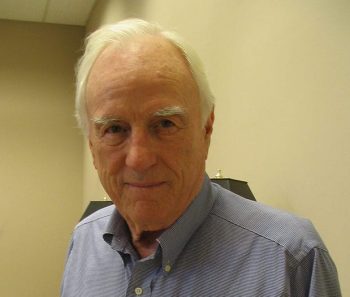

Speaker of the House Philip Gunn

Retired public employees, namely teachers, were said to be “a game changer” in the Mississippi Legislature, at least that is what the left was pushing in their narrative. It was said to “scare Philip Gunn to death.”

Those voices were wrong.

Last Thursday, the IRS provided a response to PERS whereby they declined to rule on the request that emanated from political efforts in 2019 to allow retired teachers to serve as legislators while still getting their full PERS benefits.

Irs Letter to Pers by yallpolitics on Scribd

In November 2018 and January 2019, Mississippi’s former Attorney General Jim Hood (D) issued opinions regarding PERS retirees serving in the Mississippi Legislature and continuing to receive benefits, according to PERS.

In response to those opinions, the PERS Board of Trustees approved initial adoption in April 2019 of revisions to PERS Board Regulation 34, Reemployment after Retirement, allowing PERS retirees to serve in the state Legislature while continuing to receive benefit payments under certain conditions. These revisions were officially adopted by the Board at their December 2019 meeting.

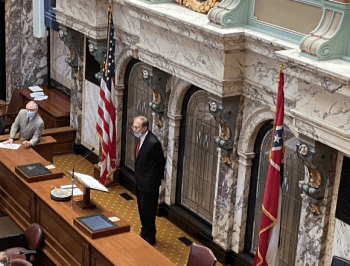

Since that time, four freshman state representatives were sworn in to the Mississippi House thinking they could both serve as a full time legislator/state employee and receive their full pension benefits from PERS.

Speaker of the House Philip Gunn, backed by the House Appropriations Committee, was adamant that that was not the case, resulting in two resignations so far with special elections pending. Gunn said on multiple occasions, “It is not right for taxpayers to have to fund both,” meaning the lawmakers’ legislative pay and their PERS benefits.

Speaker of the House Philip Gunn, backed by the House Appropriations Committee, was adamant that that was not the case, resulting in two resignations so far with special elections pending. Gunn said on multiple occasions, “It is not right for taxpayers to have to fund both,” meaning the lawmakers’ legislative pay and their PERS benefits.

Ramona Blackledge resigned from House District 88 in January while Billy Andrews resigned from House District 87 in March.

In a phone interview with Y’all Politics on Monday, Speaker Gunn was gracious on the news of the day.

“Our position has been based on three things: the law, the law, and the law,” Gunn said. “The Legislature has simply been following the law in this matter. The law is clear. It’s an unfortunate situation.”

Silly Season Ensued

What followed after the original position taken by Gunn was a good bit of histrionics among legislators, fawning media, political partisans and the education union lobby. The media was willfully complicit in creating the false narrative that legislators were being “forced to resign” by virtue of the fact that they could not draw their retirement benefits, not even thinking that there would be a scenario where a legislator could serve without having a pension.

It got so goofy, in fact, that House Minority Leader State Rep. Robert Johnson actually “retired” days after he was elected to try and avail himself of the financial advantage of double dipping. Y’all Politics was the only media outlet to report the maneuver.

Retired State Health Officer Dr. Alton Cobb, who serves on the Mississippi Retired Public Employees Association, stridently proclaimed, “I don’t think they want state retirees in the Legislature. What other reason could there? Other retirees are not restricted.”

“PERS changed its regulation based on that AG’s ruling, and on the assumption that the Internal Revenue Service grants final approval of the change,” Bobby Harrison of Mississippi Today wrote in February of this year. “And indeed, if the IRS does grant approval as expected, no one is being hurt by the ruling except perhaps legislators who could face a retired public employee in the next election.”

But they didn’t.

The Parents Campaign called Gunn’s stance a “travesty” and tried to fundraise off of the incident in anticipation of legal action.

“It appears that legal action will be required to protect your right to have retired educators and other PERS retirees represent you in the Legislature. You can help by making a donation – large or small – to help with those expenses – and to send a message,” the lobbying group wrote, also in February. “Friends, what is happening in the House is a travesty. With your help, we can protect retirees’ right to serve and draw their hard-earned retirement pensions.”

A request for comment to Nancy Loome of the Parent’s Campaign was not returned at press time.

Where We Are Now

In a statement posted on their website late Thursday, May 7, 2020, Executive Director Ray Higgins wrote:

“After months of consideration and correspondence, the Internal Revenue Service (IRS) has decided to decline to rule on the Public Employees’ Retirement System of Mississippi’s (PERS’) private letter ruling request about recent revisions to Regulation 34, Reemployment after Retirement, which is their prerogative under federal law. (Click here to view the IRS’ written response.)

“PERS leadership, representatives from the Attorney General’s Office, outside tax counsel, and the PERS Board will consider the System’s next steps going forward, and I anticipate this matter possibly being an agenda item for discussion at the regularly scheduled committee or board meetings in late June.

“Our retirees and members are important to us, and, as fiduciaries, we must always act in the best interest of the System. Thank you.”

Essentially, this means Speaker Gunn and his leadership team are vindicated in not allowing lawmakers to double dip retiree benefits while serving in the Legislature.

Former AG Jim Hood and PERS seemed to have jumped the gun in their ruling that retirees could serve in the Legislature while drawing their retirement, because their opinion depended on the IRS ultimately giving the green light. Again, that did not happen, placing Legislative districts, candidates and now office holders in a state of turmoil, all the while adding costs to taxpayers.

State Representatives Dale Goodin (HD 105) and Jerry Darnell (HD 28) must decide how they will move forward, either serve out their terms through 2023 or resign and force more special elections. All indications are that they will remain in their seats, at least for the short term.

Now, in the face of this IRS non-ruling, PERS likely has no choice other than to backtrack on their change of the rule. Otherwise, they risk imperiling the entire system and the thousands of Mississippians drawing on their retirement and the thousands more paying into the system every payday.

Whether or not Mississippi-based media outlets will cover this chapter in the story with the same fervor that they covered the potential of the IRS ruling remains to be seen.