90.9% of NFIB members in MS support reducing, eliminating the inventory tax. 77.9% support reducing, eliminating the personal income tax.

As the Mississippi Legislature gavels into session today, Dawn McVea, State Director of the National Federation of Independent Business (NFIB), says that tax relief tops the small business agenda for this year’s session.

“It’s been a challenging couple of years for Main Street businesses, beginning with the pandemic and continuing with the labor shortage, breaks in the supply chain, and inflation,” Dawn McVea said.

NFIB’s positions on public policy are based on the position of its members as determined by its state and federal member ballots.

According to this year’s state ballot, 90.9% of NFIB members in the state support reducing or eliminating the inventory tax. 77.9% are in favor of lawmakers reducing or eliminating the personal income tax.

“Our members are urging their legislators to support measures that ease the tax burden on small businesses and make it easier for them to get through this crisis,” McVea said.

The possibility of eliminating or reducing Mississippi’s income tax is one of many key issues law makers will be discussing in the Mississippi 2022 legislative session.

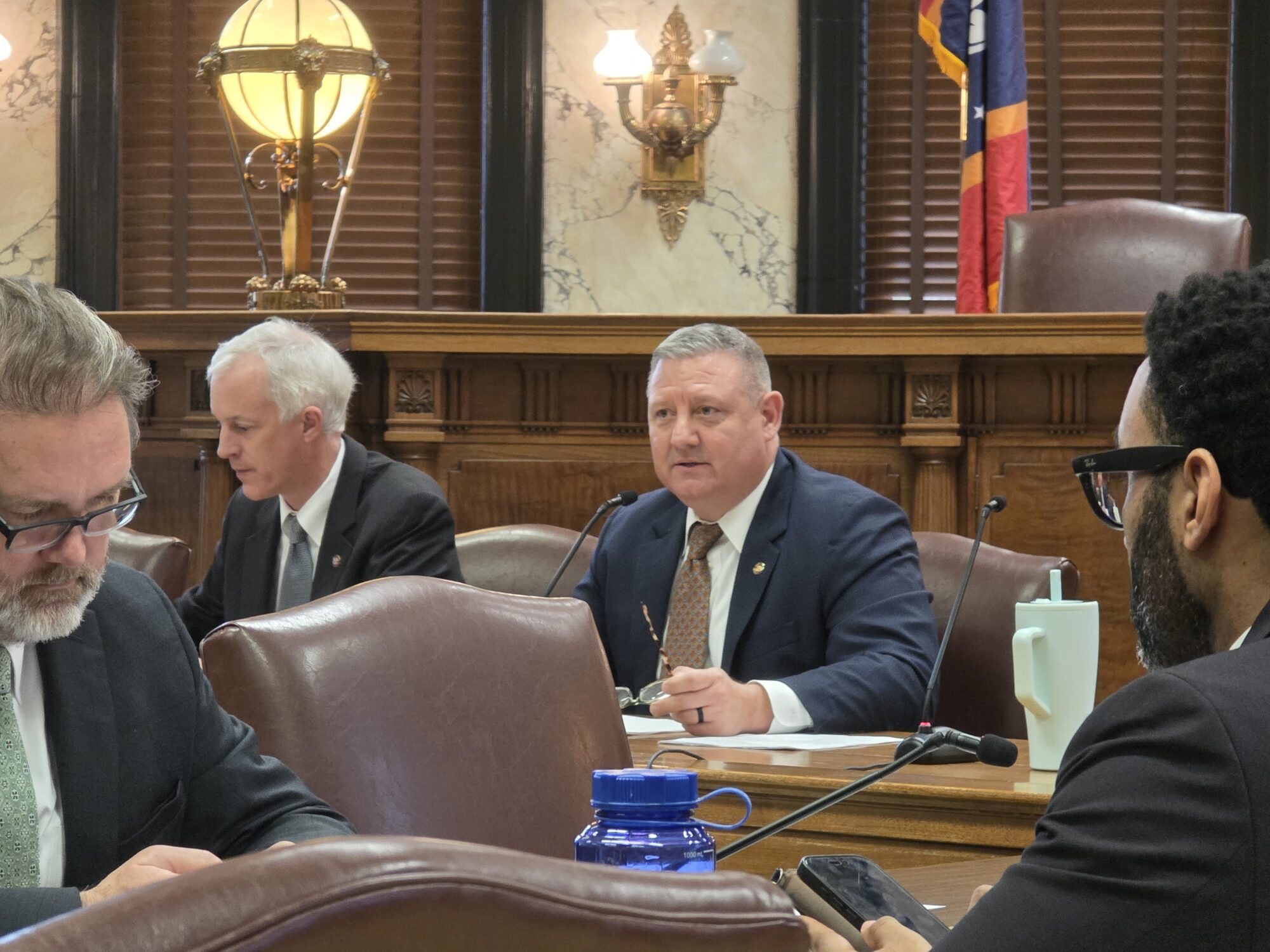

Speaker Phillip Gunn discussed with Y’all Politics on Tuesday about the need to eliminate the Mississippi State income tax this session. He states that he backs the House plan but is not “married to it.” However, there are no other proposed plans.

Speaker @PhilipGunnMS talks need to eliminate the Mississippi state income tax this #msleg session. He backs the House plan but says he’s not married to it. pic.twitter.com/fAH5VSgUad

— Magnolia Tribune (@magnoliatribune) January 4, 2022