(Photo from Governor's 2024 EBR)

- For the month of June alone, Magnolia State revenues exceeded estimates by $46.8 million.

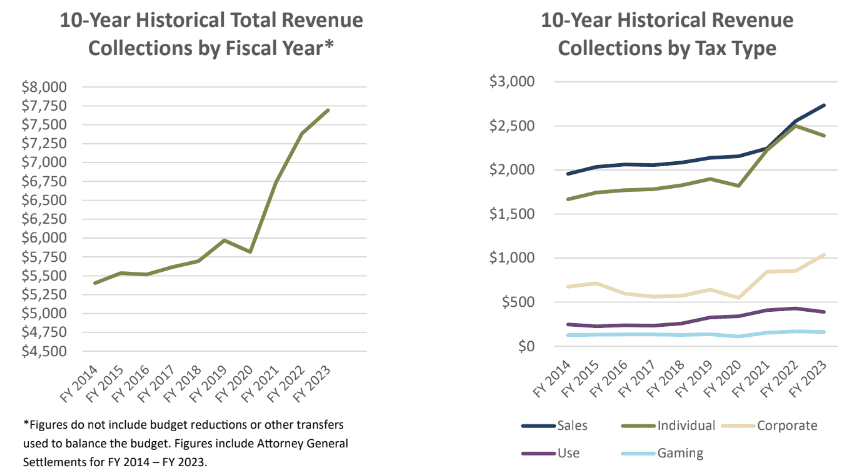

Mississippi ended the 2024 fiscal year $181.7 million over budgetary estimates, even with the phase out of a significant portion of the state’s income tax.

The Legislative Budget Office released the June state revenue report on Wednesday, showing Mississippi tax collections for the final month of the fiscal year.

A new fiscal year began on July 1st.

According to the report, revenue collections through June 2024 were $181,660,113 or 2.41%

above the sine die revenue estimate approved by lawmakers. The FY 2024 Sine Die Revenue Estimate was $7,523,800,000.

For the month of June alone, revenues exceeded estimates by $46,853,106 or 6.28%. General Fund collections were $36,347,242 or 4.81% above the prior year’s actual collections.

Sales tax collections for the month of June were above the prior year by $3.6 million while corporate income tax collections for the month of June were above the prior year by $2.3 million.

Individual income tax collections for the month of June were also above the prior year by $13.8 million. However, overall, income tax collections were down $142 million or 5.9% from the prior year due to the historic tax cut from 2022.

As previously reported, the Legislature passed and Governor Tate Reeves (R) signed into law a $525 million tax cut plan in 2022 which eliminated the 4% income tax bracket and phased down the 5% bracket to 4% over a three-year period.

Speaker Jason White (R) recently announced the appointment of a new Select Committee on Tax Reform with the goal to eliminate the “tax on work” by providing a recommendation next session to “move away from personal income tax and moving more toward a consumption model.”

Governor Reeves has repeatedly called on the full elimination of the state income tax.