While the typical tax filing deadline is April 15, this year has had a new set of challenges amid the COVID-19 pandemic which caused government officials to allow for an extension.

The decision was made to push the federal tax filing deadline back to July 15, and many states including Mississippi followed suit shortly after.

If you have not yet filed your taxes, you have until Wednesday to do so. The Mississippi Department of Revenue has a secure portal that will help you do so through their TAP registration. At this time you can also file for an extension through October 15.

Since July 15 is after the beginning of the 2021 fiscal year, the Legislature pushed to allow for all individual taxes that have yet to be filed to go towards FY 2021 instead of FY 2020.

RELATED: Debate emerging over how COVID19 delayed FY 2020 income taxes should be budgeted

Because revenue collections were not made in April the state was roughly $51 million behind the Sine Die estimates, according to former Department of Revenue Commissioner Herb Frierson. Frierson initially said they anticipated being closer to $200 million behind estimates.

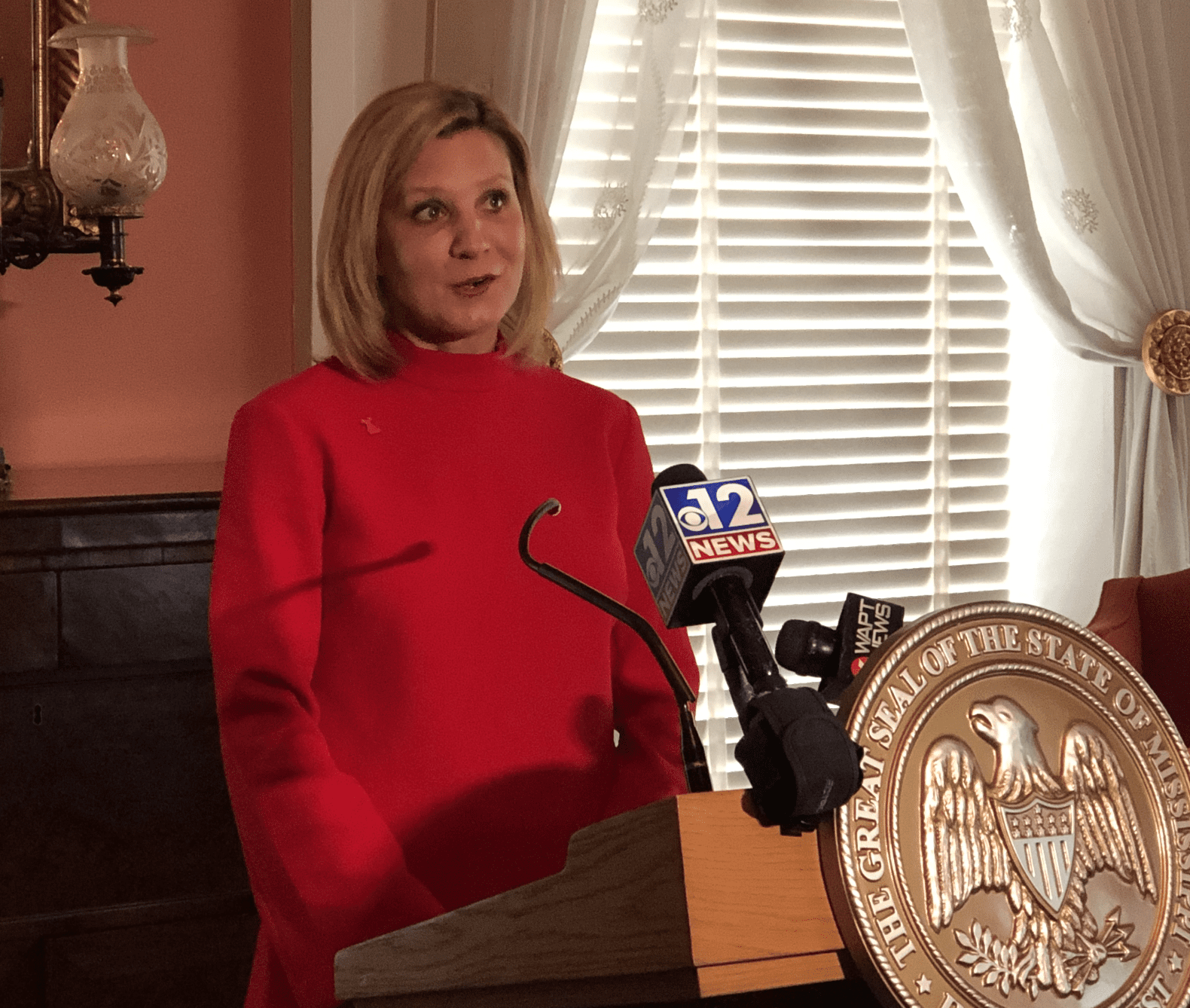

Frierson sided with Lt. Governor Delbert Hosemann and Speaker Philip Gunn saying that the taxes that would have normally been paid in FY2020 could be collected for the new fiscal year, FY2021.

However, Governor Tate Reeves did not share the same idea. He believed that because those taxes were collected from revenue in 2019, they should be applied to FY 2020.

As the budget shook out, lawmakers made the move to appropriate those individual income taxes toward FY 2021.