COCHRAN VOTES TO “GET IT RIGHT” ON FLOOD INSURANCE REFORMS

Senate Passes Bill to Address Harmful, Unintended Consequences of Biggert-Waters Act

Cochran Audio: http://1.usa.gov/1ebeSES

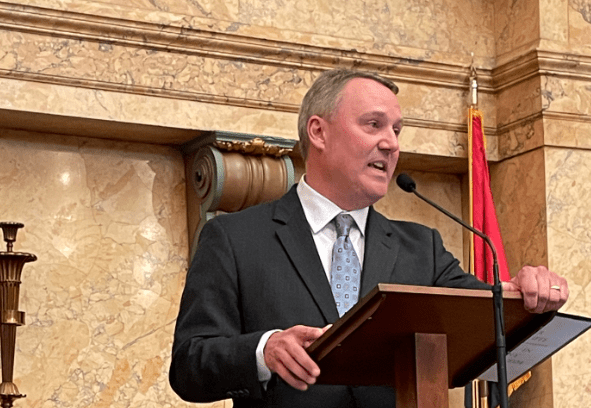

WASHINGTON, D.C. – U.S. Senator Thad Cochran (R-Miss.) today announced Senate passage a flood insurance bill he helped write, with a 67-32 majority voting with him to protect homeowners and businesses from the threat of exorbitant insurance rates until these reforms are assessed for mapping accuracy and affordability.

The Homeowner Flood Insurance Accountability Act (S.1926) would amend the Biggert-Waters Flood Insurance Reform Act of 2012 to give the Federal Emergency Management Agency (FEMA) time to certify its flood mapping methods and to complete an affordability study mandated by the 2012 law. The House of Representatives is developing similar legislation.

“This legislation provides relief to homeowner and communities in Mississippi and throughout the country without undoing the positive reforms enacted with the Biggert-Waters law. It gives FEMA time to make sure that reforms are implemented in a responsible manner that helps ensure the viability of the federal flood insurance program,” Cochran said.

“It is important that we make certain the government’s engineering practices and procedures are sound, and understand the implications of these rates before we allow them to devalue private property and ruin people’s lives. It will be very challenging to rebuild neighborhoods or restore home equity once lost, so we must get it right,” he said.

Implementation of the Biggert-Waters Act has exposed serious unintended consequences that are adversely affecting homeowners, businesses and communities in inland and coastal states as new, more costly National Flood Insurance Program (NFIP) premiums are imposed.

Cochran earlier this month met with public officials and business leaders from South Mississippi to learn more about the negative effects that escalating flood insurance premiums are having on their communities. In a floor speech on Monday, Cochran related the experience of a constituent from Ocean Springs whose “grandfathered” insurance rate jumped from an annual $245 to $18,450 shortly after purchasing her home.

“The passage of this bill represents a bipartisan consensus to make modest changes to existing law, while protecting homeowners and steering the National Flood Insurance Program onto a path to fiscal sustainability,” Cochran said.

S.1926 retains current FEMA practices while creating an opportunity for the agency to determine that some Biggert-Waters reforms will actually improve the credibility of the NFIP. The legislation would not affect Biggert-Waters reforms related to expanding participation in the flood insurance program, or the phase-out of subsidized flood insurance premiums for vacation homes and homes that have a history of repeated flooding.

Cochran has been one of the Senate’s leaders on flood disaster policy in recent years, helping to restore the Gulf Coast following Hurricane Katrina, build flood control infrastructure throughout Mississippi that minimized damage from the Mississippi River flood of 2011, and reforming the way FEMA considers that flood control infrastructure when setting insurance premiums.