- New PEER report reinforces the need for reforms to the Public Employee Retirement System to ensure long-term viability.

Mississippi’s Public Employee Retirement System has operated with a considerable unfunded liability for years. According to PERS, that amount sits at over $20 billion. A new report from PEER highlights the fact that the funding gap cannot be closed by adding new employees, and the Legislature will need to take additional action.

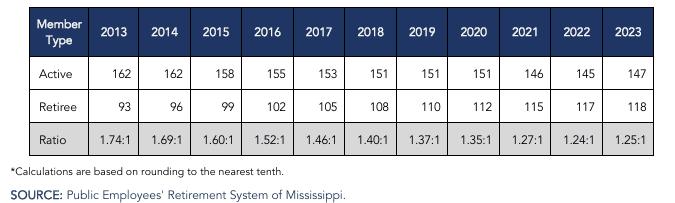

PERS saw its first increase in active membership in over a decade in 2023. Still, the state retirement system has a lower active-to-retiree member ratio compared to the average pension plan in the U.S. and continues to need the attention of lawmakers.

According to a November 2023 Public Fund Survey, a lower ratio of active members to retirees results in funding future obligations over a smaller payroll base, although a declining active-to-retiree member ratio does not automatically pose an actuarial or financial problem.

“However, when combined with an unfunded liability, a low or declining ratio of actives to retirees can cause financial distress for a pension system provider,” a recent Joint Legislative Performance Evaluation and Expenditure Review Committee (PEER) report noted.

PERS’ overall active-to-retiree ratio was 1.25 to 1 as of the end of fiscal year 2022, up slightly from the previous year but down from 1.74 to 1 in 2013.

While the Committee noted that adding active members would increase the number of workers supporting existing benefits for retirees, PEER acknowledged that adding new public employees also increases the retirement system’s future liabilities. One solution reform advocates believe would help temper this would be the implementation of a different set of benefits for new employees, referred to as a Tier 5.

Active PERS members – those still employed and working for one of the over 850 entities representing a Mississippi city, county, school district, state agency, university or community college, or other political subdivision – total nearly 146,000. Retired PERS members total roughly 114,000.

“While the PERS System saw an increase in the number of active members from FY 2022 to FY 2023, the actual rate of increase (1.10%) was still slightly lower than the rate of retiree member increase of (1.18%),” the PEER report stated.

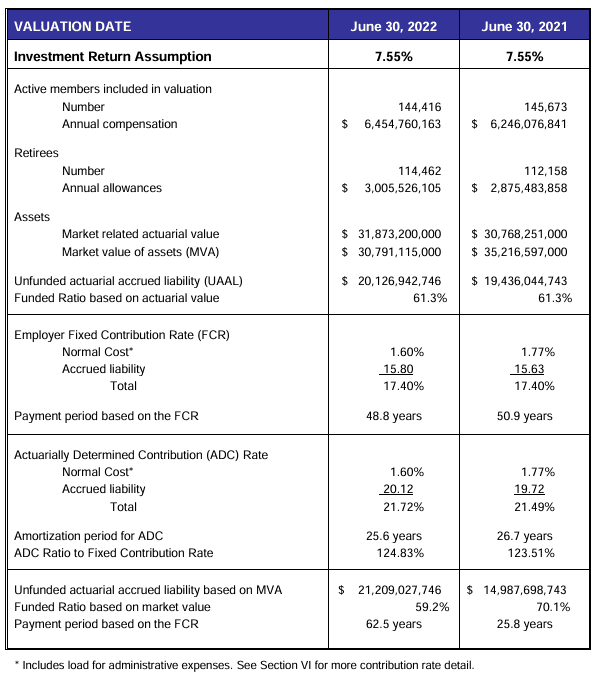

Actuarial firm Cavanaugh Macdonald Consulting, LLC, completed a study over a four-year period ending June 30, 2022, for PERS that was presented to the Board at its April 2023 meeting.

As of June 2022, the unfunded actuarial accrued liability for PERS was over $20 billion.

In the waning days of the 2024 legislative session, the Mississippi House and Senate agreed to halt an expected 5 percent employer rate increase that was set to begin a three-year phase-in this summer. In December 2023, the PERS Board voted to adopt the employer contribution rate change from 17.4 percent to 22.4 percent. The plan’s actuary had also recommended that the Board consider extending the plan’s prescribed 2 percent per year rate increases until the plan ultimately reaches an employer contribution rate of 27.4 percent.

Local governments let their voice be heard at the Capitol, saying if the increase stood there would be significant local tax increases imposed to balance city and county budgets.

READ MORE: Lawmakers agree to phase in PERS employer rate increase, send bill to Governor

Instead, lawmakers replaced the 5 percent rate increase with a 2.5 percent increase phased-in at 0.5 precent each year through 2029. A one-time infusion of $110 million was also approved for PERS and lawmakers took control of setting contribution rates away from the PERS Board.

Yet, according to the PEER report, more work is necessary to shore up the state retirement system as the active-to-retiree membership narrows and liabilities rise. The report states that “it is imperative that the Legislature and the PERS Board continue to assess the performance of the plan and evaluate the status of the PERS plan in the future.”

Had the original planned change in employer contribution rate remained in place, the retirement plan had a projected future funding ratio of 65.5 percent as of 2047, an increase from the FY 2022 projection of 48.6 percent. But after the Legislature stepped it, the PEER report said “the PERS plan is currently expected to be at a lower funded level in the future than it currently is today.”

“Additionally, an employer contribution rate increase strategy that targets a lower rate, even when coupled with a one-time cash infusion made by the Legislature, may not be sufficient to get the plan back to an all-green signal-light status and could necessitate an ultimate employer contribution rate in excess of the rate initially recommended by the plan’s actuary,” the report added.

Leonard Gilroy with the Reason Foundation told Magnolia Tribune the latest PERS report shows the need for additional reforms to the state retirement system.

“The latest PEER report on PERS reinforces the wisdom of legislative leadership’s call for a financially sustainable Tier 5 for new employees, as well as the need to tackle the chronic, structural underfunding of PERS benefits,” said Gilroy, Reason Foundation’s Vice President of Government Reform and Senior Managing Director of the Pension Integrity Project.

PERS Executive Director Ray Higgins told Magnolia Tribune during the 2024 legislative session that the PERS system is stable, but working together with the Legislature must continue in order to keep it that way. He, too, noted the need for a Tier 5 for future employees.

“To decrease future liabilities and help better sustain PERS, the Board previously recommended a new tier (Tier 5) for future employees, but it is also essential that the System receive adequate funding to meet the long-term needs of the plan,” said Higgins. “PERS is a complex issue with many moving parts. It is important our data and information be used with the full or proper context and understanding.”

In October 2023, the PERS Board voted that a new Tier 5 be established for employees who enter the system on or after July 1, 2025. According to the Board, Tier 5 would have a four-year vesting and would not have a guaranteed cost-of-living adjustment, or COLA, otherwise referred to as the “13th check.” Instead, any COLA would be at the discretion of the PERS Board and tied to inflation and the availability of funds. The employee contribution rate was suggested to be lower given that the reduced benefits with no COLA.

To read the full PEER report titled “2023 Update on Financial Soundness of the Public Employees’ Retirement System” click here.