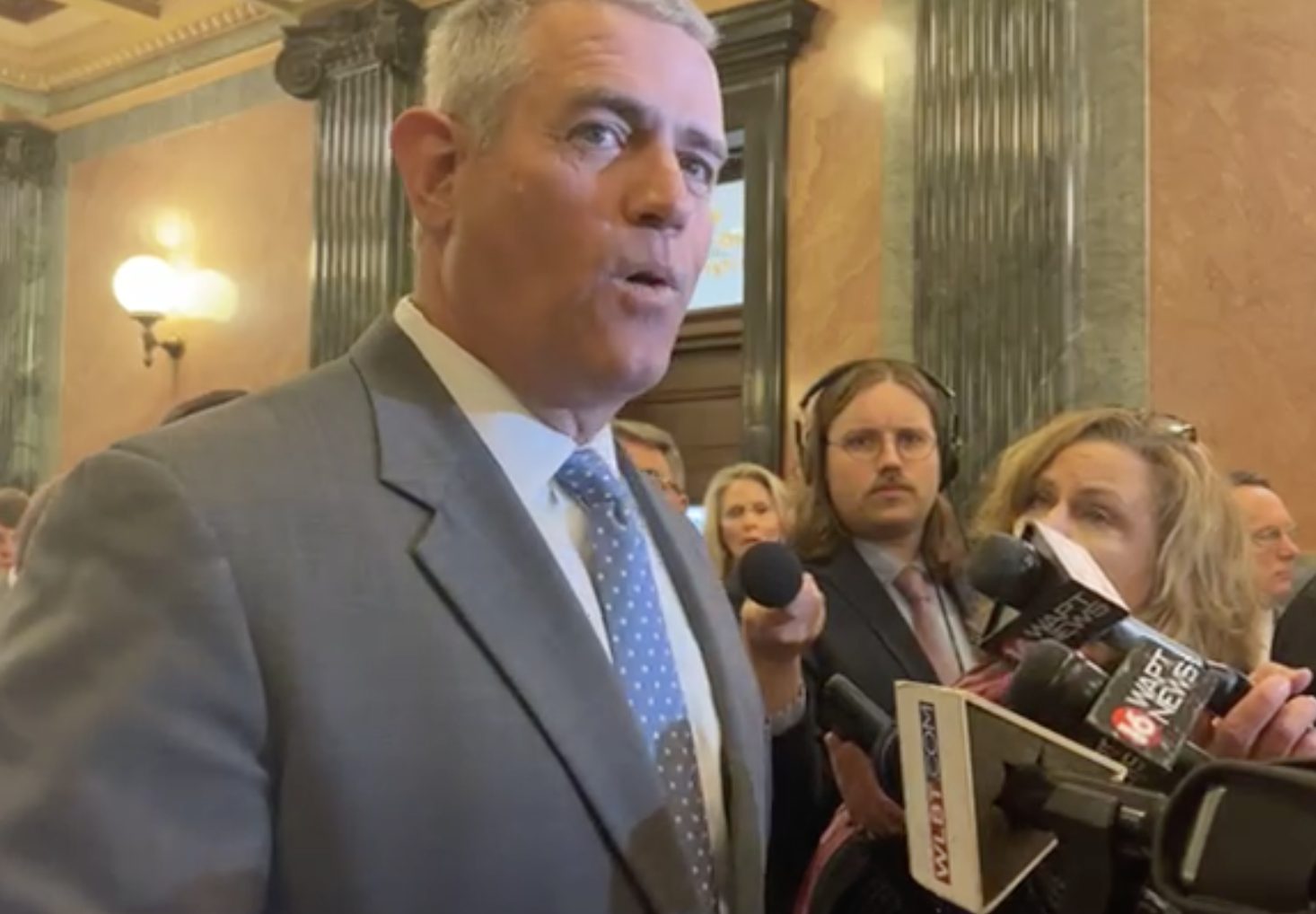

Speaker of the House Philip Gunn met with the press on Wednesday morning to discuss changes to the income tax cut plan that is currently in conference.

Currently HB 531, the House income tax cut bill and SB 3164 the Senate’s version are both in conference awaiting changes from conferees. Gunn indicated on Wednesday that the House will propose some changes to the previous set forth income tax cut.

Gunn said the new direction will be a $100 million reduction in income tax collections until it has been eliminated. There is a six year repealer in the bill. The proposal will be delivered to the Senate today in another signed conference report.

“On a dollar, thats a penny and a half of the state’s budget,” said Gunn. “We are contending given the excess revenue, we can certainly afford to give a penny and a half on the dollar back to the tax payer.”

According to the Speaker the revenue estimating group for the state met last week and revised the state estimate to about $7 billion. Gunn reiterated that the House has been assuming that would be the revised number for some time, which was largely what the income tax proposal was centered around.

“That estimate was shared with us last week. That establishes, what we believe, that the numbers we’ve been using on our income tax cut plan are accurate and are sustainable and that full income tax elimination can occur,” said Gunn.

Rep. Trey @tlamar44 comments on expected proposal on income tax in conference report to be sent to the Senate today. #msleg pic.twitter.com/oCZXpk8EOO

— Yall Politics (@MSyallpolitics) March 23, 2022

He said based on those numbers there is roughly $1.5 billion in excess revenue. He believes if this pace continues there will be over $2.5 billion in excess before the end of the fiscal year.

Gunn said the House will also move forward on obligating ARPA funds. There were prior remarks from the Senate that those bills were being bargained with to move the income tax cut forward.

The House plans for ARPA include allocations to broadband, rural water, healthcare retention, law enforcement benefits, domestic violence shelters and more.

“We have revisited that and we have recognized that those funds have certain restrictions on how they can be spent. We certainly want to help our cities and counties. We don’t have any problem going forward and appropriating the ARPA funds in accordance with the House position,” said Gunn.

Gunn was critical of any proposals made by the Senate to reform income tax. The Senate has not presented a plan that would call for a complete elimination of the state’s income tax. Their proposal would be a phase out of the four percent income tax bracket, decrease in grocery tax as well as a one time reimbursement up to $1,000.

“Under their plan, you get four bucks back per month in the first year. That’s not transformative,” said Gunn. “Our plan transforms the lives of Mississippians. It puts real dollars back in the pockets of the taxpayers.”

After Gunn’s comments, Lt. Governor Delbert Hosemann released the following statement regarding what was said:

“We understand the House is now prepared to allocate the one-time ARPA funds and we look forward to working with them to finalize a plan.

On taxes, the Senate has proposed $439 million in recurring-dollar tax cuts on top of the $235 million ($674 million total) which has yet to be phased in from the 2016 cuts. This is a conservative plan to return money to taxpayers. During the many hours we have spent with the House on this issue we have not said we do not support ever eliminating the income tax in Mississippi. We can address further cuts at any time. Taxpayers expect us to be responsible stewards of tax dollars. The Senate’s plan includes cutting taxes and taking care of core government services—not gutting them.

We also understand the House is inclined to base the budget on the Legislative Budget Recommendation (LBR) from December. Normally, agency budgets finalized at the end of the Session address deficits, new programs, court costs, and other necessary expenses. Without any adjustments from LBR, there will be no funds for the new state trooper class and no trooper raises. No new fire trucks for rural communities. No new funds for Corrections, even though the agency is embroiled in a federal lawsuit. No match money for the federal infrastructure bill which helps maintain our roads, bridges, and water systems. No public school, community college, or university building funds.

None of us were elected to grind government to a halt. We will not conduct ourselves this way in the Mississippi Senate. We will continue to work and call for public conference committees on the budget and other general bills.”

**Contributions by Anne Summerhays, Capitol Reporter**