- In the first of a five-part series on how to build a sustainable public employee retirement system, the Reason Foundation’s Steven Gassenberger examines how changing worker habits should help shape reform.

Over the last decade, Public Employees’ Retirement System of Mississippi (PERS) data has shown a significant increase in the rate public employees are quitting, with most moving to another career within the first five years of taking their government job. Understanding and addressing the evolving needs of new hires is crucial for PERS, not only for its financial sustainability but also for its ability to continue to provide adequate retirement benefits for its members.

An evaluation of current PERS retention rates suggests that policymakers have an opportunity to move away from the one-size-fits-all retirement benefit currently offered and that only a fraction of employees will ultimately receive and toward providing retirement benefit options that can accommodate the needs of both career and non-career employees.

Shifts in PERS Member Retention

PERS Retention Tracks with Other States

To properly value and fund a public pension benefit like PERS, the assumptions actuaries use—such as the rate at which new hires will leave (or withdraw from) the system—must be accurate or else unfunded liabilities accrue. The withdrawal rates assumption helps estimate the expected number of separations from active members due to resignation or dismissal.

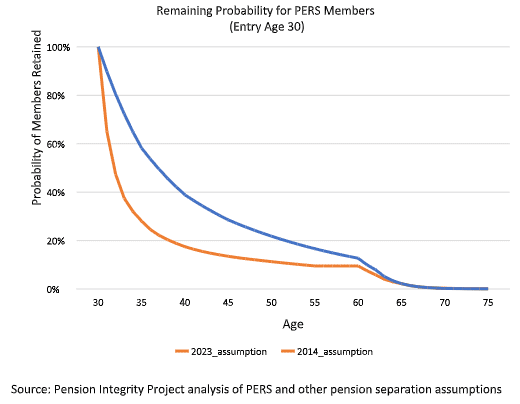

Over the last decade, PERS actuaries have responded to major national shifts in retention rates by adjusting the system’s withdrawal assumptions upwards because the actual number of withdrawals has consistently exceeded expectations since 2014, particularly among younger employees. In 2014, 22% of new male hires and 25% of new female hires were expected to leave after the first year of employment. By 2023, these figures had surged to 42% and 45%, respectively.

Assumed Withdrawal Rates After 1 Year of Service

Based on the withdrawal rates used by PERS for 2014 and 2023, Pension Integrity Project analysis shows that 70% of new members entering at age 30 will leave within five years of service, compared to 40% in 2014. Even members who join the system later in their careers are exiting earlier than before, with only a 50% probability of a member entering at age 50 remaining after the first five years of service.

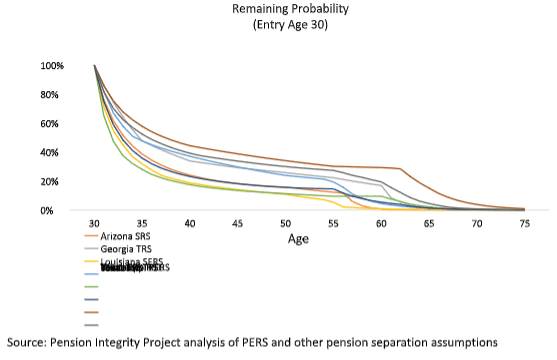

Expanding the analysis to include other large plans covering public employees, such as the Wisconsin Retirement System (Wisconsin RS), Louisiana State Employees’ Retirement System (Louisiana SERS), and Employees Retirement System of Texas (Texas ERS), reveals a similar trend.

In Louisiana SERS, only 31.8% of new public employees are expected to remain after five years of service, compared to 35.8% in Texas ERS. Even a well-funded plan like Wisconsin RS sees nearly half of new members leave the system after the first five years.

On average, the probability of staying beyond five years of service for a member joining at age 30 is well below 50%. Typically, eligibility for retirement begins at age 55. However, fewer than 30% of members remain by this time.

Compared to other state-run pension systems, the Mississippi Public Employees’ Retirement System (PERS) exhibits a notably high rate of early turnover among its members and imposes one of the longest vesting period requirements among similar pension systems, set at eight years for new members hired after July 1, 2007. Consequently, around 80% of new members are anticipated to leave the plan before reaching the vesting period. When PERS members terminate their employment before vesting, they are eligible only for a refund of their own contributions plus a credited interest of 2%. They do not receive any employer contributions made on their behalf. Therefore, only about one-fifth of PERS members are estimated to ultimately receive pension benefits.

The overall trend—and the more important part of the story for policymakers to consider—is that PERS’ current challenge with serving new hires reflects a national pattern of behavioral shifts among public workers. All these plans face nearly the same retention challenge even as they continue offering these traditional pensions, raising doubts about the effectiveness of pensions as a vehicle for recruiting and retaining employees.

In fact, the results of these withdrawal patterns suggest that policymakers should not operate under the assumption that pensions have a unique ability to attract new workers. Seeing that workforce behavior has significantly shifted all over the country, and how pensions have had no perceivable impact on stemming that shift, lawmakers in Mississippi should reevaluate what they are aiming to achieve with PERS.

Additionally, they should be concerned with how poorly the current plan serves the vast majority of hired people. It is clearly time to explore additional alternative options for new hires that will foster adequate savings for retirement, even if their tenure with PERS is only a few years.