- The Senate concurred with a House amendment on Friday, sending the legislation to the Governor. The bill also adds Sunday to the sales tax holiday period.

Mississippi’s back-to-school sales tax holiday will be moving two weeks earlier this summer, to the second weekend in July, assuming Governor Tate Reeves (R) signs off on the legislation now heading to his desk.

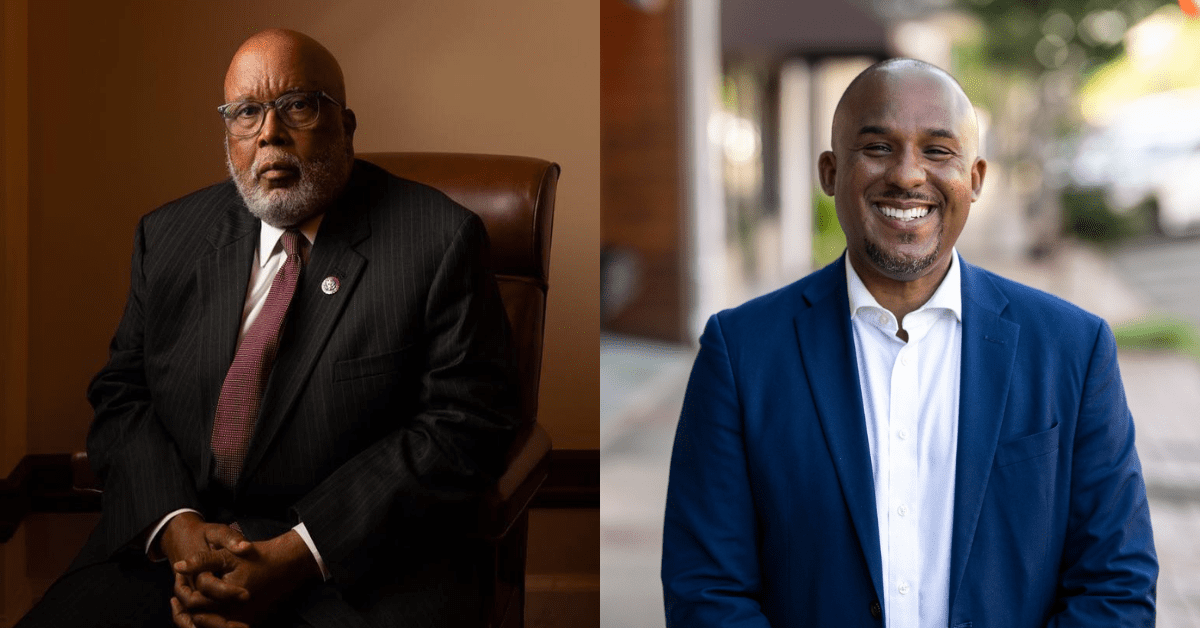

On Friday, the Senate voted to concur with the House changes to SB 2470. The legislation, authored by State Senator Walter Michel (R) and amended in the House, also adds Sunday to the sales tax holiday weekend that currently only includes Friday and Saturday.

The reason Senator Michel told lawmakers the bill was important is because of the difference in school schedules now.

“Schools are starting school earlier. Not only that, some are going to that modified calendar so we want to be ahead of the game,” Michel said Friday.

Various districts across the state have adopted the modified calendar, meaning those schools will be returning to classes as early as mid-July. The back-to-school sales tax holiday as it is currently observed during the last weekend of the month does little to help those parents with the initial annual expense.

Senator Michel also hopes the bill will bring in out-of-state shoppers to Mississippi’s border cities and towns looking for deals and spending their money in the Magnolia State. For example, neighboring Alabama holds their back-to-school sales tax holiday on the third weekend of July.

If signed into law, the Mississippi back-to-school sales tax holiday for 2024 would begin July 12 and run through July 14.

A sales tax holiday is a temporary period when sales taxes are not collected or paid on purchases of specific products and/or services. The Magnoli State’s back-to-school sales tax holiday includes articles of clothing, footwear, or school supplies if the sales price of a single item is less than $100. For a list of eligible and non-eligible items, visit the Department of Revenue’s 2023 guide here.

The amended legislation would be effective on the date the bill becomes law instead of the usual July 1st, giving retailers extra time to plan for the weekend sales period.