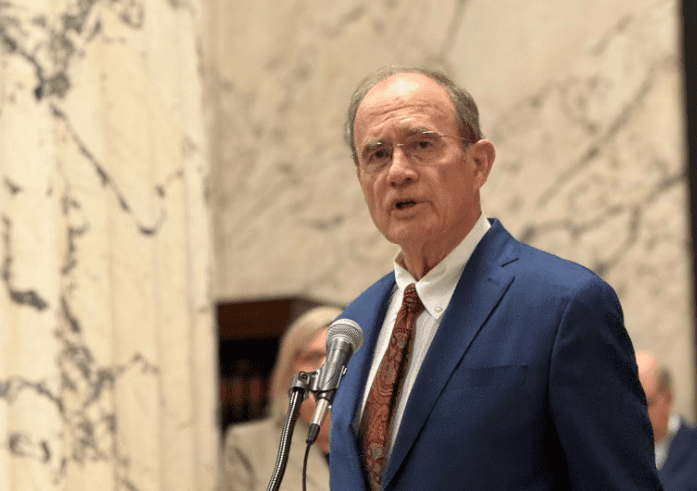

Representative Casey Eure addresses the House on his mobile sports betting bill during the 2024 session. (Photo Jeremy Pittari | Magnolia Tribune - 2024)

- Advocates say Mississippi is losing out on the additional tax revenue mobile sports betting is generating in other states.

A bill that could allow for mobile sports betting in Mississippi passed the floor of the House of Representatives Monday evening.

State Rep. Casey Eure (R), Chair of the House Gaming Committee, introduced HB 1302, saying the legislation was similar to one that passed out of the chamber last session but failed to make it to the Governor’s desk. Eure noted that while the bill has the same goal as last year’s legislation, there are changes to this year’s version after working with the Senate out of session.

“So, all mobile sports betting will still be tethered to a brick-and-mortar casino in the state of Mississippi,” Eure described.

Two major changes described in this year’s legislation include allowing each casino to partner with two platforms, or create their own, instead of just one and not accepting credit card payments for bets. Instead, the bill would only allow payment from sources such as debit, Venmo and PayPal, for example. Eure said that excluding credit cards as forms of payment was suggested by the Senate out of concern for those with a gambling addiction.

Verification requirements for the bettor’s age and identification are also outlined in the bill, along with geofencing technology to ensure bets are placed within state lines.

“Which means you’re going to have to be within the state of Mississippi to place an online mobile sports bet,” Eure elaborated.

Currently, advocates say the state is losing out on the additional tax revenue online sports betting is generating in other states.

Of the 38 states in the nation with sports betting, 31 allow online sports betting. Rep. Eure said neighboring states such as Tennessee saw $97 million in tax revenue, while Kentucky brought in $35 million and Louisiana collected $64 million. North Carolina, which started allowing online sports betting in 2024, collected $96 million from March through December.

Eure said information collected by Google shows Mississippi leads the nation in illegal online sports betting. Other states had similar problems with illegal online sports betting until it was legalized, Rep. Eure said.

As with sports betting in a brick-and-mortar casino, online sports betting will impose a 12 percent tax, which under the bill will be evenly distributed between all 82 counties for roads and bridges.

To protect smaller casinos, a fund will be established for a term of five years that will set aside $6 million under the Sports Wagering Protection Act. Eure explained that should a casino find that it is missing out on revenue due to the legalization of online sports betting, the casino can seek to draw from the fund to make up for losses.

“However, I can tell you I don’t believe that’s going to happen,” Eure said. “But if they do, they can draw down up to $6 million.”

The $6 million number was chosen as that amount was how much sports betting brought into the state within brick-and-mortar locations last year.

“If that $6 million is not used, it goes straight to roads and bridges every year. It doesn’t build up over the five years,” Eure said.

Some representatives had concerns about the bill while it was debated on the House floor.

State Rep. Robert Johnson (D), the Democratic Minority Leader, asked if geofencing could be used to ensure any bets placed within the vicinity of a brick-and-mortar casino would go to that business instead of the entire state. His concern, he said, was for a casino located in his district in Natchez. Johnson said he believed that the revenue should go to the casino that took the risks and made the investments to establish a brick-and-mortar location.

However, Rep. Eure said the bill does not include that option. Instead, the taxes collected would benefit all 82 counties with road and bridge maintenance since not every county has a casino.

The bill ultimately passed the House floor by a vote of 89-11, but Eure said he expects it to go to conference later in the session, which could result in additional changes when it is taken up by the Senate.