- Grocery store prices are nearly 25 percent more expensive than pre-pandemic reports.

The Consumer Price Index (CPI) Report, released Wednesday, shows a slowing inflation rate, but not much relief for consumers buying groceries.

Prices rose 2.9 percent in the past 12 months through July, below economists’ prediction for 3 percent, according to U.S. Bureau of Labor Statistics’ CPI data. It’s the smallest increase since March 2021.

“Breaking the 3 percent barrier is a key psychological positive,” Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist of SS Economics, told CNN.

Even though the slowing inflation rate may signal good news for consumers’ pocketbooks from quickly rising prices, economists agree it is not likely to trigger a drop in grocery store prices.

“If inflation goes down, it means the rate at which prices increase is slowing down, but it generally isn’t going to mean that prices are going down,” William Hauk, associate professor in the Department of Economics at the University of South Carolina, told CNN.

Inflation cools, but prices rise

In 2022, the U.S. experienced one of the highest rates of inflation in 40 years. Now, grocery store prices are nearly 25 percent more expensive than pre-pandemic reports, according to CPI data.

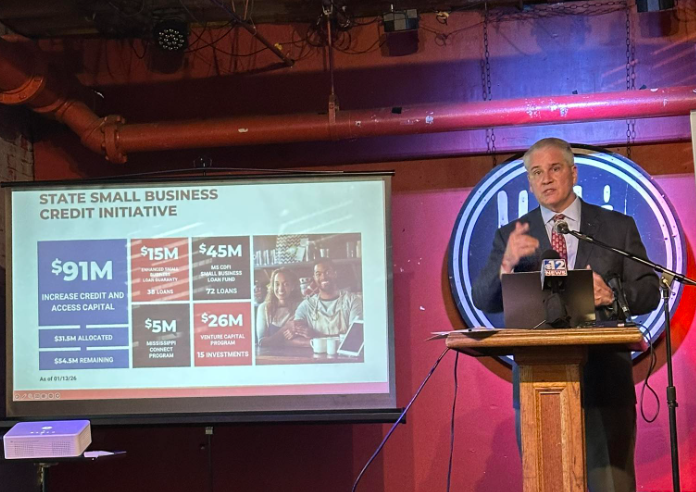

“Prices are still increasing,” said Kyle McDonald, CEO of Louisiana-based Argent Trust Group, a trust company overseeing more than $85 million in client assets. “The grocery store … our normal daily products have risen dramatically. It’s tough economically and financially for modest families.”

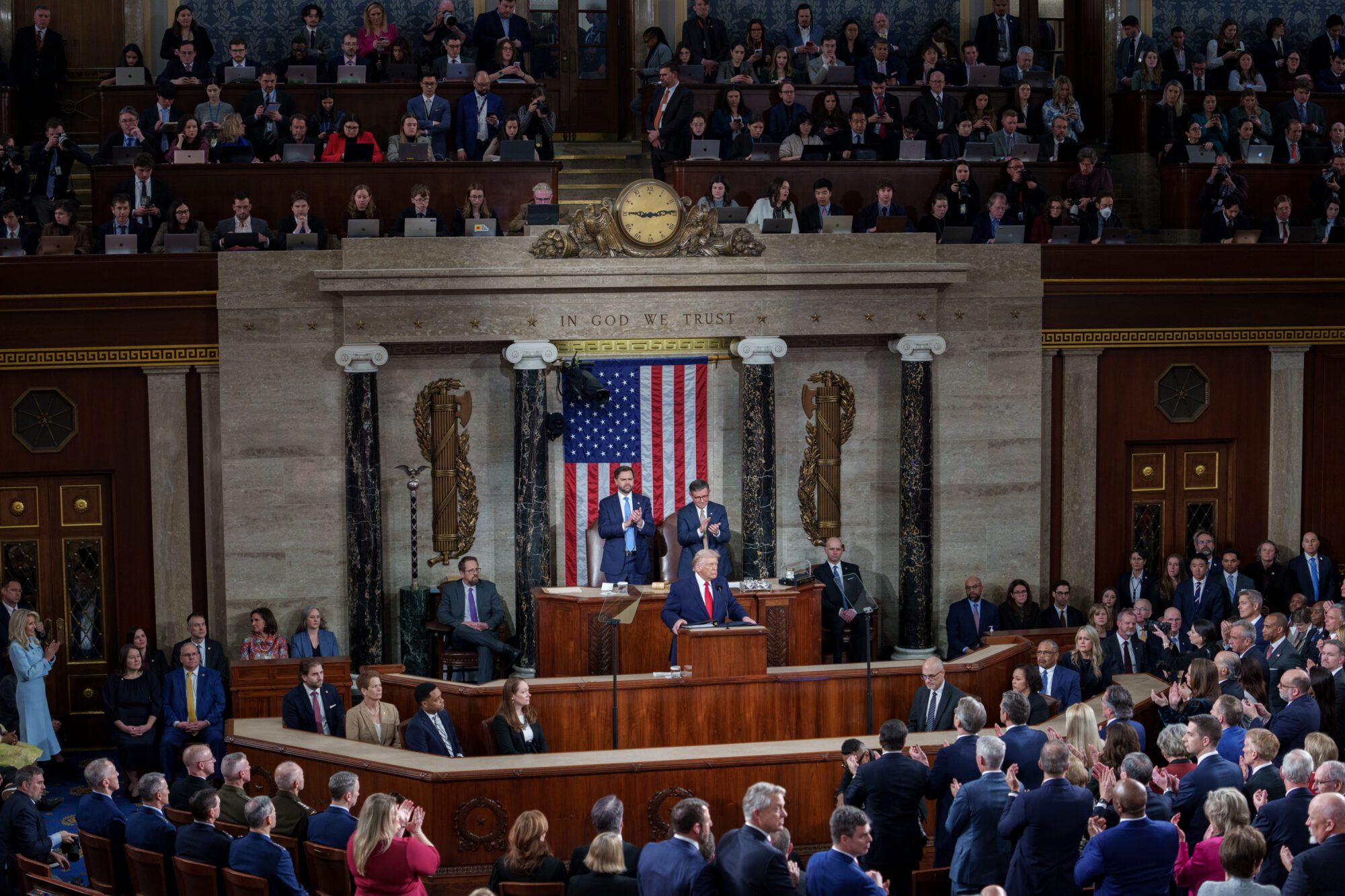

The new inflation data has encouraged investors to believe an initial rate cut from the Federal Reserve will happen at its September 17-18 policy meeting, but perhaps not the half-point reduction anticipated.

Economists believe the rate cut will be 0.25 percent to reduce borrowing costs, which would signal the first change of direction since July 2023.

The Fed has continued its standard overnight interest rate in the current 5.25 percent to 5.50 percent range. Inflation has sent rates soaring to a 23-year high. The rate pricing mostly reflects a spike in the unemployment rate to near a three-year high of 4.3 percent last month.