- Important state and national stories, market and business news, sports and entertainment, delivered in quick-hit fashion to start your day informed.

In Mississippi

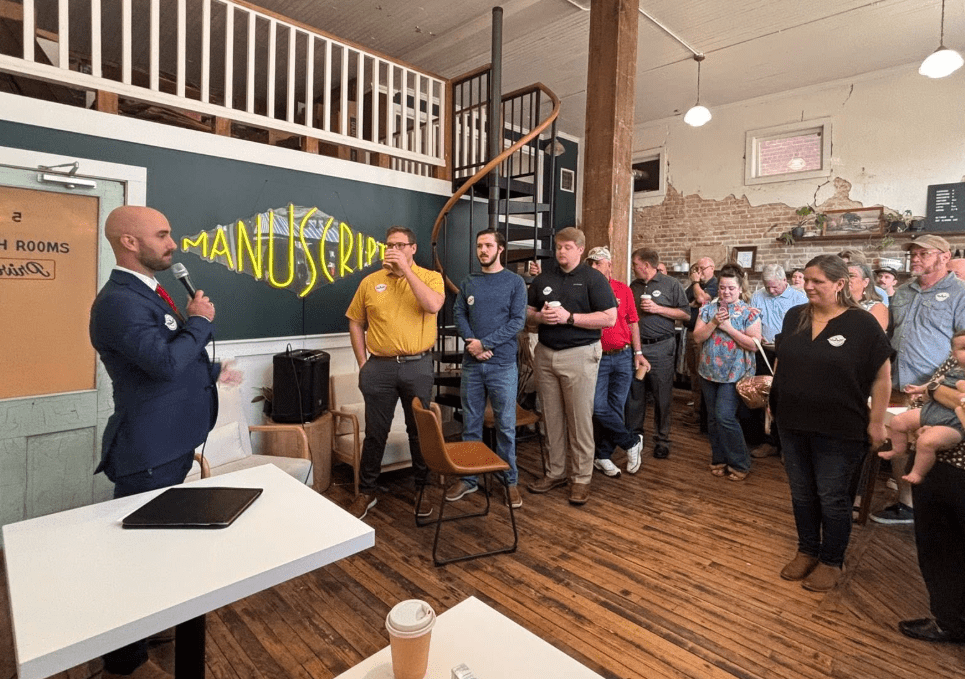

1. Brooksville mayor, city clerk arrested for embezzlement

State Auditor Shad White announced Friday that Special Agents from his office have arrested Brooksville Mayor Earlie Henley and former Brooksville City Clerk Shaquita Malone for allegedly embezzling funds from the City of Brooksville.

According to White’s office, Henley allegedly drafted checks made out to himself without the signature authority of a second signer. Henley also allegedly took cash withdrawal slips to the bank to withdraw and pocketed cash from the city’s accounts.

As for Malone, the Auditor says she allegedly entered herself into the payroll system as an hourly employee rather than a salaried employee as hired and then increased her hourly rate to receive funds she was not entitled or authorized to receive. Agents also discovered Malone is a convicted felon and therefore ineligible to be employed as a City Clerk.

If convicted, both Henley and Malone face up to $5,000 in fines and up to 20 years in prison. The Auditor noted that all persons arrested by the office are innocent until proven guilty in a court of law.

2. Ingalls completes builder’s sea trials for DDG 128

Ingalls Shipbuilding says it has successfully completed builder’s sea trials for guided missile destroyer Ted Stevens (DDG 128), marking a major milestone in the construction of the second Flight III destroyer built at Ingalls.

The trials were conducted over several days in the Gulf of America, and tested the ship’s engineering, navigation, and combat systems to ensure readiness for the future acceptance trials and eventual delivery to the U.S. Navy.

During builder’s trials, Ingalls said its test and trials team completed a full range of hull, mechanical and electrical tests, as well as Flight III AN/SPY-6 (V)1 radar array testing. These tests are designed to validate critical system performance and ensure the ship meets or exceeds Navy requirements.

National News & Foreign Policy

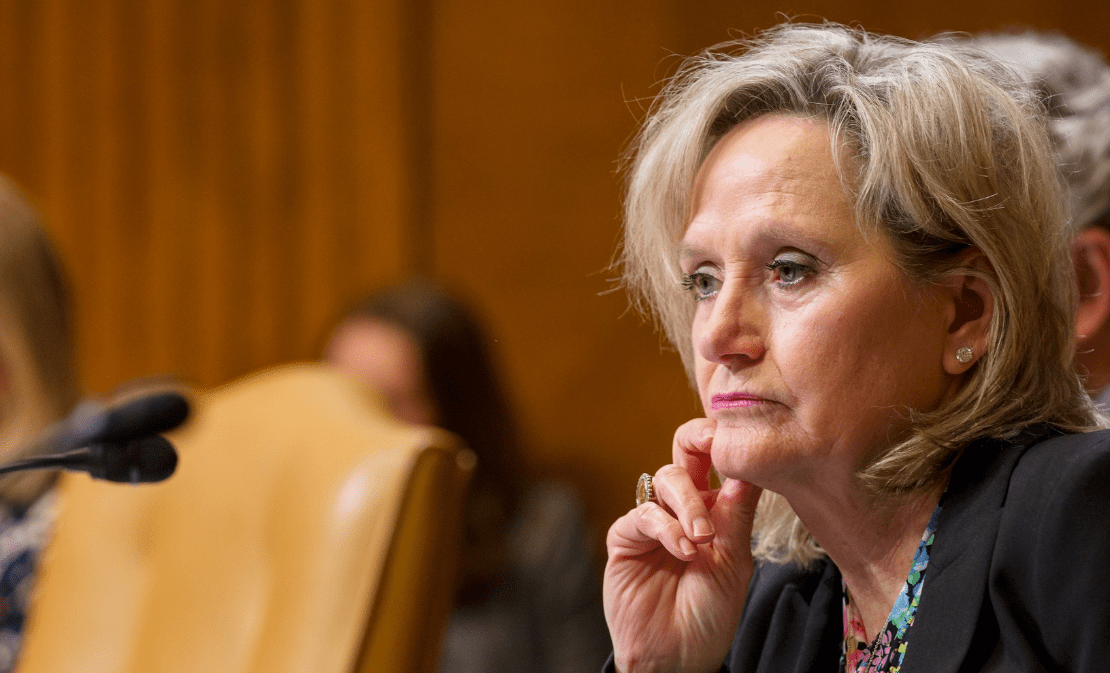

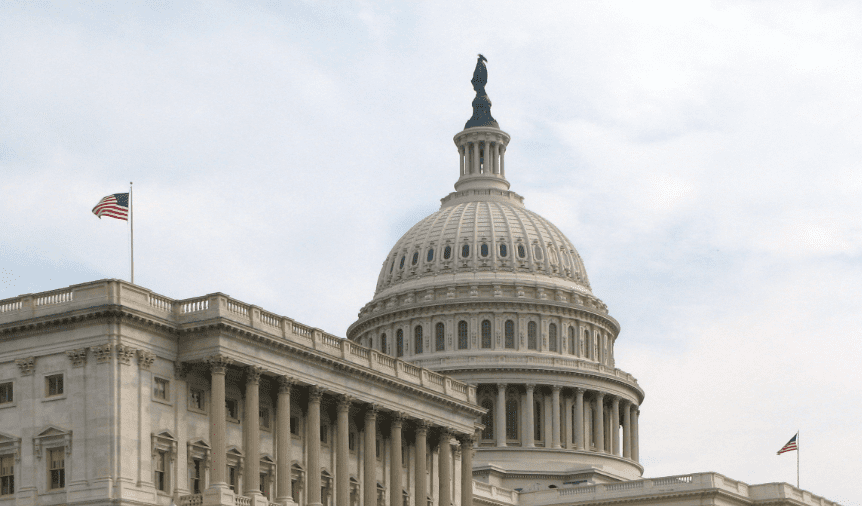

1. Congress barreling toward shutdown, meeting with Trump Monday

As Politico reports, “Congress is locked in a staring contest with less than 48 hours until the government shuts down. There’s no sign either side plans to blink.”

“The standoff is raising the odds that agencies will at least partially shutter for the first time since 2019, when President Donald Trump backed down from a record 34-day shutdown sparked by his demands for a border wall,” Politico reported. “Congressional leaders each insist they don’t want to barrel past the Sept. 30 deadline Tuesday night, but they are quickly running out of time to find a mutually agreeable off-ramp.”

Politico continued, “A make-or-break moment will come Monday afternoon, when Trump will meet with the top four congressional leaders at the White House. The sitdown, rescheduled after Trump abruptly cancelled a prior meeting set with Senate Minority Leader Chuck Schumer and House Minority Leader Hakeem Jeffries last week, is the most significant development yet in the weeks-long stalemate.”

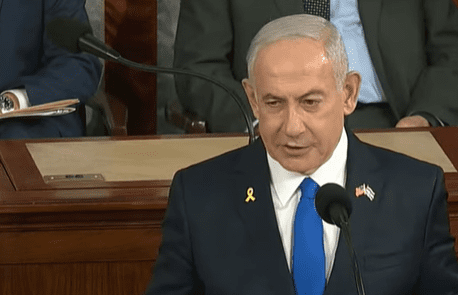

2. Trump, Netanyahu set to meet Monday in D.C.

According to the New York Times, “President Trump and Prime Minister Benjamin Netanyahu of Israel are expected to meet at the White House on Monday to discuss the latest U.S.-backed plans for postwar Gaza, which they hope could pave the way to ending the two-year-old conflict in the territory.”

“On Sunday, Mr. Netanyahu said he hoped Israel could ‘make it a go’ on Mr. Trump’s proposal. ‘We’re working on it; it’s not been finalized yet,’ he said in an interview with Fox News,” NYT reported. “He suggested that Israel would be willing to grant amnesty to Hamas members if they ended the war and released the hostages.”

NYT went on to report, “Despite the toll on Gaza and its residents, the war in Gaza has not forced Hamas to surrender or to release the remaining hostages held in the territory. At least 20 living captives are still being held, according to Israel, along with the bodies of roughly 25 others.”

Sports

1. Ole Miss jumps to No. 4 in Top 25

After a win Saturday over No. 4 LSU, the Ole Miss Rebels jumped 9 spots in the latest AP Top 25 to take the Tigers’ spot. This week’s No. 4 ranking for the Rebels is the highest in a decade.

Ohio State remained at No. 1 while Oregon moved to No. 2 and Miami dropped to No. 3. Oklahoma rounded out the Top 5.

Mississippi State again fell just shy of making the Top 25, coming in with the 28th most votes after pushing No. 15 Tennessee to overtime and nearly knocking off the Volunteers.

2. Dart gets win in first start with Giants

The Jaxson Dart era opened for the New York Giants Sunday as the former Ole Miss QB led his NFL team to their first win of the season.

The 21-18 victory came over the previously undefeated Chargers.

As the Giants shared, “Dart, who had played just six snaps entering Sunday, capped his inaugural drive (nine plays, 89 yards, 4:17 time of possession) with a 15-yard touchdown run to give the Giants an early lead, which they never relinquished. Overall, Dart completed 13 of 20 passes for 111 yards, including a three-yard touchdown on a shovel pass to tight end Theo Johnson. Dart also ran 10 times for 54 yards and a score.”

Markets & Business

1. Futures up to open week

CNBC reports that stock futures rose on Monday “as Wall Street tried to regain its footing after a week in which the artificial intelligence trade lost some steam.”

“U.S. stocks slipped last week as cracks appeared in a key pillar of the bull market rally — enthusiasm surrounding artificial intelligence buildout,” CNBC reported, adding, “The S&P 500 fell 0.3% last week, its worst weekly performance since Aug. 1, and now sits 0.8% off its record high. The Nasdaq dropped 0.7%, also its weakest since early August. The Dow edged down 0.2%, its first loss in three weeks.”

CNBC also noted, “All eyes are turning to the September nonfarm payrolls report, which is due Friday morning.”

2. Credit markets running hot?

The Wall Street Journal reports that “U.S. credit markets are running hot—maybe too hot.”

“Investors are gobbling up corporate debt like it is going out of style—even though the rewards, by some measures, are lower than they have been in decades. The frothy mood has some on Wall Street worried that the market is priced for perfection and ripe for a fall,” WSJ reported. “That is why any bad news is touching a nerve and raising the question of whether something more profound is ailing American borrowers. Two sudden bankruptcies in the auto world—of a subprime lender and a parts supplier—have triggered those conversations among bond investors and analysts.”

WSJ added, “So far, there is no sign of wider fallout—and each of those situations had unique characteristics that don’t point to broader trends. But combined with other challenges, such as persistent inflation and rising defaults in a hot Wall Street segment known as ‘private credit,’ it is enough to give longtime traders pause.”