- Big issues, from tax reform to school choice, Medicaid expansion to PERS, await the Legislature as it gavels in for the 2025 session next week.

The Mississippi Legislature’s 2025 session kicks off next Tuesday, January 7th. These are the issues likely to dominate public debate.

Tax Reforms

Even as the Legislature steadily cut taxes, revenue to the state has exceeded expectations. For years, the tandem of Governor Tate Reeves and House Republican leadership have pushed to eliminate Mississippi’s income tax. Senate leaders have been willing to cut the income tax, but have stopped short of fully committing to elimination.

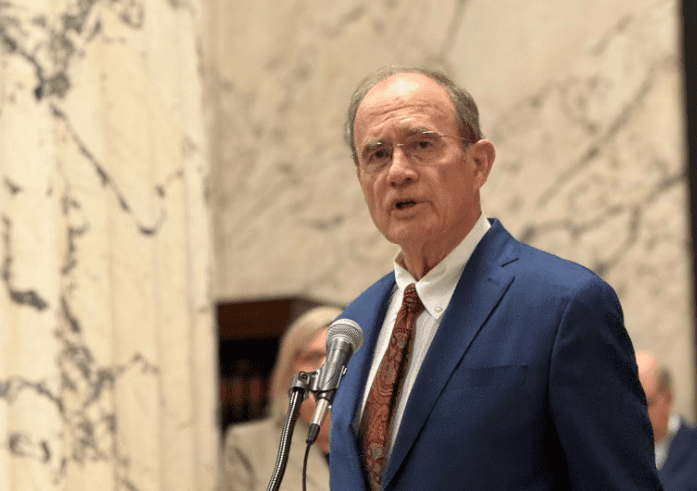

In 2022, the chambers came to a compromise on creating the largest tax exemption in the country among states that tax income and a flat tax of just four percent (down from five percent). The change will be fully phased in next year, but look for Reeves, House Speaker Jason White, and House Ways and Means Chairman Trey Lamar to make another push at elimination this year.

Any proposal to eliminate, or even reduce the state income tax, will likely be coupled with proposals related to the state sales tax. Lt. Governor Delbert Hosemann has made clear that he would like to reduce or eliminate the sales tax on groceries, and House plans in both 2021 and 2022 called for slashing the sales tax on groceries in half.

One problem with eliminating the sales tax on groceries, though, is that municipalities rely on a percentage of the tax, called a “diversion,” to fund local government. One question with complete income tax elimination is ensuring adequate revenue streams to fund government. These two issues could be addressed in 2025 by changing the broader sales tax structure.

Sources tell Magnolia Tribune this could include eliminating the current sales tax diversion to municipalities that comes out of the state’s current 7 percent rate — meaning the full 7 percent would go into the state coffers — and then adding an additional 1.5 percent local sales tax.

Finally, big fights occurred in 2016 and 2017 over increasing Mississippi’s excise tax on gas. Mississippians currently pay 18.4 cents per gallon in state gas tax in lieu of a sales tax in gas. They pay another 18.4 cents in federal gas tax. Last year, MDOT chief Brad White proposed a new diversified funding plan for the agency, which White said did not require a tax increase. But legislative leaders balked and there are talks of any tax reform package including either a gas tax increase or the elimination of the current sales tax exemption. Doing so would add another 21 cents per gallon on a $3 per gallon price under current sales tax rates.

Education Reforms

Last year, the big push among legislative leaders in education was the creation of a new funding formula. The old MAEP formula was tossed on the ash heap of history for a new “student-centered” model. Expect some tweaks this coming session, including an examination of whether the property tax cap should be increased to permit local districts to raise property taxes to meet the obligations of the new formula.

Expect more conversations about improving options for families this year, too. Speaker Jason White has made clear his commitment to expanded school choice. Don’t be surprised if four different proposals percolate this session, all with varying degrees of traction.

In 2015, the state created “education scholarship accounts” for special needs students that allow families to use their student’s public funding at private schools. Despite some administrative hurdles, the program has been a success, with families on a waiting list to access the scholarships. Expect the Legislature to appropriate additional dollars to cover these families.

Mississippi’s “open enrollment” law, which permits a student to transfer between public schools, currently requires approval from both the school sending the child and the receiving school — effectively giving the school the child wishes to leave veto power. Both House Speaker Jason White and Lt. Governor Delbert Hosemann have voiced support for eliminating this veto power. Where things can get tricky is over how money follows the student and with ensuring schools comply with federal anti-discrimination requirements.

Speaker White has also voiced support for expanding where public charter schools can open, and more broadly, for expanded education scholarship accounts available to more than just special needs students. While surrounding states, including Arkansas, Louisiana, and Alabama have all enacted “universal school choice” programs in recent years, these ideas face an uphill battle in Mississippi.

Medicaid Expansion

In the hierarchy of conservative ideas, Medicaid expansion sits at opposite ends of the spectrum from proposals like income tax elimination and expanded school choice. Expanding welfare programs and the size of government historically is more in line with progressive ideology. Indeed, in recent polling, Medicaid expansion ranked last on a list of potential priorities among self-identified Republicans, behind even the answer “unsure.”

The odd mix of legislative objectives likely signals that while the Legislature is run by a supermajority of Republicans, it is not deeply ideological/moored to conservative principles.

Whatever the case, expect both Speaker Jason White and Lt. Gov. Delbert Hosemann to make another charge at expansion in 2025 after coming up short in the 2024 session. Expect too, that Governor Tate Reeves will oppose the effort, and if a bill passes the Legislature, will veto it.

This sets up an interesting scenario. Do Republican legislators really want to be on record for overriding a Republican Governor’s veto of Obamacare’s Medicaid expansion?

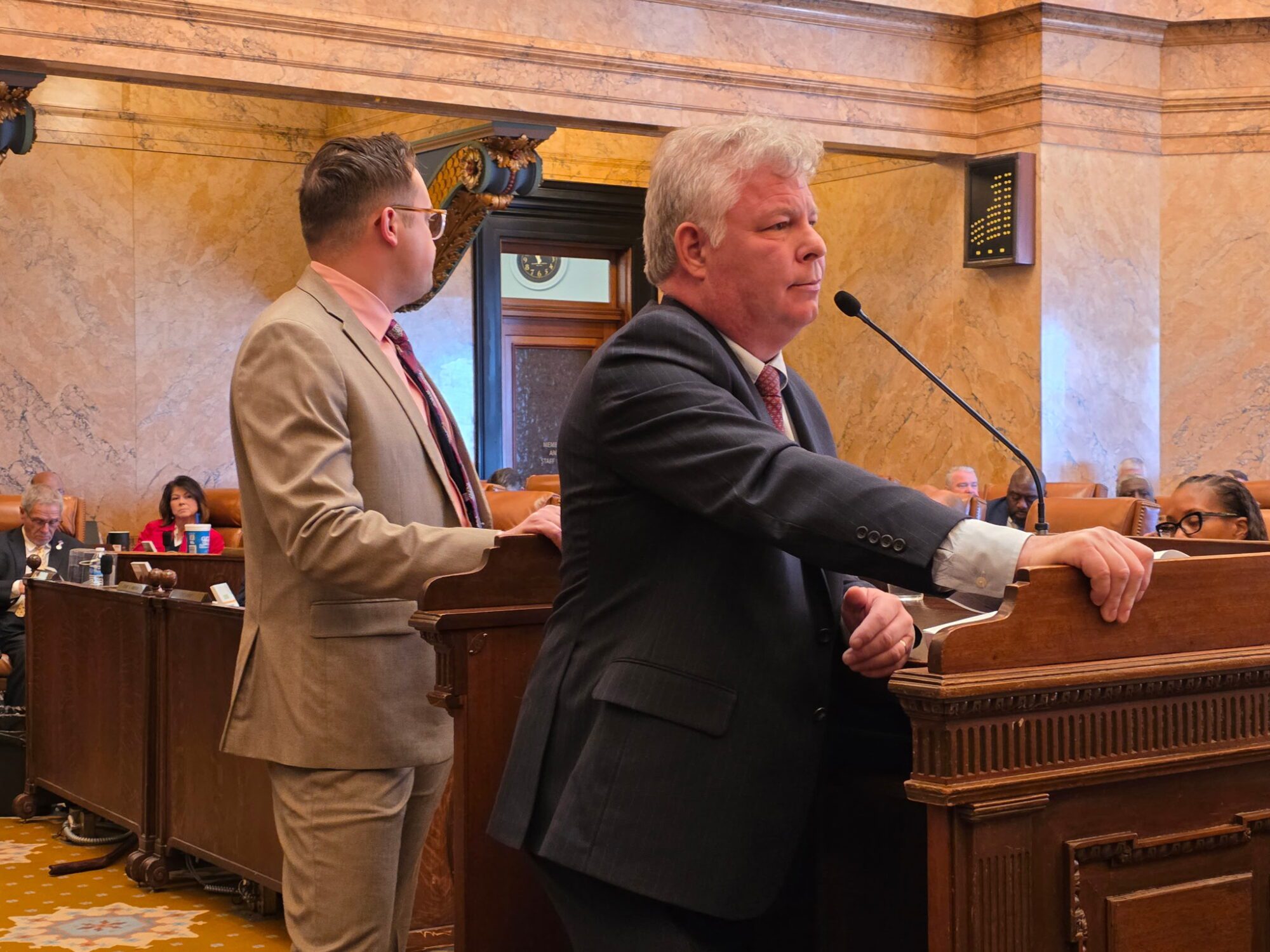

As it sits, it is unclear whether the Senate can muster a veto proof majority for full expansion. During the 2024 session, senators’ only vote came on a partial expansion plan presented by Senate Medicaid Chairman Kevin Blackwell.

Late last year, talks broke down between the chambers over a work requirement. Senate leadership was insistent on expansion being conditioned on one. The House was okay with full expansion even if a work requirement was not approved.

There’s some hope among legislative leaders that with a new Trump White House, a work requirement would be approved. This ignores the fact, however, that multiple federal courts had struck down Trump’s work requirements during his first term, even before the Biden administration began rescinding them.

Work requirement proposals also create some vote pressure in the Mississippi House. Because a chunk of Republicans will oppose expansion, White needs members of the Democratic caucus to pass the bill. While Democrats want expansion, they don’t want a work requirement.

Finally, whatever optimism Trump brings over the potential for work requirements must be tempered with the reality that he’s surrounded by health policy voices that also want to bring federal contributions for the expansion population in line with federal contributions for the general Medicaid population. Were Mississippi to expand and the federal matching rate drop, this would add hundreds of millions in cost to the state annually.

PERS Reform

According to the PERS board, the state’s public retirement system has $25 billion dollars in unfunded liabilities and is deeply underwater. The Legislature has affixed some bandaids to the problem, with some supplemental funding and some changes to process, but the systemic threats all remain.

There really are only two solutions: increase funding and change the system for new enrollees to stop the bleeding. PERS has proposed a new category of beneficiaries (Tier 5), but modeling of that proposal proves insufficient to put the program back on sustainable footing.

Expect additional conversation around bold reforms for new enrollees this year. But with all of the other priorities on the table, don’t be surprised if this can get kicked a little further down the road.

Legislative/Judicial Redistricting

Thanks to a federal court ruling, the Legislature will be forced to redraw a few districts this session to ensure Black voting power in those areas is not being diluted. This process likely will impact two Senate seats currently held by Republicans in the Hattiesburg and DeSoto County areas and could lead to Democratic pick ups.

Additionally, the Legislature must complete restricting of judicial districts this year, which impacts not only judges, but also district attorneys’ offices. A push by Senate Judiciary Chairman Brice Wiggins to complete judicial redistricting last year ran out of steam amid other high profile priorities.