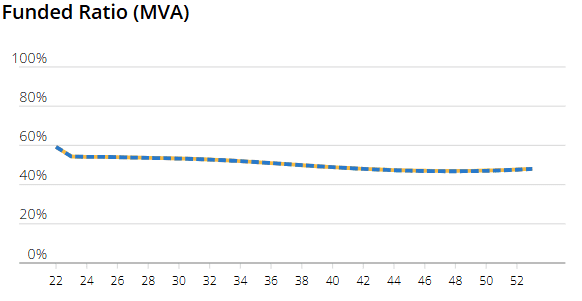

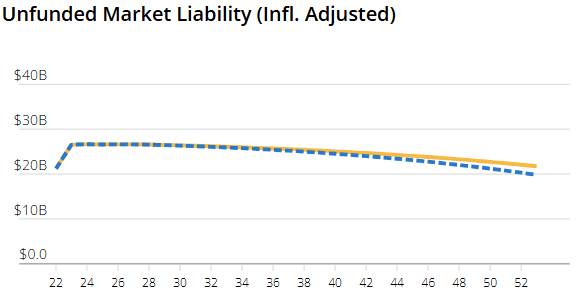

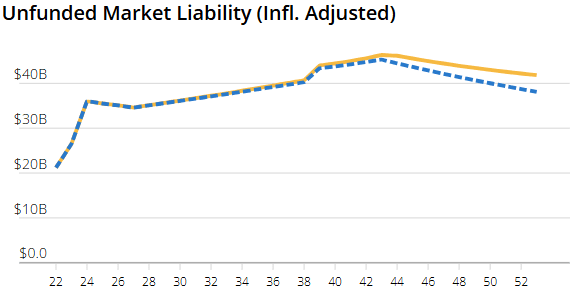

Unfortunately, the PERS Tier 5 matches that reform with a contribution reduction that effectively negates the gains of the COLA reform, pushing the new tier to essentially the same outcome compared to the status quo when all assumptions are met. Figure 3 illustrates how little of an impact such a reform would have on PERS while Figure 4 demonstrates the impact the proposed change would have on unfunded liabilities over the next 30 years.

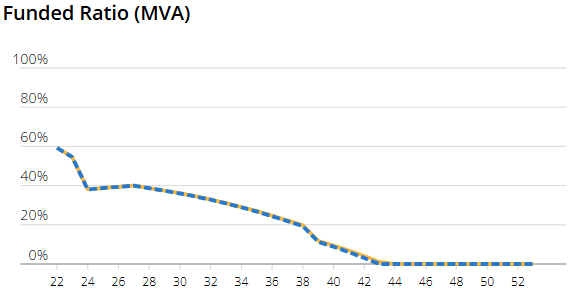

The PERS Tier 5 recommendation also does little to help the system weather global financial storms going forward. If the system were to experience two recessions, neither the status quo resulting from the 2024 regular session, nor the PERS Tier 5 recommendation, would prevent dramatic rate increases and benefit cuts.

Figure 5 shows the funded status of PERS if the system experiences the same two recession pattern over the next 30 years as pension systems have experienced over the last 30 years, while Figure 6 shows the same phenomenon from the perspective of unfunded liabilities.

Path Forward for PERS

These findings should not surprise anyone following the PERS issue during the 2024 regular session. PERS administrators and legislative leaders have all stressed repeatedly the need for a new Tier 5 PERS benefit for future employees.

A successful new tier for public employees is the best path toward a financially secure retirement for all members. Stabilizing contribution rates is important for taxpayer budgeting, but this must be accomplished through a sturdy plan to eliminate pension debt, not by pushing the growing funding problems down the road.

This approach will require a commitment to higher costs today to avoid imposing higher costs on future taxpayers.

Without a proper funding policy to secure retired and active member benefits, however, any new Tier 5 will do little to stop the PERS unfunded liability from continuing to grow.

Mississippi lawmakers, though facing unfamiliar challenges with PERS, can draw on successful reform examples from other states to navigate these issues effectively or risk the burden falling directly on the shoulders of taxpayers for generations.

This involves updating outdated actuarial policies, implementing a financial plan to eliminate underfunding, fully funding promised benefits, and providing new, beneficial options for future employees. This comprehensive method has already assisted other states and can be sustainable solution for all stakeholders Mississippi PERS stakeholders.