- A House bill would restructure the current PERS Board with appointed members by state officials as well as prevent a previously approved 2 percent rate increase from going into effect.

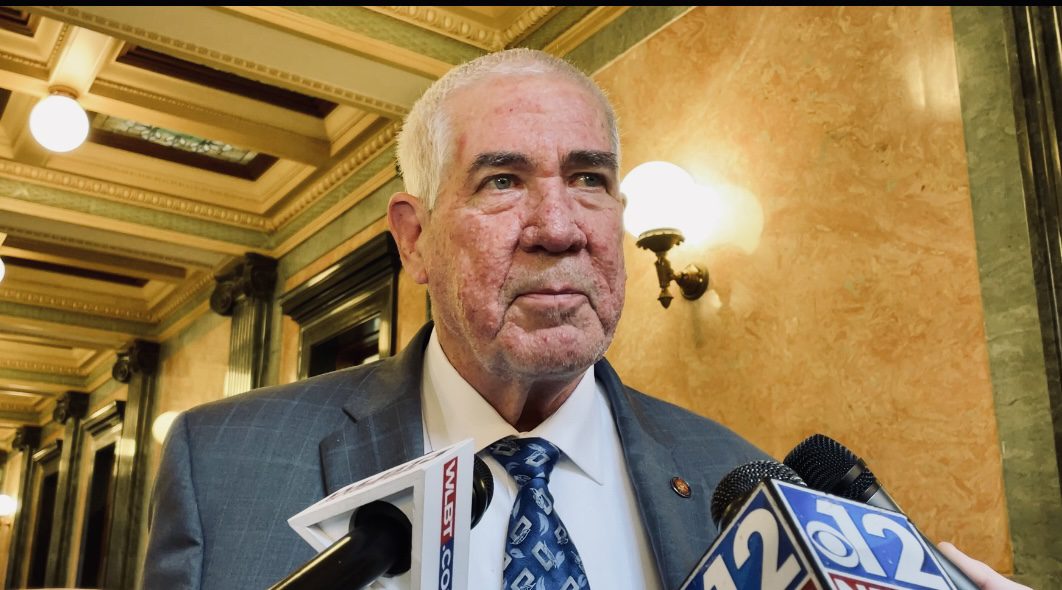

Lawmakers have taken action to restructure the Mississippi Public Employees’ Retirement System (PERS) Board in a proposal authored by State Representative Hank Zuber (R).

The PERS Board as it is comprised now mostly consists of government employees and retirees elected to serve by their peers.

HB 1590 was brought before House members on Wednesday with a proposed strike-all amendment that would reconstitute how the PERS Board is organized. The bill restructures the board with 11 members, to include four to be appointed by the Governor, three to be appointed by the Lt. Governor, the State Treasurer, the Commissioner of the Department of Revenue, one current employee, and one current PERS retiree.

The Speaker of the House will also have the option of recommending two of the Governor’s appointees and two of the three appointees from the Lt. Governor.

“For years now, the unfunded portion of our retirement plan has continued to increase while the funded portion continues to decrease. House Bill 1590 will bring a new set of eyes to look at the plan in its entirety while maintaining representation from present employees and retirees,” Rep. Zuber said on the legislation. “New appointees must meet strict financial qualifications to ensure that we have the best people in these positions. We have the best retirement plan in the country and we want to preserve it for future teachers and state employees. The bill makes absolutely no change to benefits nor is that the intention of the legislation.”

Rep. Zuber said there are provisions in the bill to require certain qualifications for these appointments prior to serving on the PERS Board. Appointees must have knowledge of the financial assets and principals of the retirement plan either as a participant or employer. The bill also outlines that there cannot be a conflict of interest for any plan administered by the Board.

The strike-all amendment also prevents the current 2 percent employer rate increase proposal from the PERS Board set to go into effect in July 2024.

The bill passed in the House by a vote of 85 to 34.

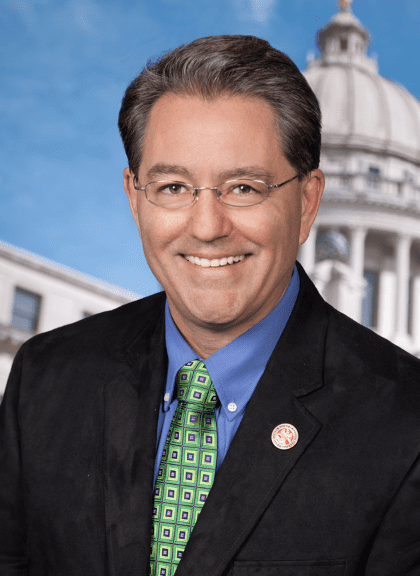

Ray Higgins, Executive Director of PERS, said he is aware of the bill, adding that the Board has always acted in accordance with their duties to its membership.

“PERS is aware of the passage of House Bill 1590, which would restructure the Board of Trustees and rescind the needed employer contribution rate increase,” said Higgins in a comment to Magnolia Tribune. “While the Board may have more comment on this bill later, the Board has always acted in accordance with its fiduciary and statutory duties, and PERS will continue to serve its membership to the best of its ability. Regarding the scheduled rate increase, appropriate funding for PERS in some manner is very important for the long-term needs of the plan.”

Currently, the PERS Board is made up of 10 members: the State Treasurer, one appointment by the Governor that is currently a member of PERS, two retirees, two state employees, and one representative from public schools, community colleges, institutions of higher learning, counties and cities. All are elected by the members except the Treasurer and the gubernatorial appointee.

State Representative Omeria Scott (D) questioned why there would no longer be a guaranteed board member to come from the community colleges and universities.

“Can you tell us why we would want to move to take off the people who would be the voice of every area of the retirement system to sit on the board. What was the thinking of you, when you decided to do that,” asked Scott.

Rep. Zuber said there was no specific reason. He insisted that the bill is attempting to get a “new set of eyes” on the retirement system to review the rate of return and the system as a whole.

There has been disagreement in recent years between the PERS Board and some lawmakers, as the Board has approved employer rate increases that impact not only state government but cities and counties as well. In 2023, legislation to take that power away from the Board was halted after an agreement was reached to pause a rate increase.

RELATED: Lawmakers will not move forward on legislation after PERS expected to push back rate change

A rate increase was approved to go into effect this year at 2 percent. This would go into effect in July 2024. Rates are expected to increase to 19.40 percent at that time. It would be the first step in a phase-in of rate increases that is expected to reach 22.40 percent.

“The PERS Board of Trustees has increased the employer contribution rate to 22.40 percent, phasing it in at only 2 percent each year starting July 1, 2024,” Director of PERS Ray Higgins said in a statement regarding the rate increase. “Under this board action, this equates to a 2 percent increase July 1, 2024; another 2 percent increase July 1, 2025; and an additional 1 percent increase July 1, 2026; up to the total employer rate of 22.40 percent. Separately, the Board has lowered the plan’s assumed rate of return from 7.55 percent to 7 percent based on the recommendations of the actuary and others.”

Higgins went on to add that it is the board’s position that a reasonable and appropriate assumption is important to avoid understating the liabilities and underfunding the plan.

However, if the House bill becomes law, that rate increase would be blocked.

Actuaries have recommended a continued phase-in of a 2 percent increase over time until PERS reaches a 27.40 employer contribution. The Board has currently not taken any action on that recommendation, only approving the increase up to 22.40 percent.

The Mississippi Senate recently passed another piece of legislation that could hold employers responsible for actuary financial liability in the event they chose to exit the PERS system.

RELATED: Employers in PERS could be held responsible for unfunded liability if they exit the system

While the bill did advance in the chamber, some lawmakers questioned how that liability number would be calculated in those potential situations.