Mississippi Capitol (Photo: Sarah Ulmer/Magnolia Tribune)

- With the first three months in the fiscal year exceeding legislative estimates, Mississippi’s revenues remain up $18.5 million on the year.

Mississippi state revenues came in under legislative estimates in October, the fourth month in the current fiscal year.

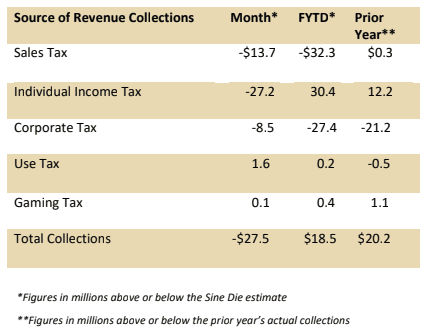

The Legislative Budget Office reported Tuesday that the total revenue collections for October were $27.5 million, or 4.08% below estimates. It is the first month in the 2025 Fiscal Year that revenues have not exceeded legislative estimates.

Sales tax, individual income tax, and corporate tax all came in below estimates, as shown below.

The Magnolia State’s year-to-date revenue collections for the first three months were $46 million above estimates, meaning when factoring in the October decline, Mississippi’s revenues remain above estimates by $18.5 million on the year.

When comparing October FY 2025 revenues to the same month in the prior fiscal year, General Fund collections were $7.7 million or 1.22% above October FY 2024 actual collections while corporate income tax collections were equal to the prior year.

Sales tax collections for the month of October were below the prior year by $1.8 million and individual income tax collections were below the prior year by $2.5 million.

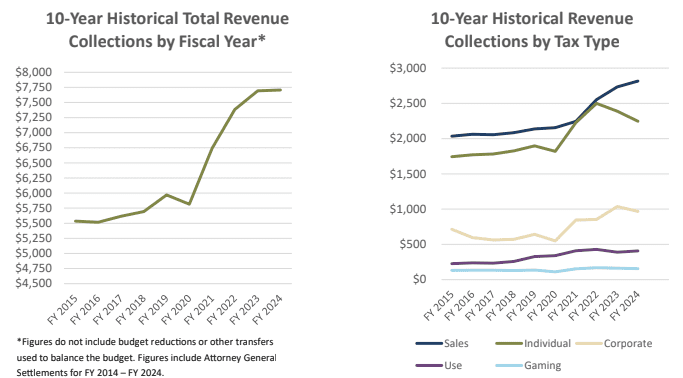

Total revenue collections in Mississippi have leveled off over the past year, largely attributed to the 2022 income tax cut being phased in. Sales tax has continued to rise annually other budget lines have also begun to stabilize.

Lawmakers, particularly in the Mississippi House of Representatives, are considering ways to provide additional tax relief to state taxpayers when they return in January.

The total FY 2025 revenue estimate is $7.6 billion.