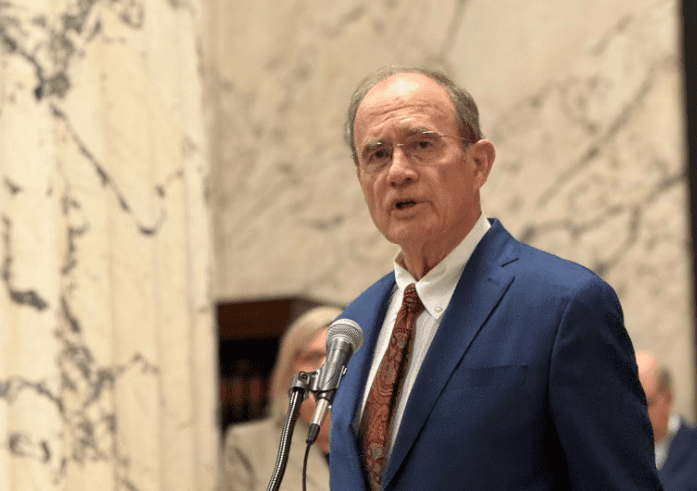

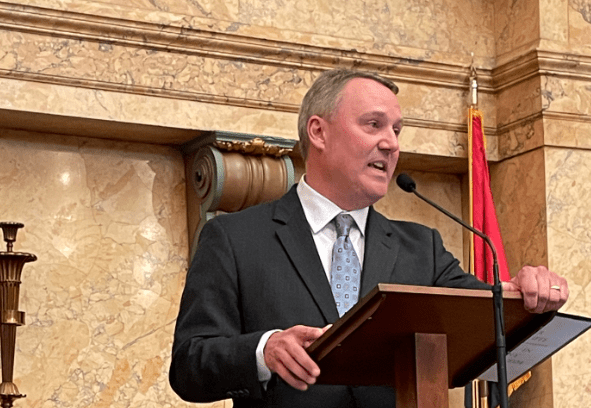

Speaker Jason White, January 2, 2024. (Photo: Sarah Ulmer/Magnolia Tribune)

Speaker Jason White will host a summit today on tax policy. Based on hearings held earlier this month and from outward appearance of the scheduled panels, it would seem a few different tax policies could be up for debate in 2025.

Income Tax Elimination

In 2021 and 2022, the Mississippi Legislature made a push to eliminate the income tax. While falling short, the effort yielded the largest tax cut in Mississippi history — one which when fully phased in will create a single 4 percent flat tax on income.

It appears that Speaker Jason White wants to pick up where his predecessor, Philip Gunn, left off and finish the journey to income tax elimination. The policy has the potential to be transformational in Mississippi.

An income tax is a tax on productivity, or what people contribute to the economy. In an ideal world, tax punishment for productivity would be minimal, because for economies to grow more people need to be working, earning, and ultimately, spending.

The theory bears out in practice. There are nine states without a state income tax in the United States. They dramatically outperform Mississippi, but more importantly, they dramatically outperform national averages.

Between 2010-2019, the economies of states with no income taxes grew by over 30 percent, or at 36 percent more rapid pace than national average. Mississippi’s economy was largely treading water during this period.

Population growth in no income tax states was nearly 13 percent during this period, more than double the national average. Mississippi, again, treaded water.

Not only did the broader economy outperform in no income tax states, but revenue to government for its core functions did not suffer. The tax burden in no income tax states was roughly half that of Mississippi, measured as a percentage of the overall economy.

But revenue in these states climbed much more rapidly. Between 2010-2019, revenue growth in no income tax states exceeded 50 percent. By contrast, revenue growth for Mississippi’s state government came in at just under 33 percent. Mind you, that is state revenue growth that still far exceeded the actual growth in our economy or in people’s income levels.

States like Texas, Florida, and Tennessee are proof not only that a state can survive without an income tax, but that states can absolutely thrive without an income tax. It makes sense if you start with an understanding that the way economies grow is through private sector productivity and investment. Allowing people to keep and spend more of what they earn is a recipe for long-term state success.

The problem for the Legislature, however, is in deciding whether it wants to spend more tax revenue or allow the people to spend what they earn. For the 2025 fiscal year that began July 1st, the Mississippi Legislature budgeted total state support of $7.866 billion, a jump of over $1.5 billion, or 24 percent, from the 2020 budget of $6.351 billion.

The big question is whether lawmakers’ recent spending burst left sufficient room for a tax reform the size of income tax elimination.

“Grocery Tax”

There is no “grocery tax.” There is a sales tax that Mississippians pay when they buy things, including groceries.

There’s no doubt that families are feeling the strain at the grocery checkout, and everywhere else. Three solid years of persistent inflation will do that. But not charging sales tax on the purchase of groceries will have a negligible effect on Mississippian’s bottom line and will not contribute to improving the overall economic health of the state.

It will, however, negatively impact local tax collections, because cities get a nearly 1/5th portion of all sales tax collected in their jurisdiction–called a “diversion.” Eliminating the sales tax on groceries would eliminate funding from your city, which is why the Mississippi Municipal League has historically opposed this idea.

It bears mentioning that Mississippi already makes provision for the poor when it comes to sales tax on groceries. No sales taxes are charged on groceries purchased with food stamps.

Still, when income tax elimination was pushed by former Speaker Philip Gunn in 2021 and 2022, one of the sweeteners offered to assuage Democratic House members was cutting Mississippi’s sales tax in half for the purchase of groceries. In 2023, Democratic gubernatorial candidate Brandon Presley made eliminating the sales tax on groceries a primary talking point in his campaign.

Gas Tax

Mississippians pay 36.8 cents in state and federal taxes on every gallon of gas we put in our cars. It’s a hidden tax built into the price of the fuel — it does not show up on your receipt at the pump. In 2016 and 2017, a substantial push was made to increase the fuel tax charged on every gallon of gas purchased in Mississippi, but those efforts fell short.

In the intervening years, the Legislature has acted to secure additional pots of money for the Department of Transportation, including through the diversion of lottery revenue. The Mississippi Lottery says it has transferred $409 million to Mississippi roads and bridges since 2019.

In 2020, the Legislature appropriated a budget of $1.1 billion to MDOT. For FY 2025, MDOT’s budget came in at $1.438 billion. Additionally, the Department received an $817 million supplemental appropriation, which included the reappropriation of roughly $370 million in unspent funds from last year, as well as $250 million to support large scale capacity projects.

But transportation officials have continued to voice concern over ensuring a stable stream of state funding that allows them to draw down more federal dollars. Last session, an effort was made to establish another dedicated funding stream for MDOT, but ultimately did not gain traction.

A hearing held earlier this month by the House Select Committee on tax reform featured heavily conversation on increasing revenue for roads and bridges. Today’s Summit will include a panel with Mississippi Transportation Commissioner Willie Simmons and MDOT Executive Director Brad White.

One of the original components of bills to eliminate the income tax was an offset in the form of a sales tax increase. Could a gas tax increase be at play as part of a larger package to eliminate the income tax in 2025? Time will tell.

The Speaker’s Tax Summit will take place at the Sheraton Refuge in Flowood between 8 AM-6 PM today, Tuesday, September 24th.

Author’s Note: The data on income tax elimination was compiled by the author in preparing a report for Empower Mississippi with economist Jorge Barro, Ph.D. from the Baker Institute at Rice University and Joseph Bishop-Henchman of the National Taxpayer Union Foundation. The report included not only comparative analysis, but a dynamic analysis on the effect of income tax elimination. A copy of the report can be accessed here.