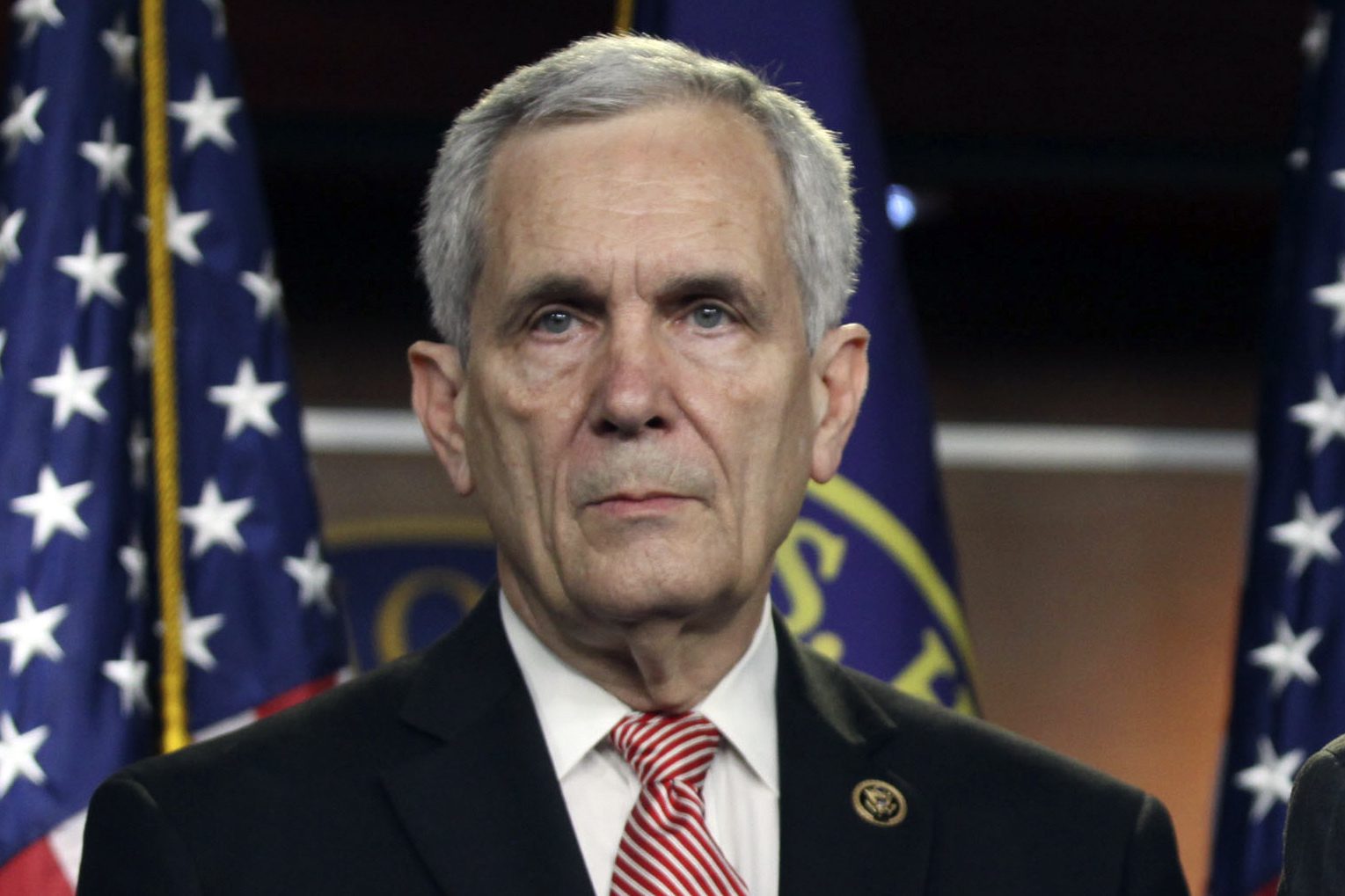

Jason White, Speaker for the Mississippi House of Representatives, updated members of the Mississippi Press Association about the Legislature's efforts to address healthcare, taxes and education during an MPA conference held last Friday. Photo by Jeremy Pittari | Magnolia Tribune

- White said school choice, tax reform would be top priorities heading into the 2025 legislative session.

Speaker of the Mississippi House of Representatives Jason White provided a legislative update to members of the Mississippi Press Association on Friday in Biloxi.

Topics of discussion at the luncheon event included tax reform, mobile sports betting and a new funding formula for K-12 public education, with Medicaid expansion dominating the conversation.

Recapping the Medicaid Expansion Effort

White, a Republican from West, said the House introduced a bill that would have addressed the coverage gap working Mississippians experience when they make too much money to qualify for Medicaid, but not enough to cover their health insurance costs. He said the issue rose to be a top priority after his Republican members heard concerns from constituents on the campaign trail during the 2023 election that supported expansion.

During the 2024 legislative session, the House initially proposed full Medicaid expansion under the Affordable Care Act for those earning up to 138 percent of the federal poverty level. By committing to full expansion, the state could have drawn down a higher federal reimbursement rate of 90 percent for the expansion population. Current Medicaid enrollees would continue to draw the state’s current 77 percent federal match rate.

Speaker White added that there were tax and other provisions that would have covered the state’s 10 percent share for the first four years. White also touted that the bill included a four-year repealer, so the next administration could decide whether to continue the program.

He said most Mississippians currently making up to 138 percent of the federal poverty level cannot afford insurance. Presently, someone making between 100-150 percent of the federal poverty level is eligible for a private health insurance plan on the Affordable Care Act’s federal exchange with no premium costs.

White said these subsidized plans offered through the Affordable Care Act’s federal exchange come with high deductibles and co-pays. Within Mississippi, the Speaker told Press members that about 200,000 people have enrolled in those subsidized plans, but they often go unused.

“They don’t use them because they can’t afford the deductible,” White explained.

The ACA plans for someone making between 100-150 percent of the federal poverty level come with a 94 percent “cost sharing reduction” on deductibles and co-pays. According to the Kaiser Family Foundation, once the cost sharing reduction is applied, the average deductible on one of these plans, known as a CSR94, is $90 annually.

If traditional expansion had occurred up to 138 percent of the federal poverty level, approximately 181,000 enrolled Mississippians would have been moved off the ACA plans and onto Medicaid.

Even if the bill had made it out of both bodies in the Legislature, Speaker White admits Governor Tate Reeves (R) would not have signed off on it.

“He and I have had long conversations about it, and he is right when he says, ‘My opponent ran specifically on Medicaid expansion and I beat him,'” White said, referring to the failed campaign of Democratic nominee Brandon Presley during the 2023 election cycle.

However, the Speaker believes Reeves was re-elected based on his being a conservative, not particularly because of his stance on Medicaid.

As for the uncertainty of exactly how many more people would be added to the Medicaid rolls if the Legislature passes an expansion bill, White concedes that other states had issues with their predictions when taking similar action.

“Now I will tell you the jury is out on how many people we are talking about. Are we talking about 50,000 or 250,000?” White said. “That is tricky. Most states that guessed did not get the guess right.”

Currently, there are 718,000 Mississippians enrolled in Medicaid programs, or roughly one-fourth of Mississippi’s 2.9 million people. The Mississippi Legislature approved a $7.9 billion Medicaid budget this year, making it the largest single expenditure by government in Mississippi. The bulk of those funds come from the federal government, but the state portion of the expense is still the second largest item on the state’s budget. The first is K-12 education at more than $3 billion.

“We’re currently spending almost a billion dollars (on Medicaid), so now you’re talking about whatever the cost will be added on top of that,” White added.

Even though expansion failed this year, Speaker White anticipates the conversation will continue in the 2025 session.

Education Changes

One of the big-ticket items that did become law this year was a change to how K-12 public education is funded. The new model, the Mississippi Student Funding Formula, was based on the House’s initial plan that included a weighted funding system. The Speaker said the system ensures districts in the most need receive additional monies from the $230 million increase in funding.

Speaker White was clear that the highest performing school districts will most likely not see additional funds because the focus was on helping districts that were previously neglected.

Two other education related topics discussed at the Press luncheon included the need for a new accountability model and school choice.

White was brief on the accountability model, stating that districts that continually fail should expect “conversations moving forward.”

In terms of school choice, Speaker White said parents have been asking Republican lawmakers for the option to take their children to other public schools outside their home district, if the school has room and is willing to accept them. Under such a plan, state dollars allocated for that student’s education would follow them to the new school.

Mississippi law already has a provision that allows for open enrollment between public schools, but both the receiving and sending school must agree to the transfer. In recent years, proposals have been floated to eliminate the ability of the school losing the child to stop the transfer.

Creating magnet schools is also being considered, White said. He told the Press that he’s spoken with Governor Reeves about the potential for opening magnet schools on the campuses of universities and colleges that have empty seats.

“So, you’re going to continue to see Republicans push those things, but it’s a result of hearing from constituents,” White stated.

Select Committee Work

Last month, Speaker White’s office announced the formation of a few new committees. Two of those focus on tax reform and rising prescription costs. There is also a committee focused on certificate of need, or CON laws to address healthcare issues.

Members of the tax reform committee have been tasked with finding a way to move away from relying on individual income tax while lowering the sales tax on groceries. Groceries are currently taxes at the same 7.0 percent sales tax rate applied to other purchases.

Mississippi revenues have exceeded budgetary requirements in recent years. The overruns have allowed the state to provide funding to the Mississippi Department of Transportation for road and bridge projects, but Speaker White recalls years where cuts were made to MDOT’s budget due to shortfalls.

“We won’t always have a billion-dollar-budget surplus every year that we can just throw five or six million over to MDOT for capacity projects,” White said, adding that there is a need for a sustainable solution for such efforts.

As for the sales tax on groceries, Speaker White knows cities, especially small to medium size ones, rely on the tax to help cover local government expenses. He said it will be a challenge to lower that rate while ensuring those cities remain whole. Mississippi has been noted by various sources as having the highest grocery tax in the nation.

Another select committee will work to address issues with the rising cost of prescription drugs. Its goal will be to consider concerns from independent pharmacists that pharmacy benefit managers are pricing them out of the market, resulting in more business for larger chains, raising the potential for local pharmacy closures.

Mobile Sports Betting

A bill that would have opened mobile sports betting up to all Mississippi residents of legal age outside the walls of a casino failed this session. Speaker White explained that it failed because one or two operators in the state had concerns, even though most operators supported the bill.

Legislators also had concerns, such as with addressing gambling addiction and how much young males up to age 35 would be spending on the new option.

Those concerns, White said, led to restrictions in the bill, such as not being able to use a credit card to place bets. He said conversations about the topic will continue, especially since the aim is to use the anticipated $35 to $60 million in taxes for road and bridge projects.