The notion that higher income earners are not paying their “fair share,” whether nationally or in Mississippi, is utter nonsense. Wealthier people pay the lion’s share of taxes. Poorer people receive the lion’s share of benefits.

President Joe Biden routinely argues that “rich” people “need to start paying their fair share.” Closer to home, kindred spirit Bobby Harrison contends that “Mississippi’s tax structure favors the rich and hurts the poor.”

This kind of rhetoric is predictable among folks who want ever bigger government, particularly if the expense of Leviathan’s insatiable appetite falls almost exclusively on someone other than them. “The rich” are an easy target. They are in the minority and envy is a powerful emotion, easily manipulated by the unscrupulous.

But the idea that higher income earners are not paying their fair share, whether nationally or in Mississippi, is utter nonsense.

Not only do higher income earners pay the overwhelming majority of taxes collected at all levels of government, but low income earners receive the overwhelming benefit of those taxes in government transfer payments.

People arguing otherwise nearly always: (1) focus on rare exceptions instead of the norm; (2) highlight one type of tax at one level of government instead of accounting for the broader tax system; and (3) ignore entirely the flow of taxpayer-funded government benefits to low income individuals.

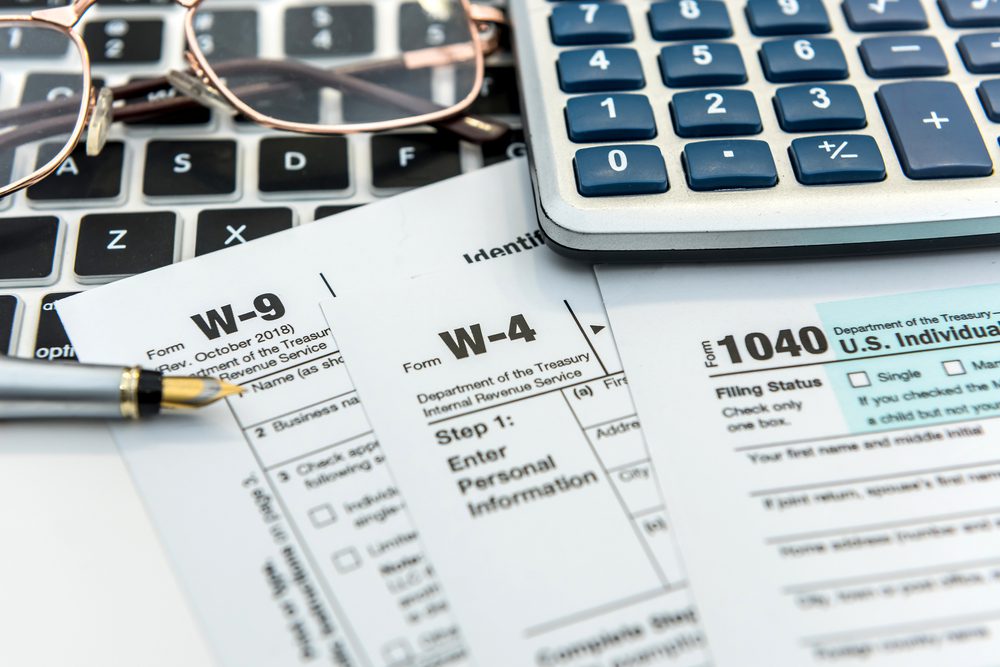

Top Earners Pay Over 80 Percent of Income Taxes

Federal and local income taxes comprise, by far, the largest pool of taxes collected in the U.S. They are also extremely progressive in design — meaning that higher income earners pay far higher rates.

According to IRS data, in 2020, the top quintile (20 percent) earned 56 percent of all income, but paid 81 percent of all federal income taxes. The bottom 50 percent of earners paid just 2.3 percent of federal income tax collections.

In 2021, individuals making over $50,000 in Mississippi paid 86 percent of all state income taxes. 77 percent was paid by workers making over $70,000.

This was before a 2022 tax reform package became law. The new tax law created the largest tax exemption in the country among states that tax income. A married couple can now earn up to $36,600 before incurring any state income tax liability. Mississippi’s median household income is $52,985.

With the new heightened exemption, a considerable portion of the state’s population will not pay any state income taxes. While the law cut rates for everyone, resulting in lower taxes for everyone, higher income earners will actually pay a larger percentage of total collections moving forward.

Tax Collections Only Part of the Equation

The Tax Foundation’s analysis of federal, state and local income taxes found that the top quintile paid $3.23 trillion in taxes nationally. The bottom quintile paid $142 billion. If you are doing the math, that’s a 22X difference.

Even that gap is misleading, though. Because government does not only collect revenue, it redistributes it. The overwhelming beneficiaries of this redistribution are no-to-low income earners. According to The Tax Foundation, the poorest quintile of households received net government transfers of $1.27 for every dollar earned — an income tax rate, on average, of negative 127 percent. Individuals in the second quintile are also net recipients of government transfers, with an average negative tax rate of 31 percent.

The Congressional Budget Office performs a similar analysis in its publication “The Distribution of Household Income.” The CBO looks at the net effect of both taxes and government benefits on income. This holistic analysis shows who actually pays and who actually receives.

The net effect of taxes and government benefits to the lowest quintile of earners in 2020 was a $23,900 (or 110 percent) increase in income, on average, to $45,800. The net effect of taxes and government benefits to the highest quintile of earners was an $82,100 reduction in income.

In short, no-to-low income earners receive exponentially more in government benefits than they pay in taxes. And high income earners pay the taxes that afford those benefits.

But what of that Dastardly “Regressive” Sales Tax?

Many economists argue that sales tax is the fairest, least disruptive, and most efficient form of taxes. The argument for fairness is founded on the idea that sales taxes are neutral and broadbased. Everyone making a purchase in a taxing jurisdiction pays the same rate.

Unlike income taxes, which discourage productivity, and property taxes, which discourage stewardship of resources, consumption taxes present less disruption — taxing what people take out of the economic stream.

Finally, there is considerably less bureaucracy, waste, and fraud with sales taxes, particularly when they are collected at the point of sale. This makes consumption taxes one of the most efficient, cost effective and stable forms of taxation.

The bulk of sales tax revenue collected by the state still comes from higher income earners. It is intuitive. People who make more money have more money to spend. It is also empirical. Overlay a map of the counties in Mississippi with highest median incomes with a map of the counties that generate the highest volume of sales tax revenue. Adjusted for population variances, it is essentially the same map.

The argument goes, though, that sales tax is still “regressive” because low income earners feel it more as a percentage of their total income.

Of course, the same could be said of any product purchased. A can of tomatoes is a bigger percentage of a low income earner’s wages than that of someone who makes more. Still, few people seriously suggests that the price of items purchased should fluctuate, not based on their value, but based on the wealth of the purchaser.

Notably, our tax code does make allowances for purchases by low income individuals. For instance, the state applies no sales tax to grocery purchases made with food stamps.

The Tax Code & Government Benefits Should Not Be Analyzed in a Vacuum

Individual taxes at a single level of government do not represent the entire complex web of our tax code. A state’s sales tax does not exist in a vacuum. To accurately assess the impact of the tax code — and whether it favors any specific class of people — it is necessary to consider the whole tax code. It is also necessary to consider how the tax dollars collected are spent, and who those tax dollars benefit the most.

When done honestly, it is clear that higher income earners fund the government and low-to-no income earners are the beneficiaries of that funding. The tax code does not favor the wealthy at the expense of the poor.