- With a cut to state income taxes being phased in and more on the table, lawmakers admit the math and policy gets tricky when bringing sales tax into the mix.

A possible cut to the sales tax on groceries is gaining traction among lawmakers this off session, but the math and politics get a bit tricky as Mississippi’s cities and towns heavily rely on the revenue. Add in another likely attempt to fully eliminate the state income tax, and the path for more taxpayer relief is clouded at best.

By 2026, Mississippians will be paying a flat 4 percent rate on their income tax. That is due to the historic tax cut passed in 2022 which allows working Mississippians to keep nearly $500 million of their money.

Over the last two years there have been promises by state leaders – namely Governor Tate Reeves (R) and Speaker Jason White (R) – to continue to explore tax relief, with the goal being to fully eliminate the income tax. Yet, while those efforts stalled during the 2024 session, there is hope the policy debate could reemerge come January.

As for the sales tax on groceries, Mississippi currently imposes a 7 percent tax on the dollar, including groceries. According to the AARP, Mississippi is one of 13 states that tax grocery purchases, with the Magnolia State’s rate being the highest nationally.

Calls for Change

During the Neshoba County Fair last week, Speaker of the House Jason White (R) said his plan is to work to at least cut the grocery sales tax by half, decreasing the total to 3.5 percent. He admitted it would be a difficult task since 18.5 percent of the current 7 percent tax is diverted to municipalities to fund local government operations.

Speaker White appointed a Select Committee on Tax Reform in May. The committee is to thoroughly study the state’s tax structures and provide recommendations to the House come January.

As previously reported by Magnolia Tribune, White recognizes that to gain consensus around eliminating the income tax, cutting the sales tax on groceries while ensuring municipalities are not negatively impacted is key. The Speaker said everything is on the table with two goals in mind, at least for him.

“At the end of the day we’re looking to do two main things: eliminate the personal income tax in as few years as possible and cut the grocery tax, hopefully in half,” Speaker White said in May.

READ MORE: Speaker White forming committee to tackle income tax elimination

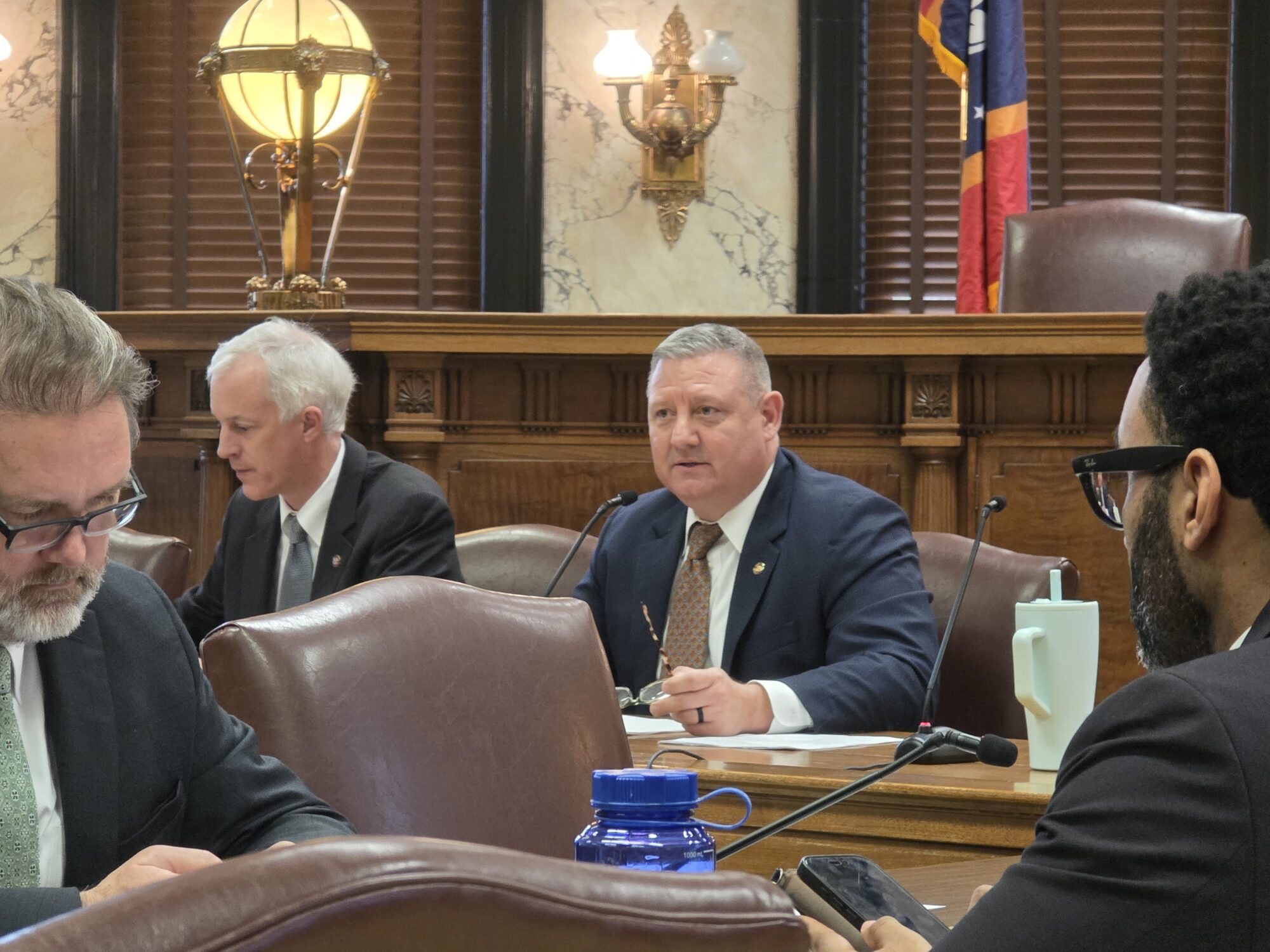

State Representative Jansen Owen (R) is one of the members of the Speaker’s Select Committee. He said members are taking a comprehensive look at taxes in the state to see what is best.

“We’re looking at the overall tax system of Mississippi from local all the way up,” Owen told Magnolia Tribune during a recent legislative update in Pearl River County. “We’re looking at what’s best for the state economy, what’s best for businesses, what’s best for the people and what’s best for the local governments.”

Talk of cutting the sales tax on groceries was top of mind during the 2023 election cycle as Democratic gubernatorial candidate Brandon Presley made it one of the pillars of his campaign. Lt. Governor Delbert Hosemann (R) has also previously voiced support for a reduction in the sales tax on groceries.

State Senator Brice Wiggins (R) told Magnolia Tribune that he supports a cut of some sort on the sales tax on groceries and has for a number of years. He said his Coast constituents have expressed the need for relief. Wiggins added that if the details could be worked out, he would support elimination of the tax.

“That’s a tradeoff I’m willing to make, trade off in less revenue, for the relief that it will bring to Mississippi families,” Wiggins said. “This is about day-to-day living; this is something that would bring relief to those families.”

Navigating the Complexities: Balancing Revenue Needs and Tax Relief

State Senator Josh Harkins (R) said the hurdles to cutting the sales tax on groceries include keeping the municipalities, and other entities that benefit from sales tax diversions, whole. Unlike the cut to the income tax, cutting sales tax is not a dollar for dollar cut.

“The grocery tax, however, if you cut a dollar of grocery tax, you also have to make all the participants of all the diversions whole, or else they get cut,” Harkins explained.

According to the Annual Report issued by the Department of Revenue for the state of Mississippi, a portion of sales tax is also diverted to education and infrastructure.

To address that problem, Speaker White has suggested increasing the 18.5 percent of the sales tax diverted to cities to make up for the lost revenue. But White knows “if you’re going to keep those cities whole, that’s where it gets tricky.”

By the Numbers

For example, Senator Harkins explained that a $100 purchase of goods will result in $7 dollars being collected by the state for sales tax. Of that tax, 18.5 percent is sent back to the city where the product was purchased. Only municipalities receive sales tax diversions in Mississippi; counties do not receive a diversion.

While exact numbers for grocery sales taxes are not included in the Department of Revenue’s Annual Report, estimates provided by the Department’s Communications Department show that in Fiscal Year 2023, grocery sales within the state totaled $6.2 billion, equating to nearly $440 million collected by the state in grocery sales tax. The state sent nearly $315 million from the grocery sales tax total to the general fund and diverted almost $73 million to cities for their use. Another $52 million was diverted to education and infrastructure.

“You got $440 million in grocery tax they want to eliminate. You got $2 billion of income tax they’re wanting to eliminate, and we bring in about $7 billion a year,” Harkins added. “At the end of the day, it’s about priorities. I haven’t seen too many proposals cutting funding to anybody.”

In fact, the state budget continues to increase annually.

For the sake of comparison, the total of all sales tax collected by Mississippi was $4 billion. Of that, $560 million was diverted to cities in that same fiscal year, according to DOR’s Annual Report. The report further indicates that sales tax accounts for a large portion of the state’s general fund, about 36.8 percent – higher than the individual income tax at 32.2 percent.

The Road Ahead: Challenges in changing Mississippi Grocery Sales Tax

With such a large portion of the general fund coming from sales tax, Senator Harkins said it would be difficult to cut the sales tax rate on groceries while continuing to cut the income tax at the same time.

“It’s a lot of money when you’re talking about trying to cut the income tax. You don’t have that many options when it comes to cutting taxes,” Harkins elaborated. “You got to get it from somewhere. You either have to grow economically, grow the economy so there’s more revenue being generated. If you’re going to try to cut all these taxes, at the end of the day it’s great in theory but putting it into practice is the hard part.”

However, Senator Wiggins points out that the state has seen revenue surpluses in the last several years. The most recent numbers released Monday from the Legislative Budget office show that Mississippi ended FY 2024 with an estimated excess of $979.4 million including reappropriations.

“I think this is one of those instances where you don’t need to make it up,” Wiggins said. “The ones who benefit from the sales tax are local cities and local governments, in addition to other governments. I think that there is a lot of trade off that needs to be done and this is one of those tradeoffs. So, I don’t know that you actually have to make it up.”

The only solution Senator Harkins sees to cut sales taxes on groceries is to increase some other tax, such as property taxes. That is something State Senator Angela Hill (R) doesn’t want to see.

“Because, personally, I don’t want my property taxes raised to make up for the loss in the grocery tax,” Senator Hill told Magnolia Tribune.

Various proposals from both sides of the aisle and in both legislative chambers are expected to hit the hopper come January. Until then, lawmakers will continue to discuss options in the lead up to the 2025 session, holding hearings and vetting tax reform proposals.