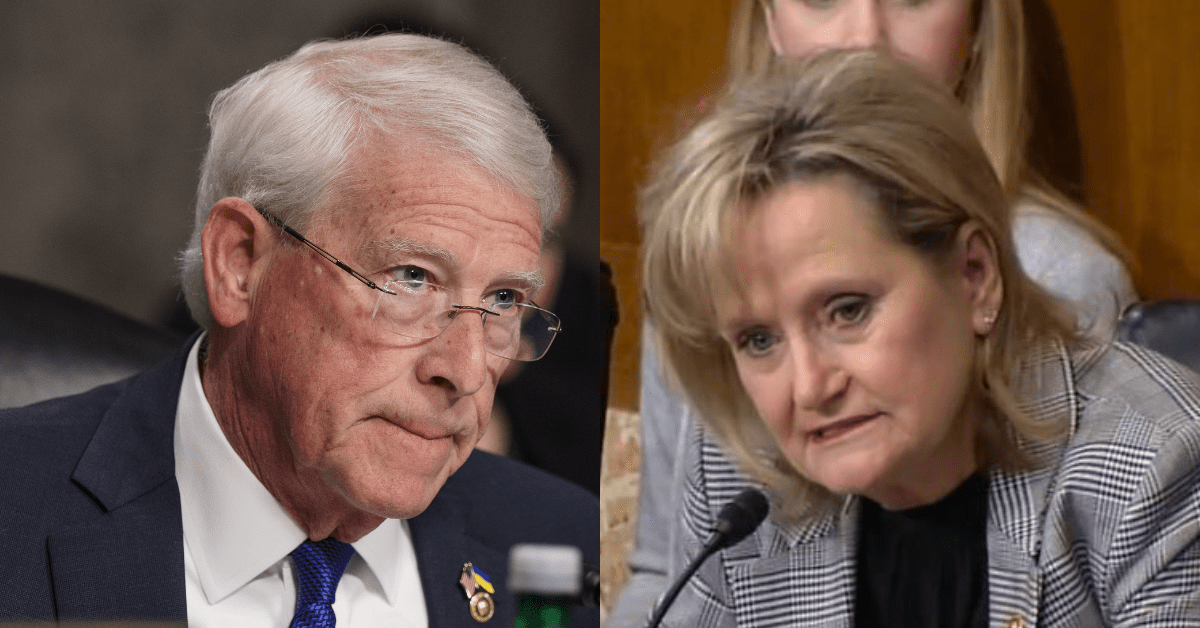

Sen. Roger Wicker and Sen. Cindy Hyde-Smith

- U.S. Senators Roger Wicker and Cindy Hyde-Smith are among a group of senators that say flood insurance changes have led to unacceptable premium increases that undermine the long-term future of NFIP.

Mississippi’s U.S. Senators have signed onto a letter that asks Acting FEMA Administrator Karen Evans to halt further implementation of the NIFP Risk Rating 2.0 pricing system.

Senators Roger Wicker (R) and Cindy Hyde-Smith (R), along with other Senate colleagues, contend that the Biden-era flood insurance changes has led to unacceptable premium increases that undermine the long-term future of NFIP.

It is their second letter to FEMA seeking action on the matter, the first of which came in June 2025. The group called attention to FEMA’s lack of transparency in releasing the data on which Risk Rating 2.0 was based and criticized the agency’s response to their initial request.

The initial letter cited estimates that at least 84% of Mississippi NFIP policyholders experienced sharp increases in their monthly premiums under Risk Rating 2.0.

“Since Risk Rating 2.0 took effect, flood insurance premiums have increased in every state, and FEMA estimates that approximately 77 percent of policyholders now pay more than they would have under the prior system,” the Senators wrote this week, adding that in some flood-prone states, premium increases of well over 100 percent have forced tens of thousands of homeowners to drop coverage altogether.

“These trends are not isolated—they reflect a nationwide contraction in NFIP participation driven by affordability pressures,” the Senators state.

The Senators go on to say that the loss of participation in the NFIP “is a structural problem” as flood insurance depends on a broad risk pool to function effectively.

“As policyholders exit the program, risk becomes more concentrated, premiums face additional upward pressure, and volatility increases,” the Senators explained. “At the same time, uninsured homeowners are more likely to rely on post-disaster federal assistance, shifting costs away from a pre-disaster insurance model and onto taxpayers. Rather than reducing federal exposure, Risk Rating 2.0 risks increasing long-term disaster costs while weakening the insurance base Congress intended the program to rely upon.”

The full letter from the Senator is shown below.