President Donald Trump signs his signature bill of tax breaks and spending cuts at the White House, Friday, July 4, 2025, in Washington, surrounded by members of Congress. (AP Photo/Evan Vucci)

- See the key provisions in the reconciliation bill that will impact families and businesses in Mississippi.

President Donald Trump (R) signed the reconciliation bill, otherwise known as the “one big, beautiful bill” into law on Friday, July 4th at a White House ceremony.

Both Mississippi U.S. Senators and three of the state’s four Congressmen voted in support of the Republican-backed measure.

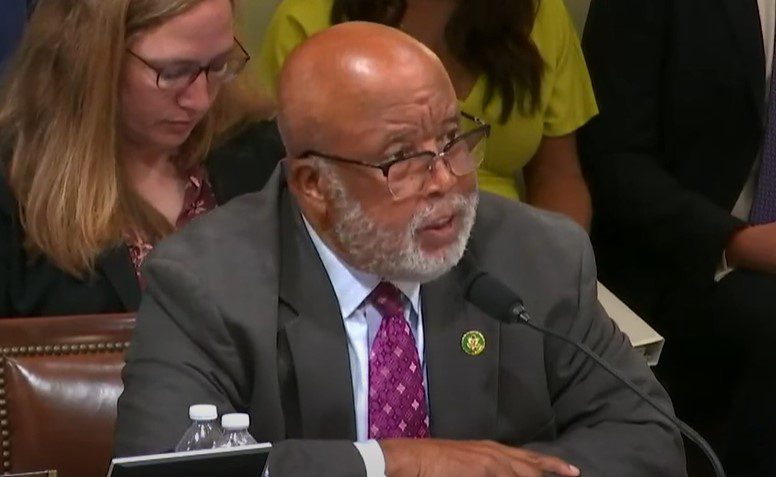

Congressman Bennie Thompson (D-MS 2) was the lone no vote from the Mississippi delegation. He claimed the legislation meant “closed hospitals, nursing homes, families struggling to afford groceries, and educational opportunities deferred” in his district.

“The people of Mississippi, and this country deserve better,” Thompson said in a statment. “I will keep fighting to stop the cruelty pushed by Trump and House Republicans, and I will continue working for a government that delivers for working folks.”

However, Senator Roger Wicker (R), chairman of the Senate Armed Services Committee, shared a list of provisions included in the 900-plus page legislation that he believes will benefit Mississippians.

“The reconciliation bill is an investment in the future of the United States. Through this legislation, the Senate secured a down payment on a generational upgrade for our nation’s defense capabilities,” Wicker said prior in a statement prior to the bill’s signing.

Wicker said many of the key provisions of the 2017 Tax Cuts and Jobs Act will be cemented and expanded under the new legislation.

“This will stimulate the economy and benefit job creators across the country,” Wicker added. “Additionally, this legislation will help secure the southern border and unleash American energy production. This legislation delivers on the promises Republicans made to the American people in November.”

Key Provisions of Interest in Mississippi

Besides making permanent the tax cuts from the 2017 Tax Cuts and Jobs Act, the Child Tax Credit is doubling from $1,000 to $2,000, while increases to tax credits are now available for childcare expenses. In addition, a 20 percent small business deduction is maintained in the legislation and the New Market Tax Credit was made permanent.

For employees in the service sector, a provision in the bill allows workers to deduct up to $25,000 for qualified cash tips received in occupations that customarily receive tips.

In terms of health care, $50 billion over five fiscal years was allocated for states to carry out rural health transformation plans and support rural hospitals.

Work requirements will now be required for Medicaid coverage and narrowed for Supplemental Nutrition Assistant Program (SNAP) recipients. Medicaid and SNAP will no longer available for illegal immigrants. Of note, the Mississippi Legislature considered expanding Medicaid during the 2024 session but the House balked at work requirements put in by the Senate. Governor Tate Reeves (R) has maintained his opposition to the program’s expansion even with the increased requirements.

Thompson claims over 153,000 Mississippians could lose health care coverage in Mississippi and 139,000 people are at risk of losing some or all of their SNAP benefits with these changes.

Border security was a major part of the bill, with $175 billion going to construction of the border wall, expanding ICE detention capacity, adding personnel, and reimbursing states for border security expenses.

Congressman Michael Guest (R-MS 3), a member of the House Homeland Security Committee, said the bill is a critical step to deliver much-needed resources to the border and support our border patrol agents while investing in technology to improve border enforcement and completing the building of the border wall.

As it pertains to industrial and business interests in the Magnolia State, the bill provided the following funding:

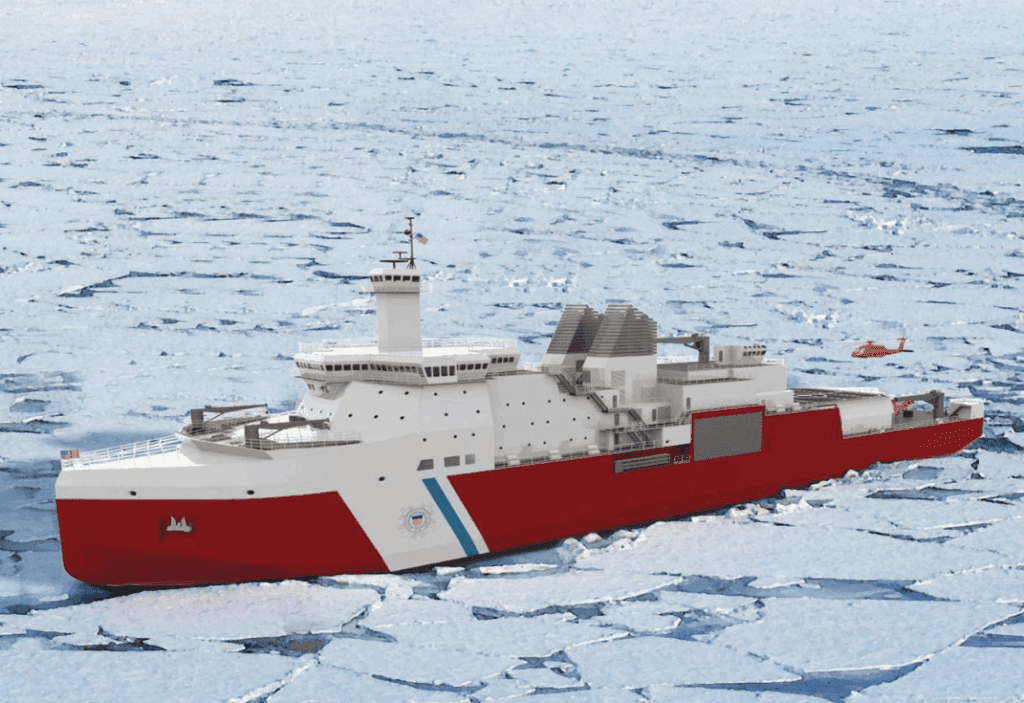

- $4.3 billion for the procurement of Polar Security Cutters being built at the Bollinger Shipbuilding’s Pascagoula yard.

- $120 million for infrastructure modernization projects at NASA’s Stennis Space Center in Hancock County.

- $4.1 billion for the Space Launch System for Artemis Missions IV and V. All engines in the Artemis program are tested at the Stennis Center.

- $29 billion for shipbuilding and the Maritime Industrial Base. Pascagoula’s Ingalls Shipbuilding is expected to play a key role in construction of new Navy ships.

Other military investments of note include $25 billion for the Golden Dome for America missile defense system, $16 billion to improve readiness, $9 billion for service member quality of life, and $15 billion for nuclear deterrence, among other provisions.

For agriculture, commodities reference prices were increased to account for inflation to aid farmers and cattlemen. Also, farm-raised fish producers who experience losses associated with bird predation will now be eligible for emergency assistance in the event of a disaster.

As for education, the bill eliminates Grad PLUS loans and reduces Pell Grant support but also aims to streamline student loan repayment options