According to the State Treasurer and State Economist, Mississippi should not feel many, if any, short term impacts from the change, but long-term implications could be a national issue.

At the beginning of August, Fitch Ratings downgraded the United States’ credit rating from AAA to AA+.

Credit ratings are established based on a country’s current and expected fiscal status. This includes things such as federal spending, the debt to GDP ratio, and overall economic health. According to a House Budget Committee report, public debt grew from 39% in 2009 to over 100 percent in 2023.

It is projected that over the next 30 years that percentage could increase to 181% of the GDP under current laws.

According the Mississippi State Economist Corey Miller, this downgrade shouldn’t have much impact on Mississippi’s economy, or even the U.S. economy in the short term. Overall, he believed that it was motivated by a desire to see the U.S. get a handle on current debt issues.

“Investors in Treasury bonds aren’t likely to divest themselves of U.S. government bonds anytime soon, and the downgrade is unlikely to affect the ability of the federal government to borrow,” said Miller. “However, I believe the downgrade from Fitch was intended as a wake-up call to U.S. leaders to get the country’s fiscal house in order sooner rather than later.”

He said the downgrade signaled that the recent debt limit battle between Congress and the White House caused damage to the rating agency’s confidence in U.S. leadership’s ability to deal with the country’s debt issues.

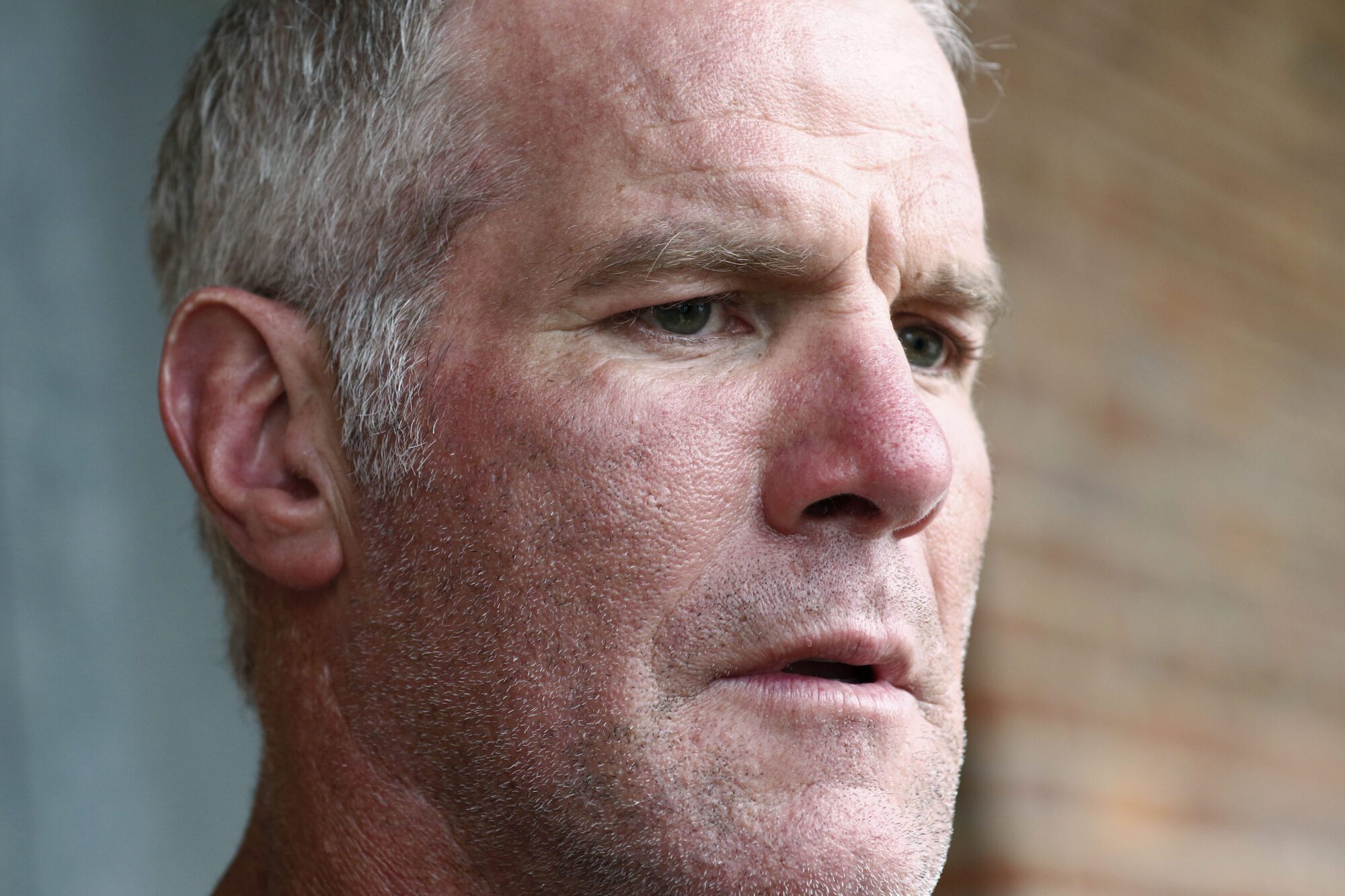

State Treasurer David McRae echoed similar sentiments but largely attributes that to the state’s efforts in economic stability.

“The drop of the U.S. credit rating will have no impact, short term, on Mississippi. In part, that’s because we’ve positioned ourselves well as a state to weather this storm,” said McRae. He added that several officials have gone through a series of debt refinancing deals that should save taxpayers more than $100 million dollars.

McRae also mentioned that the state has a solid rainy-day fund with a revenue surplus. He points to Biden Administration policies for the current financial issues the nation and other states are facing.

“President Biden has created a real financial mess. In the long term, if the Biden administration does not get their house in order, not only will Mississippi be affected, but the entire country will see a negative effect. It is time for him to put his woke agenda to the side, get our fiscal house in order, and start growing the economy again,” said McRae.

Miller says the federal debt is currently closer to 120%, which is one of the highest ratios among developed countries. Higher interest rates, currently being implemented in an attempt to combat inflation, make those debt payments increase.

“If these payments go unchecked, the share of the federal budget devoted to interest payments on the debt continues to grow, which over time could make budgeting decisions more difficult,” said Miller.

In the long-term, Miller believes if a larger share of the federal budget is put toward interest on debt, there would be less money for other items. This ultimately means fewer federal dollars for states like Mississippi that heavily rely on those funds.

Fitch Rating also noted the increase in government debt due to a failure to “address medium-term public spending and revenue challenges.” This coupled with an aging population, increased healthcare costs, increased interest and rising debt stock will ultimately raise spending.

The report also mentioned a recession is on the horizon. Fitch expects it to hit in the fourth quarter of 2023 or beginning of 2024 at mild levels.