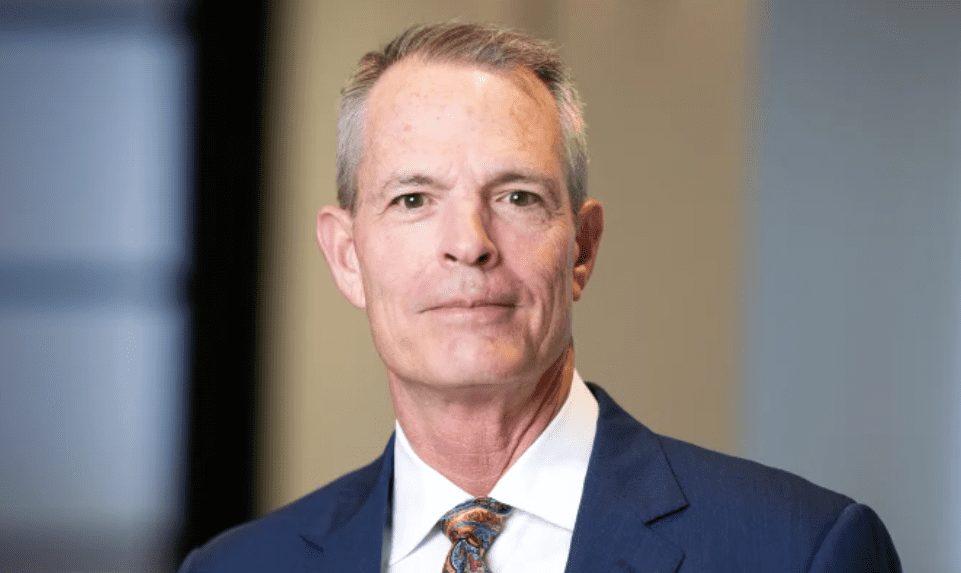

- Pepper Crutcher discusses the complexities of Medicaid expansion.

“From thirty feet away she looked like a lot of class. From ten feet away she looked like something made up to be seen from thirty feet away.” – Raymond Chandler, The High Window

That’s typically true of legislation that seeks to solve complex problems. How you see the House-passed Medicaid Expansion bill probably depends on your pre-existing point of view. The Mississippi House passed HB 1725 with a vote of 98-20 on February 28, advancing it to the Mississippi Senate.

Everyone would like to see reliable, relevant data about a truly comparable, prior State expansion, but no such data is available. Since we have little more than confirmation bias to inform us, none should question the character or motives of those who see this differently. Here’s a short, over-simplified explanation of why this topic confounds so many who sincerely want to get it right.

Who would be eligible for expanded Mississippi Medicaid coverage?

There are 15 coverage categories; low Modified Adjusted Gross Income (MAGI) alone won’t suffice. To qualify under the most restrictive category, non-disabled adults with dependents, your MAGI must be very low indeed. Typically, these are households with reported income from part-time or sporadic employment at or just above the minimum wage. Mississippi has the option to raise this limit to 138% of the Federal Poverty Limit (FPL), thereby drawing a more generous federal Medicaid match – currently up to 95% of qualifying expenditures.

HB 1725 goes all-in. Even if CMS (the federal Centers for Medicare and Medicaid Services) disapproves the bill’s work requirement, full expansion will happen; so says section 1(f) of HB 1725. Mississippi Medicaid would no longer cover only the abjectly impoverished; it would cover many people with full-time jobs that pay more than the minimum wage.

When would Mississippi Medicaid expansion become effective?

Even if CMS denies Mississippi’s work requirement request, the enrolled expansion population would be covered beginning January 1, 2025, based on HB 1725 as passed by the House.

What is the difference between Medicaid and “Obamacare”?

Medicaid is a federal/state health insurance program administered mostly by states but funded, in the poorest states, almost entirely with federal dollars. Payments to providers are, in most situations, lower than private insurance or Medicare payments.

Currently, there is a gap between the upper MAGI limit for adult Mississippi Medicaid and the lower limit of “Obamacare” subsidy eligibility. Mississippi households with income 100% to 400% of the Federal Poverty Level are eligible to buy federally subsidized, privately issued health insurance plans through Healthcare.gov – the “Obamacare” web site. See for yourself. Go there, enter single member household, minimum wage, full-time job numbers (amounting to $14,720 annually) and the site’s calculator will tell you that your income is too high for Mississippi Medicaid but that you are eligible for Obamacare subsidies.

Through “Advance Premium Tax Credits,” the Feds pay all Obamacare premiums for households with incomes between 100% and 150% of the FPL. There also are “Cost Sharing Reduction” subsidies, but, even with them, beneficiaries may have to bear several thousand dollars annually of “out-of-pocket” (OOP) costs that they would not bear if Medicaid had covered the same medical expenses.

What’s the problem?

Lest this article become a book, let’s just scratch the surface. Should HB 1725 become law as passed by the House, the upper Medicaid adult MAGI limit will substantially overlap the lower limit of Obamacare subsidies. Healthcare.gov will redirect Mississippi applicants to Medicaid if they enter Medicaid-qualifying MAGI numbers, reducing federal expense for that household’s coverage (100% of premiums plus cost sharing reduction subsidies), while increasing State expense (5% of covered costs of care for the expansion population). The added Mississippi Medicaid burden of the newly enrolled would be known in percentage terms but unknown in absolute dollar – i.e., budgetary – terms. The State’s cost could be raised further by small employer decisions to drop their plans. Some people now working full time for their employer-sponsored insurance might quit or go part time, and Mississippi already has the nation’s lowest workforce participation rate. HB 1725 anticipates this and directs the Division of Medicaid to make coverage hoppers wait a year to enroll in Medicaid. Just like the work requirement, this would require CMS approval.

Plus, enforcement mechanisms and capacities are unclear. If the people dropping from employer insurance plans tend to be younger and healthier than average, those plan terms and premiums may get worse as claim experience trends badly. Some small employers might become uninsurable, effectively. In the worst-case scenario, expansion might solve much of the Obamacare OOP problem for current uninsureds while creating a new group of uninsureds who would be less likely to qualify for full Obamacare subsidies. A similar expansion consequence could wreck Mississippi Obamacare. About 286,000 Mississippians are enrolled in a 2024 Healthcare.gov plan.

If insurers expect most of them to shift to 2025 Medicaid, will those insurers compete for the shrunken 2025 Healthcare.gov business? How much would the remaining insurer(s) raise premiums in response to what they may see as increased risk? If rates spike or if insurers bail out, many new uninsureds could fall in a new gap between expanded Medicaid and employer-provided coverage.

What could go right?

“Only two people know the future: God and a fool,” says the Lebanese proverb. Medicaid expansion worries may turn out to have been excessive. Expansion might cost the State little, solve the Obamacare OOP problem, throw a lifeline to struggling providers, increase workforce participation, and not wreck the Obamacare exchange program. An old joke, told by Milton Berle, is an apt one: “Two Irishmen are leaving a bar …. What? It could happen!” This, too, could happen. In hindsight, expansion proponents might seem to have been prescient.

But everyone is guessing. If your friend’s guess doesn’t match yours, he or she should remain your friend. Let it be so, please.