- In part 4 of this series on modernizing PERS, Steve Vu and Steven Gassenberger explore solving the state’s retirement shortfall with more pension choices.

The Mississippi Public Employees Retirement System (PERS) needs more money to meet its promises to active and retired public workers, long-term. Senate Bill 3231, adopted during the 2024 Regular Session, signaled the legislature’s intention to eliminate this problem by introducing a new “Tier 5” of retirement benefits for future public employees.

SB 3231 was a good first step—but it’s only a first step. There is a lot of work to do and tough decisions to face. The Pension Integrity Project at Reason Foundation has gathered best practices from half a dozen major state-level public pension reform efforts to compile a comprehensive Tier 5 reform package, titled the “Choice” proposal, for lawmakers to consider.

The “Choice” proposal provides competitive and fiscally sustainable retirement options for new hires and is paired with a plan to fully fund all earned and accruing benefits of current PERS members and retirees that will remain untouched. Reason’s analysis of this proposed reform demonstrates that, while it will require a significant government budget commitment, it will ultimately save the state, and therefore taxpayers, $14 to $21 billion over the next 30 years.

With a fundamental commitment to honoring promises to current and retired members while also eliminating unfunded liabilities, the Reason Foundation’s Tier 5 “Choice” proposal encompasses several elements organized into three primary categories:

- Commit to Proper Annual Pension Funding

The first category focuses on updating funding policies. PERS should move away from a fixed contribution rate set in statute and instead adopt an actuarially determined employer contribution (ADEC) policy that adjusts the amount of money state and local governments must pay for their employees’ retirement benefits annually based on calculations by plan actuaries for the existing Tiers 1-4. During their November meeting, the PERS board voted to recommend the legislature fund Tiers 1-4 benefits at the ADEC rate, currently at 25.92% of payroll. The “Choice“ proposal is different from the PERS board recommendation in that it also introduces an equal cost-sharing policy for the new hires entering the future Tier 5. This policy distributes the cost of the pension plan, and any future increases or decreases to that cost, equally between employees and employers.

- Pay Off Debt

The second category emphasizes the importance of quickly addressing unfunded liabilities to avoid higher costs in the long term. Upon passage, the “Choice” proposal entails implementing amortization policies to pay off Tiers 1-4 pension debt over 25 years. Any new unfunded liabilities attributed to Tiers 1-4 will be paid off on a preset schedule over 15 years going forward, while a 10-year policy will be used for Tier 5. The “Choice” proposal’s ADEC rate is based on this muti-tier amortization schedule and is different from the ADEC rate that PERS currently reports, which is based on a simple 30-year schedule.

- Introduce Choice of Modern Retirement Options for New Hires

The third category aims to offer prospective public employees a choice between a new PERS defined contribution (DC) retirement plan and a new PERS Tier 5 defined benefit (DB) plan. Starting July 1, 2026, all new hires would be enrolled either in a 401(a)-retirement plan with a 5% employer contribution and a 7-9% employee contribution or they would choose a risk-managed Tier 5 pension plan. This pension would feature a responsive, automatic cost-of-living adjustment (COLA) tied to inflation and the financial health of the system. Because most new hires are better served by the DC option in this proposal—as most employees will leave the plan before the pension’s vesting requirement is met (see part 1 in this series)—Reason Foundation proposes to set the DC option as the default for those who make no selection between the two.

Reason Foundation’s actuarial modeling of PERS shows that the proposed Tier 5 “Choice” recommendations would fully fund all accrued benefits of current PERS members and retirees while preventing the same debt issues from inflicting financial stress on future generations.

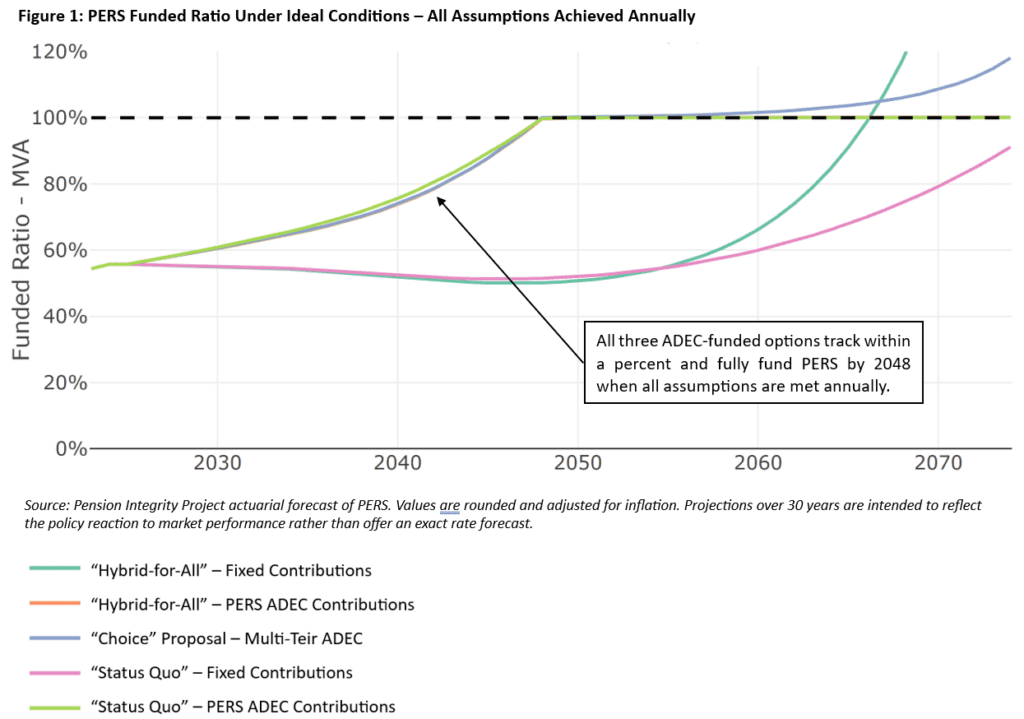

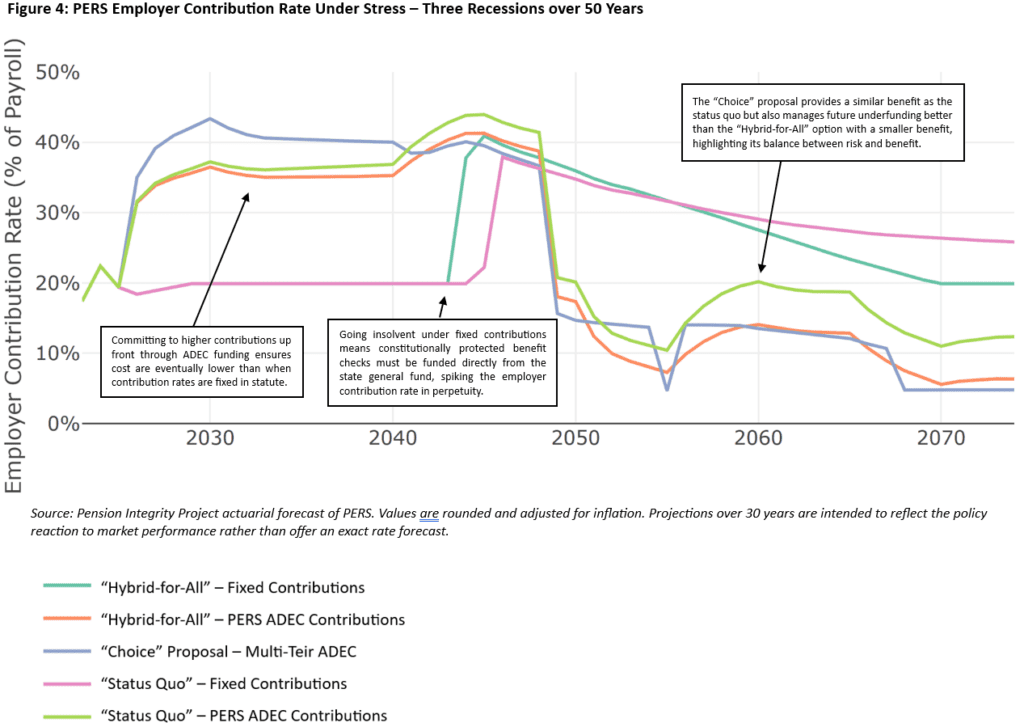

The graphs below highlight the differences between the status quo, Reason Foundation’s “Choice” proposal, and a separate “Hybrid-for-All” benefit for new Tier 5 members that was reviewed by PERS (which blends a small DB pension with a small DC plan).

Stakeholders can see the long-term value of providing Tier 5 choice to the state’s workforce (to stop digging the unfunded liability hole deeper) and sound pension funding policy (to fully fill the current funding hole) by evaluating actuarial forecasts of how PERS will perform under each proposal, using stress testing to simulate long-term market volatility.

Instead of a decline in funding health that would come about by maintaining the status quo, Figure 1 shows that the “Choice” proposal and the Hybrid-for-All options would steer PERS toward substantial progress in reducing and eventually eliminating unfunded liabilities by 2048 under a 7% investment return scenario. The graph also demonstrates the value of recognizing and fully funding the cost of PERS benefits now versus kicking the financial can down the road.

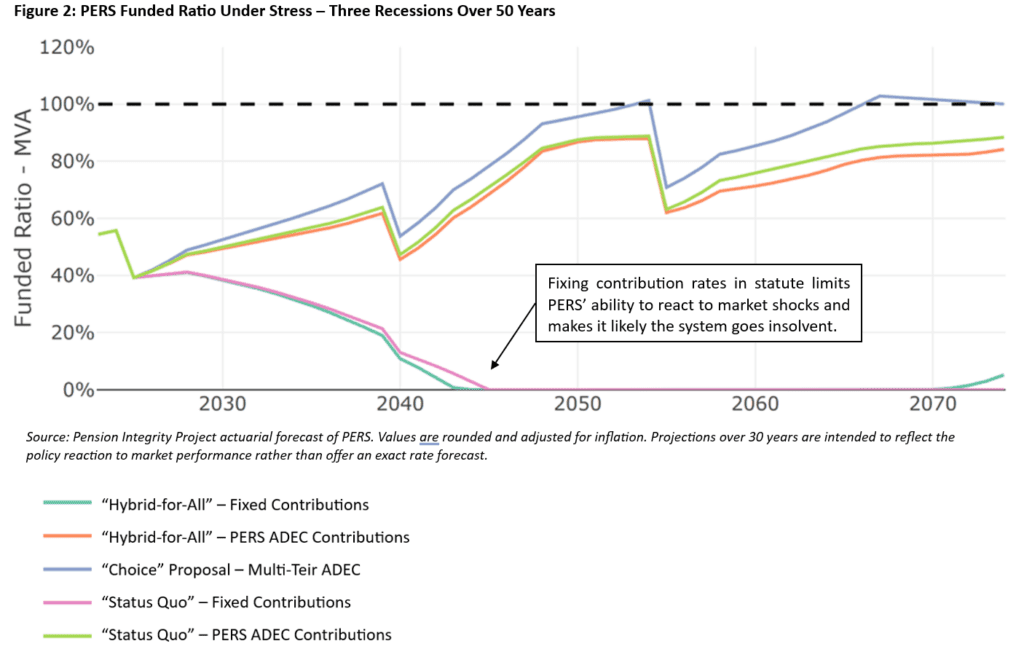

Given the numerous warnings from PERS investment consultants and the global investment market’s inherent volatility and unpredictability, any PERS reform must be resilient to potential stress. Figure 2 shows that a reformed PERS is projected to still achieve full funding by 2053, under a Dodd-Frank-style triple recession stress test over 50 years, but only through the implementation of the “Choice” proposal. In stark contrast, under today’s fixed contribution approach, PERS risks running out of funds and resorting to a “pay-as-you-go” (PAYGO) system, where benefits are paid monthly out of the state’s general fund, by as early as 2041.

Here’s the hard truth: Implementing these badly needed reforms will necessitate a significant short-term financial commitment from local and state budgets. Without it, as Figure 2 shows, PERS is likely to quite easily descend into insolvency under reasonable market stress conditions. That’s because under the current funding policy, the legislature writes into law the amount it wants to pay into PERS each year, regardless of the amount actuaries calculate is mathematically necessary each year to fully fund benefits and avoid underfunding and long-term insolvency.

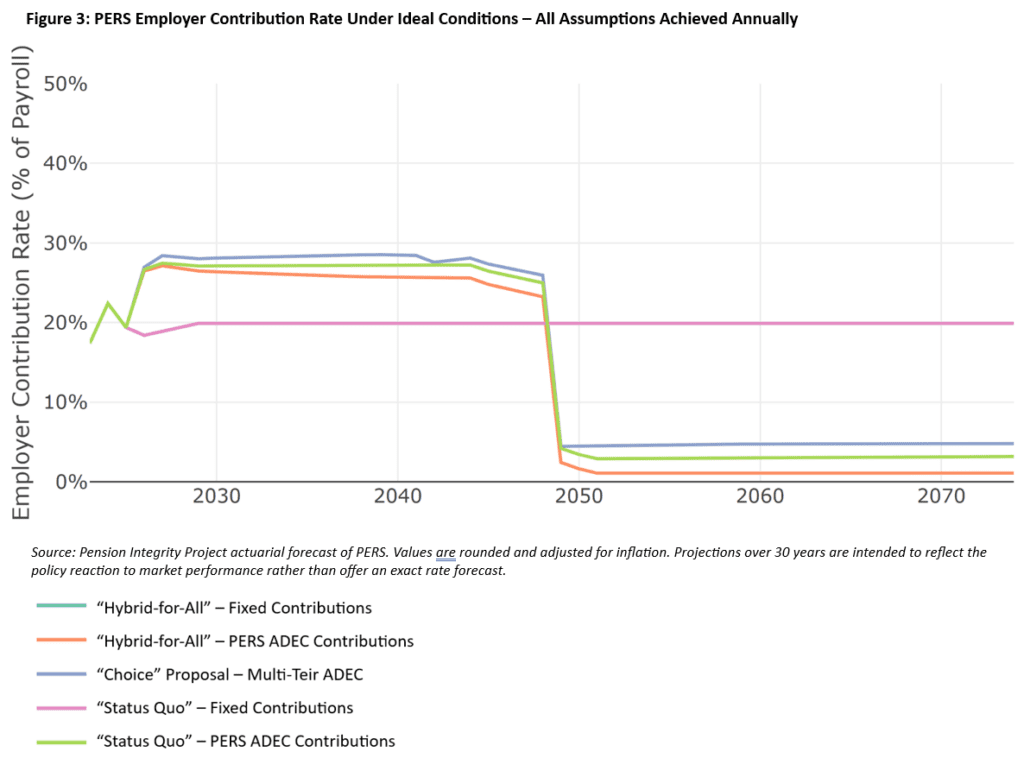

Figure 3 shows what the financial commitment to fully fund PERS benefits looks like under the various proposals if all actuarial assumptions, like investment returns and payroll growth, prove accurate each year. As expected, fixing the rate in statute will fix the cost for employers, but it also ensures that PERS goes insolvent (Figure 2), even if significant benefit changes are adopted through a fifth tier. If the legislature commits to actuarially based funding, the status quo, “Hybrid-for-All” and “Choice” proposals all would require annual contributions equal to between 25% to 29% of pay for the next 20 years, at which point annual costs will drop between 1-5%, depending on the level of benefit being offered.

A scenario with three recessions could increase annual employer contributions to 43% of payroll, with the timing depending on the proposal option (see Figure 4). The effects of actuarially determined funding are also clear, as maintaining a fixed contribution rate will ensure the system will start requiring general fund appropriations to pay for monthly benefit checks by 2045, which would impose annual costs four times higher than the reform proposals in perpetuity.

The value of ADEC funding is also clear. For the increases in the actuarially determined rate over the next 30 years, employers will pass on a more manageable situation to future generations. However, the application of these reforms would require a major budget commitment. In the past, Louisiana, North Dakota, and New Jersey have taken proactive measures to assist local municipalities and employers in managing the rising costs of pension contributions.

Mississippi lawmakers will need to address unfunded pension liabilities sooner or later, so the most comprehensive evaluation of these reforms’ impact involves a 50-year aggregation of contributions and whatever pension debt will remain at the end of that timeframe.

Right now, PERS is on a path toward insolvency. Reason Foundation’s comprehensive Tier 5 ”Choice” proposal offers a viable solution to these challenges by modernizing funding policies, accelerating the payoff of unfunded liabilities, and providing future employees with sustainable retirement options that better fit their career and retirement savings. While all workable solutions will involve spending more money to pay down existing pension debt, failure to adopt these necessary reforms will result in even higher costs to the state. Lawmakers must address these issues promptly to secure the financial health of PERS, protect the retirement security of current and future employees, and ensure the long-term fiscal stability of Mississippi.