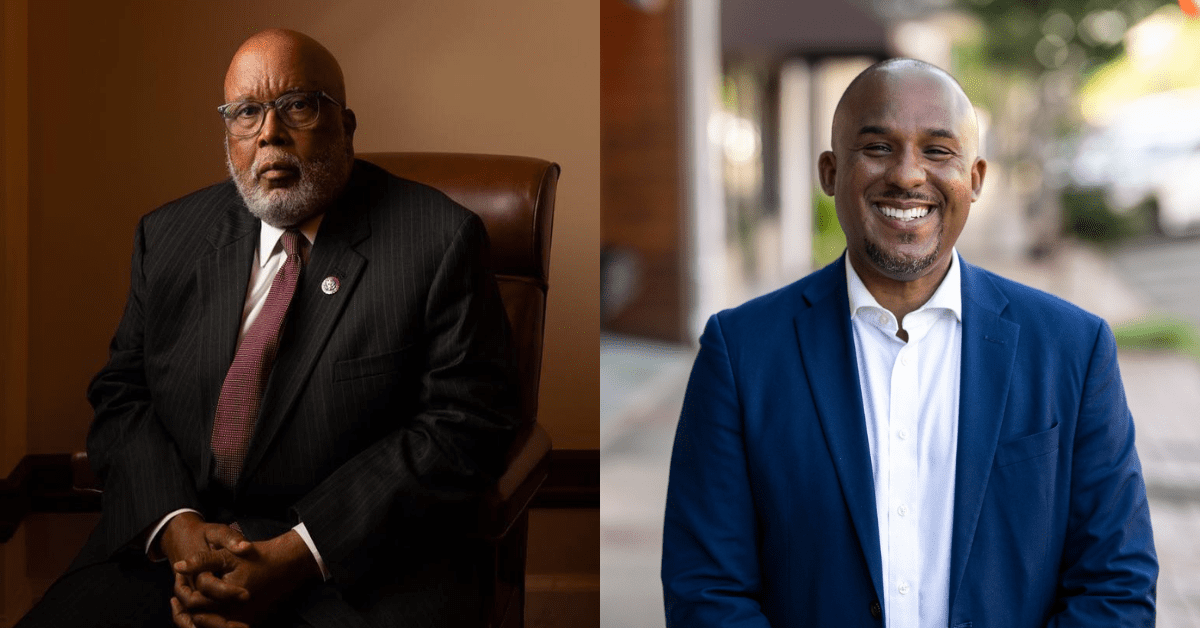

State Rep. Earle Banks (Photo from Legislature's website)

The 30-year lawmaker admits to making false statements on a federal tax return. He’ll be sentenced on August 21st and faces a maximum penalty of three years in prison.

State Representative Earle Banks has pled guilty to willfully making a false material statement on a federal income tax return.

The plea was announced by the U.S. Attorney for the Southern District of Mississippi Darren J. LaMarca and Special Agent in Charge James Dorsey of IRS Criminal Investigation’s Atlanta Field Office.

On Wednesday, Banks appeared in U.S. District Court in Jackson.

The U.S. Attorney’s office released the following statement regarding Banks’ plea:

According to admissions by Banks, he failed to report more than $500,000 of income resulting from the sale of real property. Banks admitted that he was aware of his legal duty to report that income, and instead willfully failed to report that income to the IRS on a 2018 Form 1040X tax return. Banks also admitted that the United States Attorney’s Office has sufficient evidence to convict him at trial if he had decided to go to trial instead of pleading guilty. It is against federal law to intentionally file false income tax returns which deliberately report less income than a person actually received.

Banks is scheduled to be sentenced by a federal district judge on August 21, 2023 and faces a maximum penalty of three years in prison. The IRS is investigating the case.

Banks, a funeral director and attorney, has represented House District 67 in the Mississippi Legislature for 30 years. He is currently running unopposed for re-election and has been out on bond.

As previously reported, a conviction may not prohibit Banks from continuing to serve in the Mississippi Legislature as Section 44 of the state constitution states that a person is not disqualified “from holding office if he has been pardoned for the offense or if the offense of which the person was convicted was manslaughter, any violation of the United States Internal Revenue Code or any violation of the tax laws of this state unless such offense also involved misuse or abuse of his office or money coming into his hands by virtue of his office.”