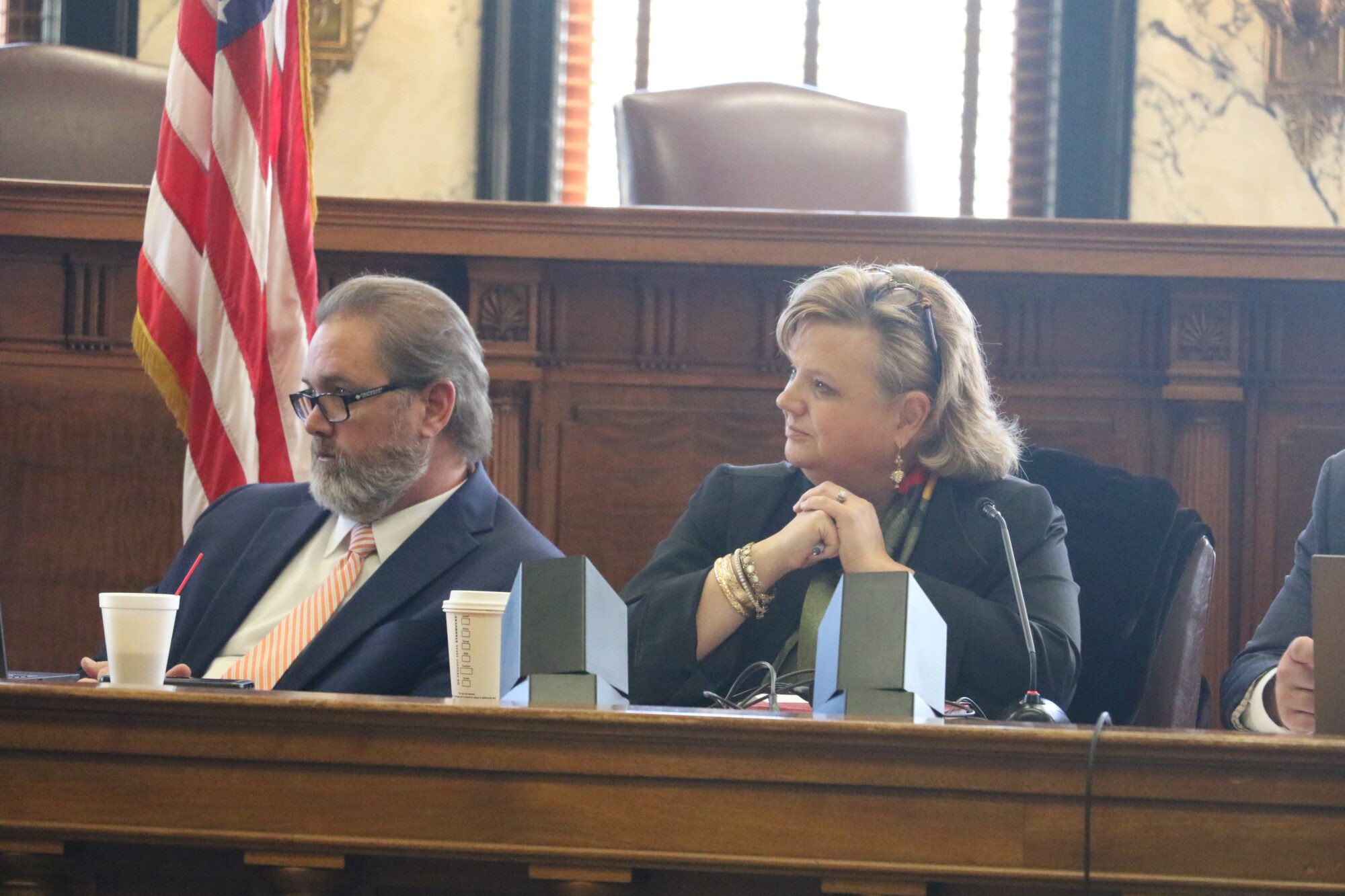

From Left, State Senators Scott Delano (R) and Nicole Boyd (R). (Photo by Jeremy Pittari | Magnolia Tribune)

- “We will be looking at some legislation that will mandate financial literacy at our colleges and universities and really at every level,” State Sen. Nicole Boyd said.

The Senate Committee on Universities and Colleges discussed the importance of financial literacy in Mississippi on Friday on day two of hearings at the state Capitol, particularly as it relates to those who may go into debt while seeking a higher education or certificate.

State Senator Nicole Boyd (R), the committee’s chair, has put a focus on financial literacy due to growing concerns that those who seek a degree or career certificate can face difficulties without the skills to effectively manage their bank accounts.

Jean Massey, Executive Director of the Mississippi Economic Council, agrees this topic is of great importance because employers say their employees are regularly seeking help in understanding their pension and other financial issues.

Boyd’s intent in bringing in experts on the issue hinge on the expectation that legislation will be introduced in the coming session mandating that every person seeking a degree or certificate in Mississippi’s college and universities attend financial literacy courses.

“We will be looking at some legislation that will mandate financial literacy at our colleges and universities and really at every level,” Boyd described.

Massey said data indicates only two out of every six incoming college students have basic knowledge of financial literacy, and less than half have taken a financial literacy course prior to attending a college or university.

“Now this is beginning to change in Mississippi, because it’s now a requirement, but it’s going to take time to see those results,” Massey explained.

College debt consumes about half of a graduate’s earning potential in their first year. This leads to a large percentage of people falling behind on payments or defaulting on their student loans.

“We all know when you get delinquent, that means you’re adding more finance onto it, and you’re having to pay more,” Massey said. “So, as we look at this and where we are with our debt to GDP per capita, we’re the highest in the nation.”

This impacts the potential of a person who wants to become a small business owner to get the upfront capital that may be required.

“Most of the time, or a lot of time, they can’t even qualify for a loan because of these debts that we’re seeing,” Massey explained.

People also turn to payday loans, which can have exorbitant interest rates. Today in the state there are about 1,000 licensed payday lenders, the lawmakers were told.

“We have more payday lenders than we do McDonald’s in this state,” Massey said.

Apryll Washington, Deputy Director of Student Financial Aid at the Mississippi Office of Financial Aid, described how defaulting on a student loan can further impact a person’s ability to be financially stable. It is especially hard in Mississippi, she said, because pay rates are lower than other states in the nation.

“Mississippi maintains the worst student debt burden in the country. The average student loan balance here equals roughly 56 percent of median annual income,” Washington outlined. “In plain terms, Mississippians are trying to manage substantial debt on much lower wages, making every dollar owed far more painful than higher wage states.”

Data from the Urban Institute indicates that as of August, 22.3 percent of student loan borrowers in Mississippi were at least 60 days delinquent on their loans, the second highest in the nation. Louisiana was the highest at 22.6 percent. The national average is 16 percent.

“Nearly a quarter of our borrowers are seriously behind, facing damaged credit, mounting interest and also the risk of default,” Washington added.

These issues can lead to wages being garnished and seized tax returns.

The teaching profession is at higher risk due to their debt equating to as much or more than their annual salary. Washington said this can force teachers out of the state as they seek higher paying jobs to keep up with their debt payments.

Massey suggested addressing the issue by partnering with local credit unions, banks, and nonprofits to provide expertise and mentorship. Washington said lawmakers should also consider creating student loan ombudsman programs, providing more state loan repayment assistance, and of course, providing financial literacy.