Santa Clara Police officers exit Silicon Valley Bank in Santa Clara, Calif., Friday, March 10, 2023. The Federal Deposit Insurance Corporation is seizing the assets of Silicon Valley Bank, marking the largest bank failure since Washington Mutual during the height of the 2008 financial crisis. The FDIC ordered the closure of Silicon Valley Bank and immediately took position of all deposits at the bank Friday. (AP Photo/Jeff Chiu - Copyright 2023 The Associated Press. All rights reserved.)

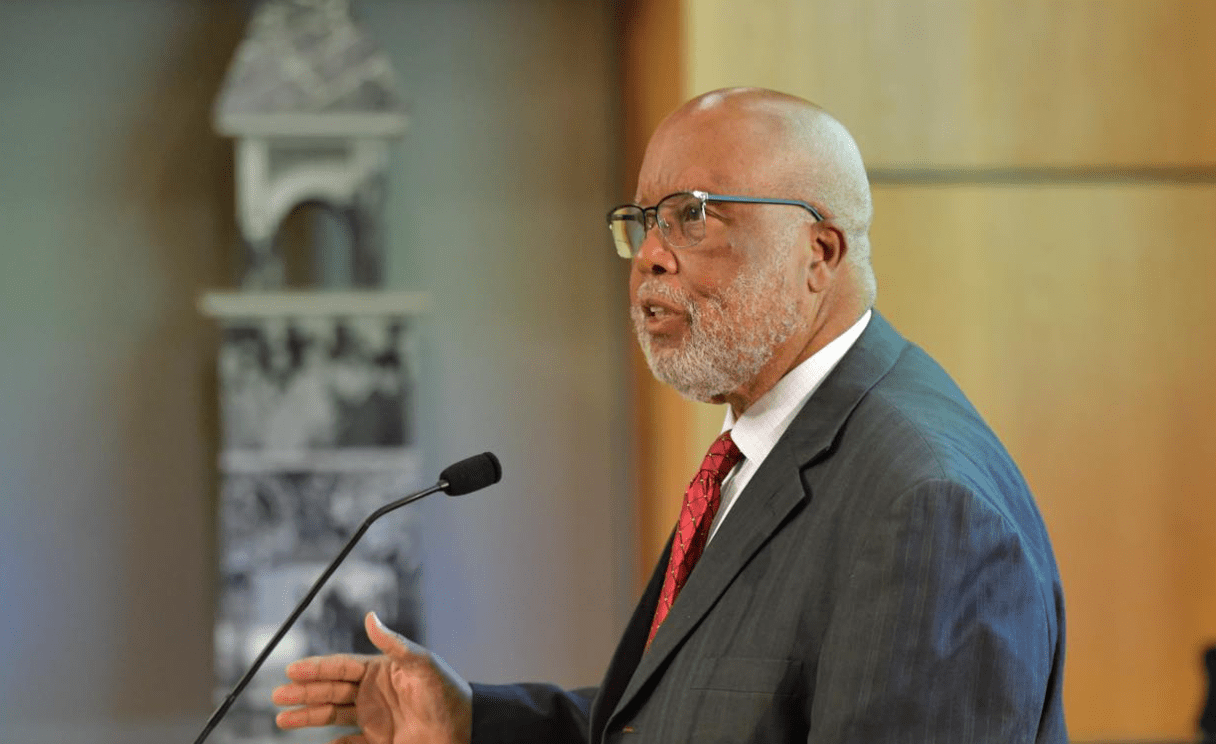

While Magnolia State banks are monitoring the situation, Bankers Association President Gordon Fellows reassures Mississippians that their financial institutions are strong, well capitalized, and well managed.

Late last week, Silicon Valley Bank (SVB), based in Santa Clara, California, collapsed following a report that the financial institution was struggling. That report resulted in a run on the bank as depositors, many of whom were venture capitalists in established and startup tech companies, rushed to withdraw their money.

California bank regulators placed SVB in receivership, handing control of the bank to the Federal Deposit Insurance Corp. (FDIC).

It was the first bank failure in almost three years and the largest financial institution collapse since Washington Mutual in 2008. Fears quickly spread across the U.S. banking industry. The trepidation sent stocks in the nation’s largest financial institutions sagging on Friday.

On Sunday, another bank – Signature Bank in New York – abruptly stopped operations and regulators moved in. Signature Bank catered to cryptocurrency and real estate companies.

Both SVB and Signature had a large number of customer deposits that were not insured by the FDIC, meaning deposits exceeded the $250,000 insured limit.

However, the FDIC, U.S. Treasury Secretary Janet Yellen and the Federal Reserve all stepped in over the weekend in an effort to stabilize the environment and reassure depositors. A joint statement from the feds released Sunday said depositors will have access to all of their money starting today – Monday, March 13th. They also noted that no losses associated with the resolution of SVB or Signature will be borne by the taxpayer.

The announcement means depositors with over $250,000 – the FDIC insured limit – will be able to access their funds. It is estimated that over 85% of the deposits at each bank exceeded that insured limit.

The Federal Reserve Board will also make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

“The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry,” the joint fed statement said. “Those reforms combined with today’s actions demonstrate our commitment to take the necessary steps to ensure that depositors’ savings remain safe.”

Gordon Fellows with the Mississippi Bankers Association told Magnolia Tribune on Sunday that there are several idiosyncratic factors that contributed to these failures. Unlike traditional banks like the ones we have in Mississippi that work to maintain a diverse portfolio to mitigate risks, the bank failures seen over the last few days are specifically tied to the tech industry.

“SVB was a very niche bank with an extremely high concentration of assets and deposits tied to the innovation economy and the tech sector specifically. This is a business sector under significant strain, and that strain impacted the bank financially as well as the decisions made by its customers,” Fellows said.

Mississippi banks, on the other hand, serve the agriculture sector, the commercial real estate sector, the home mortgage market, private banking, wealth management, and several other categories. Fellows said that diversity of customer segments helps banks absorb risks related to a specific market segment.

From all indications, at least at this point, these bank failures look to be limited in scope and should not have a significant impact on banking in Mississippi.

“Mississippi banks are strong, well capitalized, and well managed. We don’t think that there are systemic issues at play here, and we do not foresee the same systemic issues that arose after Lehman brothers,” Fellows said. “Mississippi’s bankers are closely monitoring this situation and are more than happy to help customers work through the details of their insurance.”

As Fellows notes, the FDIC and its Deposit Insurance Fund has been around for nearly 90 years. No American that has had their deposits insured by the FDIC has lost a single cent due to a bank failure.

“FDIC insured bank accounts are the safest place for individuals and businesses to keep their money. The FDIC insures up to $250,000 in eight separate account categories per depositor per bank, and it’s completely funded by the banking industry – not taxes or federal funding,” Fellows added. “The FDIC insurance fund has been at all-time high.”

The President and CEO of the Mississippi Bankers Association said it’s easy in the times we live in now to overlook how important deposit insurance is, but this event is a really good reminder.

“We encourage Mississippians that have questions about the insurance on their account to talk with their local bankers,” Fellows said. “Mississippi banks are relationship driven, and your state’s bankers are going to do all they can to support their customers.”