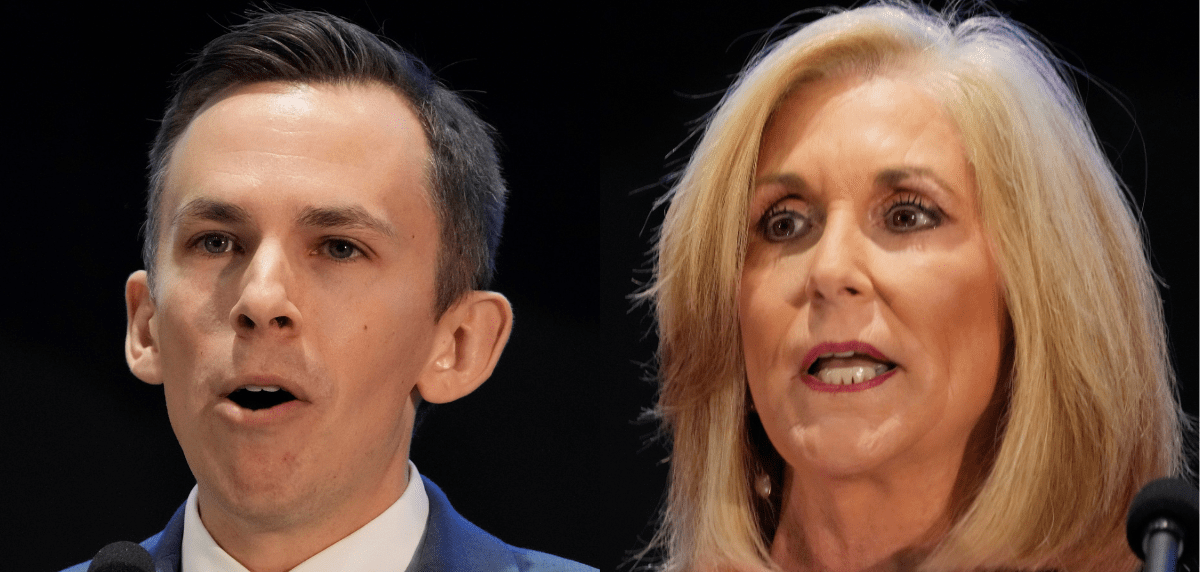

President Donald Trump welcomes Mississippi Lt. Gov. Tate Reeves, left, to the stage at a rally at BancorpSouth Arena in Tupelo, Miss., Friday, Nov. 1, 2019. (AP Photo/Andrew Harnik)

- “Mississippi believes that parents – not government – know what’s best for their children’s education,” said Governor Tate Reeves.

Governor Tate Reeves (R) announced Monday that he has opted Mississippi into the Federal Tax Credit Scholarship Program to promote school choice in the state.

The Federal Tax Credit Scholarship Program was created in the One Big Beautiful Bill Act, which was signed into law by President Donald Trump on July 4, 2025. The Magnolia State joins other states such as Alabama, Virginia, Arkansas and more in opting into the federal school choice program.

A congressional summary notes that under the program, taxpayers will be eligible to receive a tax credit of up to $1,700 for the value of cash contributions to certain scholarship granting organizations (SGOs). These organizations will be required to use these contributions to grant scholarships to students at private and public elementary and secondary schools located within their states.

The governor’s office said by opting into the program, which begins in federal tax year 2027, Mississippi will expand school choice opportunities for families across Mississippi.

“Mississippi believes that parents – not government – know what’s best for their children’s education,” said Governor Reeves in a statement. “The Federal Tax Credit Scholarship Program will help Mississippi continue its historic performance in classrooms across the state and further empower parents to do what’s best for their children. Thank you to President Trump and his administration for continuing to put parents and students first.”

Donations to SGOs are required to fund scholarships for eligible K-12 students across Mississippi whose family income falls below 300 percent of the area median income.

The congressional summary states that recipients may only use the funds for qualified expenses, including:

- Tuition, fees, books, supplies, other equipment, academic tutoring, and special needs services for special needs beneficiaries that are incurred by the beneficiary in connection with enrollment or attendance as an elementary or secondary school student at a public, private, or religious school;

- Room and board, uniforms, transportation, and supplementary items and services (including extended day programs) if these expenses are required or provided by a public, private, or religious school in connection with enrollment or attendance; and

- Computer technology, equipment, or internet access and related services if used by the beneficiary and the beneficiary’s family during any of the years the beneficiary is in elementary or secondary school.

Under the law, these scholarships will constitute tax-free income for the recipients and their families.

In the coming months, the Office of the Governor will designate eligible SGOs to participate in the program.

As outlined in the legislation, States are responsible for ensuring that SGOs meet the various requirements in the measure, including structuring themselves as 501(c)(3) nonprofits and spending at least 90% of revenue on qualifying scholarships.

The SGOs must prioritize scholarships first for students who have received scholarships in previous years and then for siblings of such students, after which they may grant scholarships to other qualifying students.

Governor Reeves’ announcement of Mississippi joining in the Federal Tax Credit Scholarship Program comes just days after the House of Representatives passed HB 2, the Mississippi Education Freedom Act.

READ MORE: Mississippi Education Freedom Act passes House by narrow 60-58 vote

HB 2, authored by Speaker Jason White (R) and supported by the House Republican caucus, is an omnibus education package that would, among other things, loosen restrictions and aid to support transfers between public schools, allow a first year limit of 12,500 students to access their state allotted funds for private school tuition, and rework of the authorization framework for new charter schools.

Governor Reeves touted HB 2 as “a well-thought out next step in giving Mississippi families more say in their kid’s education!”

“The House should pass it! The Senate should then pass it! And I will gladly sign it to keep Mississippi’s momentum booming,” Governor Reeves said.