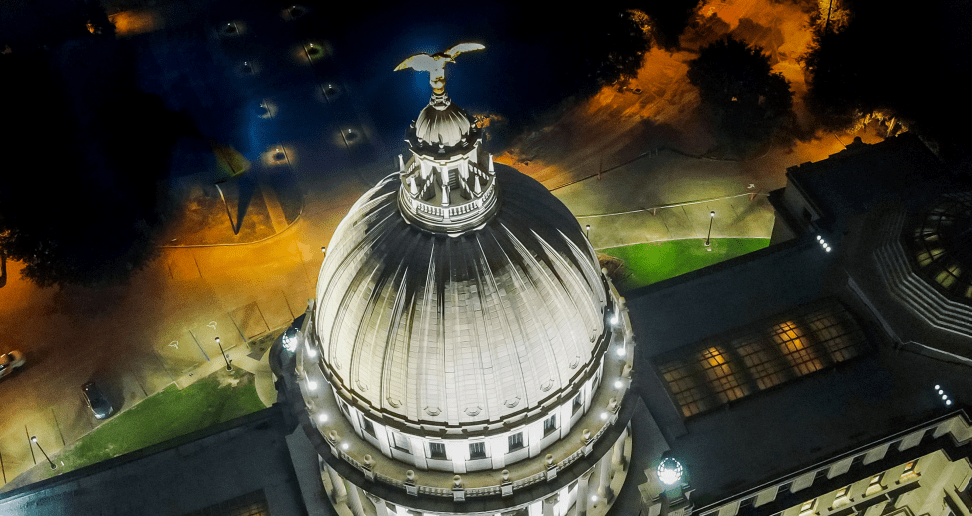

A letter in support of repealing the state income tax was delivered to state lawmakers today.

Business leaders across the state are calling on the Mississippi Legislature to repeal the state income tax.

In a letter addressed to Governor Tate Reeves, Lt. Governor Delbert Hosemann, Speaker Philip Gunn and all members of the Legislature delivered to the Capitol today, 48 businesspeople representing entrepreneurs, doctors, bankers, farmers, retailers, restauranters, and small business owners tell the policymakers that now is the time to eliminate the income tax.

“This is Mississippi’s moment,” the group writes. “With unprecedented revenue surplus, policymakers have a rare opportunity to pass a truly transformational reform that will deliver to our children and grandchildren a more prosperous future.”

Among the signers of the letter is the chairman of the Mississippi Republican Party, Frank Bordeaux. He is employed by BXS Insurance.

The business leaders say for Mississippi to leap forward, there has to be “a bold paradigm shift” that signals to the people of Mississippi that its leaders believe in them, to Mississippi businesses that they can afford to grow, and to people outside of the state that Mississippi is open for business and a ripe environment for capital investment.

“It is our conviction that the elimination of the income tax in Mississippi, if executed well, could prove to be that paradigm shift,” the letter continues. “Mississippi has the opportunity to act boldly in becoming the tenth U.S. state without an income tax. Our counterparts in states like Tennessee, Texas, and Florida know all too well the advantages of creating an environment for sustained population and economic growth.”

State revenues are indeed in unprecedented territory. Last fiscal year, revenues exceeded estimates by over $1 billion, and this fiscal year, it is on track to do the same, currently over $750 million above estimates.

Critics, mostly Democrats and those in the mainstream media, question whether these revenues are sustainable. They point to the notion that these record revenues are a result of the injection of money Mississippians received from the federal government during the pandemic.

As a result, Mississippi lawmakers are split on two possible plans to provide tax relief, one in the Senate that seeks to end the 4% bracket but does not fully eliminate the income tax and one in the House that phases out the full income tax but raises the state sales tax by 1.5%. Both plans reduce the sales tax on groceries, and both offer a reduction on car tags, although the House plan provides more of a savings to taxpayers.

Governor Reeves and Speaker Gunn, along with the Republican supermajority in the state House, have advocated for a full elimination of the income tax while Lt. Governor Hosemann and most in the state Senate have advised caution, reluctant to go as far given the impact on the state budget and the uncertainty of the sustainability related to the current state revenues.

Yet, as the business leaders write, most conservatives have said that the impact of fully repealing the income tax is self-evident.

“When workers get to keep more of what they earn, they will spend those dollars on their families and in their communities. Increased commerce will create opportunities for businesses to expand, employ more Mississippians, and pay them higher wages,” the group tells lawmakers. “Cumulatively, this type of economic activity promises not only that our people will have access to a higher quality of life, but also that government reliance will diminish.”

As noted by the business leaders, other conservative states are not standing still. Various efforts are underway across the country to eliminate state income taxes, including in West Virginia where they are advancing legislation and in neighboring Louisiana where they have made substantial changes to their tax code.

“Mississippi should be an early adopter, not a last actor,” the businesspeople contend.

You can read the full letter below.

Business Leaders for Income Tax Repeal by yallpolitics on Scribd