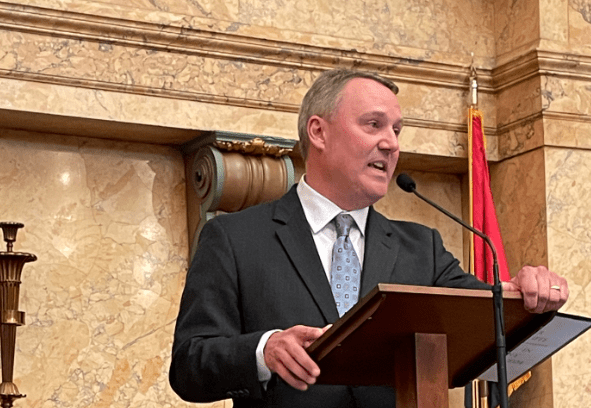

Speaker of the House Philip Gunn sat down with Y’all Politics to talk about the particulars of HB 1439, the Tax Freedom Act. Gunn says now is the time to pass an elimination of the income tax, that the state cannot afford to wait.

“The time is now. Our citizens need tax relief now,” said Gunn. “This needs to happen this year, today, people need tax relief.”

The highlights of the legislation include:

- A 10-year phase out of individual income tax. The first year would be immediate for up to $50,000 for an individual and $100,000 for a married couple

- A cut of the grocery tax from 7% to 4%

- A 2.5% increase on the state’s sales tax items (i.e. clothes, furniture, cars, farming equipment)

- A $1,000 teacher pay raise

“I don’t think there’s a bigger policy item that we have ever done or ever will do, nothing that we have ever done will benefit more people in the state of Mississippi than this,” said Speaker Gunn of the legislation.

The phase out would only happen if certain budget triggers are met. Gunn said this is to ensure that the budget does not fall in the red due to a lack of revenue. Currently, one- third of Mississippi’s budget is from income tax.

The bill has passed in the House and now heads to the Senate. Speaker Gunn said the House is open to any suggestions and solutions that come from the Senate.

Lt. Governor Delbert Hosemann has not been as enthused about the bill. He said on Monday at a public event that Senators have not made comments to him that they want to pass this Legislation.

Lt. Governor Delbert Hosemann has not been as enthused about the bill. He said on Monday at a public event that Senators have not made comments to him that they want to pass this Legislation.

“I have not had one Senator come to me and say they wanted to pass this bill. I don’t think the Senate will operate as Nancy Pelosi operates,” said Hosemann. He added that while he is in favor of reducing taxes for Mississippians, he has reservations about increasing any.

He also criticized the length of the bill, a topic Gunn mentioned on his own during the interview. But he did leave open the possibility that the bill will get amended and passed on the Senate side.

“It’s not a hard bill to understand,” countered Gunn. While the bill is 309 pages long, Gunn said the actual legislative changes only account for about 20 pages. However, when changing code sections, even just a word of it, you must include the code entirely.

The Speaker said this bill will also help Mississippi fight against the “brain drain,” a common phrase used to refer to the exiting of young people from the state for better opportunity. With a reduced or eliminated income tax, like neighboring state Tennessee, talent will remain in the state because those dollars will go straight in their pocket.

The bill includes several triggers that would either continue the phase out after five years, or pause it due to a lack of revenue being poured into the state budget.

“One of the big concerns with this is making sure that the revenue that we lose through the elimination of the income tax is in fact replaced,” Gunn noted.

Comparisons to Kansas unwarranted

When Kansas attempted to phase out their income tax in 2012, there was no plan in place to supplement the revenue being lost. Within five years they were reinstating it and upping it by $1.2 billion in order to help their bankrupt budget recover. However, their cuts were more immediate than HB 1439, something Gunn is also leery of in this proposal.

He said this bill will guard against that budget shortfall through growth. Roughly two-thirds of what will be lost in the phase out will be replaced by the 2.5% sales tax increase. The remainder of that, approximately $600 million, is to be phased out over that 10 year period of time through growth. Any growth up to 1% goes toward the elimination of the income tax, which is about $60 million a year.

Currently, the state has been growing at nearly the same rate per year, so Gunn said if it continues that direction it should work fine. However, if the growth does not occur they will put a pause on the phase out for that year.

Gunn said the best thing for someone to do to understand the legislation is calculate how much money you spend on sales taxed items and add 2.5% to that number. He said you will find that amount is significantly less than what you will get back in your refund.

For example, someone who makes $40,000 a year, they are getting $1,500 back on the refund. In order to spend that $1,500 in sales tax, they would have to spend more than $61,000 to burn that 2.5% on a sales tax.

“You’re going to get a whole lot more back then you will be paying on a sales tax,” said Gunn.

He said the same for the grocery tax being cut in half. For a couple spending roughly $75 to $100 a week on groceries, times 52 weeks in a year is about $400 yearly in tax. This bill would cut that number in half.

“The good news is, there’s coming a day where Mississippians will pay no more income tax. Be it 10 years, 12 years from now. At some point the day is coming where we will not pay an income tax,” said Speaker Gunn.

Teachers could benefit, but some groups still skeptical

Education groups, including Nancy Loome with The Parent’s Campaign, Erica Jones of Mississippi Association of Educators and Philip Burchfield of Mississippi Association of School Superintendents, have called the legislation a “political ploy that holds teachers hostage.”

Speaker Gunn said at this point he does not know the basis for their claims. He said all he has seen is suspicion and concern. Some of that may stem from the worry that if the budget is changed this much it will negatively impact education funding.

“That is absolutely false,“ said Gunn concerning the insinuation. He said the measures implemented in the bill will be enough to offset that loss. “It is our intent and plan to not have any budget shortfalls that could in some way cut into the education budget.”

The bill would allow that a teacher making $40,000 a year would immediately receive back $1,500 because they would be under the initial phase out of $50,000 income. On top of that, they would receive a $1,000 pay raise. In total, teachers making $40,000 would receive a $2,500 pay raise yearly.

“Just do the math, I can’t imagine why any teacher would not be in favor of that,” said Gunn.