Research shows Mississippi is the highest audited state in the nation.

Last weekend, U.S. Senate Democrats, at the urging of President Joe Biden, passed the “Inflation Reduction Act.” Among the provisions in the bill is a funding increase for the Internal Revenue Service (IRS) that looks to add some 87,000 new agents in that federal agency.

READ MORE: U.S. Senate Democrats push through tax increases, green industry subsidies, IRS funding in marathon weekend voting

This has raised concerns among many Americans as the new IRS employees could be tasked with auditing more citizens and finding ways to increase government revenues through more aggressive reviews of tax filings.

Republicans have said there is no need to increase IRS agents, especially during a time when there are many other pressing issues the federal government should be addressing.

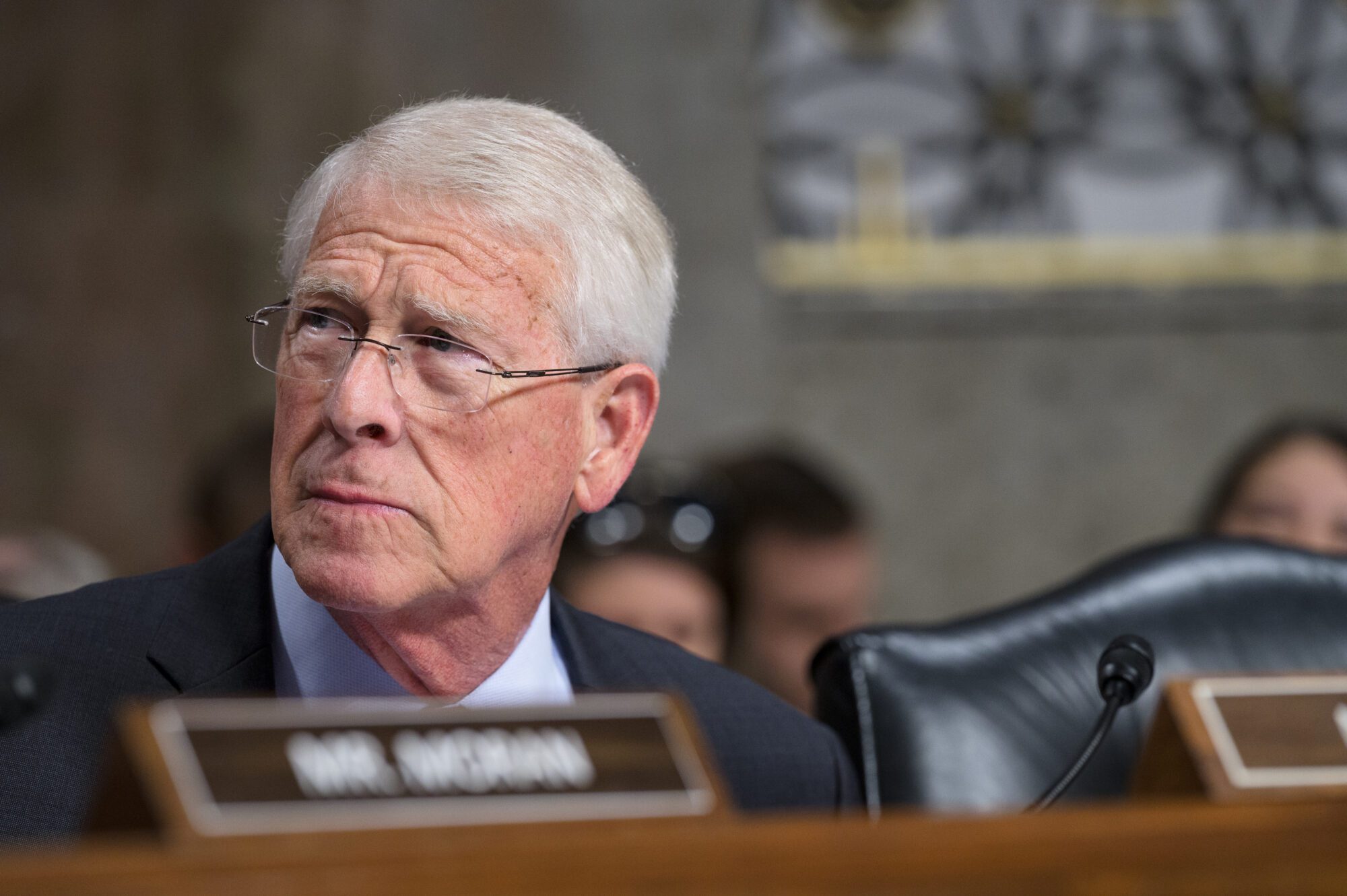

“The latest Democrat spending bill would massively expand the IRS, giving it more bureaucrats than the Pentagon, Border Patrol, and others combined,” Mississippi Senator Roger Wicker tweeted this week. “Democrats seem to care more about taxing you than keeping you safe.”

Congressman Steven Palazzo asked, “Who needs additional border agents when you could have 87,000 new IRS agents spying on you?”

The White House maintains that those earning less than $400,000 annually will not be targeted by the IRS. When asked about the potential for new audits on those making less than $400,000 per year, Press Secretary Karine Jean-Pierre said emphatically, “No. Very clear. No.”

Yet, it is estimated that 99% of Americans make less than $400,000, raising further red flags and questions as to the validity of the White House’s claims.

In 2019, ProPublica published an article titled, “Where in The U.S. Are You Most Likely to Be Audited by the IRS?” Surprisingly, one county in Mississippi leads nation, per research.

“Humphreys County, Mississippi, seems like an odd place for the IRS to go hunting for tax cheats. It’s a rural county in the Mississippi Delta known for its catfish farms, and more than a third of its mostly African American residents are below the poverty line. But according to a new study, it is the most heavily audited county in America,” writers Paul Kiel and Hannah Fresques state.

According to Kim Bloomquist’s research in Tax Notes, an estimated 11.8 per 1,000 filings were audited in Humphreys County. The national rate is 7.7 per thousand.

Mississippi has the highest audit rate in the nation, Bloomquist estimates.

“In a baffling twist of logic, the intense IRS focus on Humphreys County is actually because so many of its taxpayers are poor. More than half of the county’s taxpayers claim the earned income tax credit, a program designed to help boost low-income workers out of poverty,” Kiel and Fresques write.

Rankin County, Mississippi is the only county in the state that is below the national average, per the research. It sits at a 7.6 per thousand audit rate.

The article’s writers claim that the IRS already audits earned income tax credit recipients and the richest Americans at higher rates than all others.

While limiting waste, fraud and abuse of taxpayer funds are admirable pursuits, given the influx of 87,000 new IRS agents and the limited number of Americans who make over the $400,000 income mark, it is reasonable to assume from this research that more focus will come on the 99% of U.S. tax filers at some point despite what the White House currently asserts.

The uncertainty of whether that focus is for valid reasons to protect taxpayers or to further the Democrats’ political spending agenda is why average Americans and Congressional Republicans remain skeptical of the massive increase in the agency.

For Mississippians, the increase in IRS agents could mean even more scrutiny across the board no matter where you live or what level of income you enjoy.