- After rejecting the House proposal last session, the Senate now considering a recurring funding source to buoy PERS.

Changes made to the state employee retirement system, or PERS, during the last two legislative sessions show promise in reducing in the plan’s liabilities in coming years, a legislative report says. However, research shows more needs to be done to improve PERS’ long-term stability.

Those were the findings outlined in a report issued by the Joint Legislative Committee on Performance Evaluation and Expenditure Review (PEER) Committee titled “2024 Update on Financial Soundness of the Public Employees’ Retirement System” released this week.

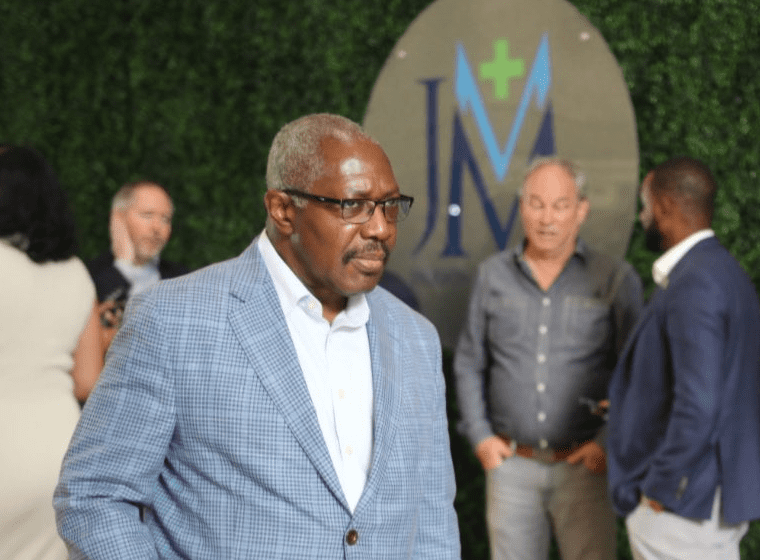

“This update reinforces the critical importance of creating Tier 5 during the past legislative session to gradually reduce PERS liabilities and ensure payment to retirees.” Lt. Governor Delbert Hosemann (R) told Magnolia Tribune. “We’ve taken positive steps by increasing the employer contribution rate and establishing the Fifth Tier.”

That new tier will go into effect March 2026 for all new hires and will be a hybrid retirement plan. The additional tier will not impact those currently in PERS.

The report shows two of the metrics under the plan are at “red-light signal status” and one other is at “yellow-light signal status.” Red-light signal status indicates those metrics have shortfalls in funding. A yellow-light signal status indicates there are challenges, with the metric not considered to be critical.

“All three funding policy metric results declined from June 30, 2023, to June 30, 2024,” the report outlines.

Gains of 10.78 percent were seen in the plan while market value increases of $1.7 billion brought it to a total of $32 billion in Fiscal Year 2024.

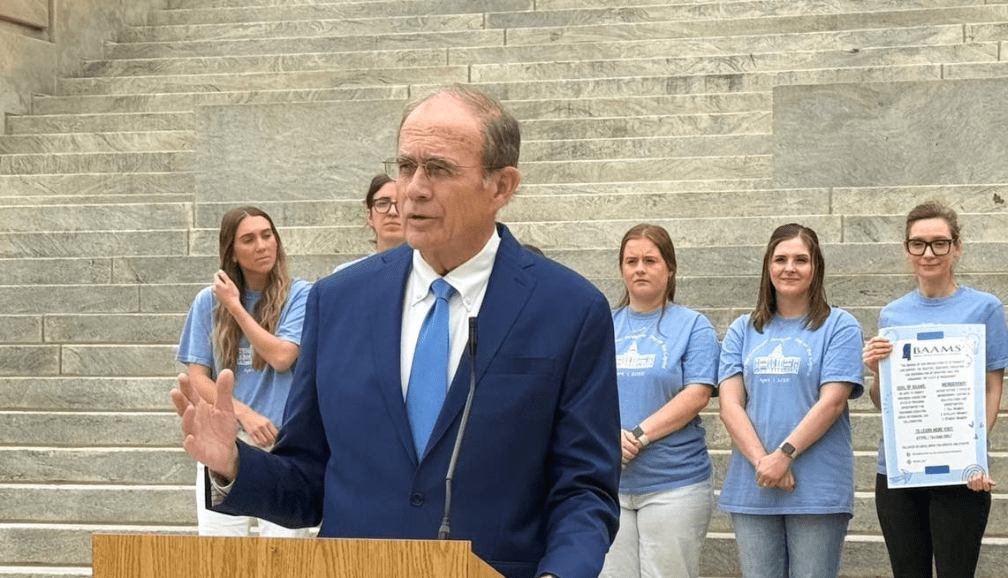

“The 2024 Update on Financial Soundness of the Public Employees’ Retirement System echoes the House’s well-established position that there is more work to do on PERS. HB 1’s Tier Five is a positive first step to stop the bleeding when it comes to the future liability of PERS; however, it does not solve the current issue of the solvency and stability of the state retirement system,” Speaker of the House Jason White (R) told Magnolia Tribune.

The PEER report lays out the potential for reductions in the plan’s liabilities due to changes made by the Legislature in the 2024 and 2025 sessions but makes no promises.

“This promise is predicated upon the plan(s) meeting all actuarial assumptions, including investment returns, which are not under the control of PERS or state policy makers,” the report describes.

It is also noted that over the previous five fiscal years, average payroll increases to PERS were more than the projected annual increases. Yet, for the past 10 fiscal years the increase was below projected rates.

“Less-than-expected payroll growth can increase the amortization period of the unfunded actuarial accrued liability (UAAL). However, the upward pressure on the UAAL may be partially or totally offset due to the decrease in the number of future liabilities resulting from a lower payroll amount than assumed in the actuarial model,” PEER stated in the report.

Changes to the plan made over the past two years aim to increase the employer’s contributions and make other adjustments to PERS.

In the 2024 regular session, the Legislature assumed responsibility for the employer contribution rate under the plan, statutorily mandating increases to increase the rate from the current 17.40 percent to 19.90 percent by the 2029 fiscal year. To reach that goal, increases of 0.5 percent annually for the next five years will occur. Rate adjustments started in the 2025 fiscal year.

The changes also include the establishment of the “Fifth Tier” for applicable positions where employees begin their employment starting on or after March 1, 2026. Those employees will contribute 9 percent of their earned compensation into the PERS system. Four percent of the total contribution will be placed in an annuity savings account and five percent will go to that employee’s defined contribution account.

By moving to the Tier Five retirement system, PEER anticipates the state will see a reduction in future liabilities and therefore see cost savings.

“However, it is worth noting that under the new Tier Five, employees are required to shoulder more of the burden for the cost of their retirement benefits,” the report finds.

That shift will be from 73 percent under the outgoing PERS structure to about 75 percent under Tier Five.

Changes were also made for lawmakers related to the Supplemental Legislative Retirement Plan (SLRP) and those who are employed with institutions of higher learning and are part of the Optional Retirement Plan (ORP).

Members in the House of Representatives, Senate and the Lt. Governor elected after March 1, 2026, will not be provided membership in SLRP. Instead, they will become part of the Tier 5 program. Ending that program will be beneficial over the course of years, PEER finds, but there is a caveat.

“The closing of SLRP to new members which have the effect of reducing future liabilities to the plan but will increase costs for the plan in the short-term,” the report cites.

In an effort to attract and retain talented faculty to the state’s public institutions of higher learning, the ORP provides a portable contribution plan that follows faculty as they move between states. Changes brought about under HB 1 will establish new structures of payment for existing members of that plan, while a different tier will be offered to new members.

“Actuary projections assume that future employment levels in ORP will remain at current levels (approximately 5,000) and are based on current payroll of $510 million,” the PEER report adds.

Despite the report finding “promising potential for reducing plan liabilities over time,” there is concern how the establishment of Tier Five will affect the PERS system. Most notable of the concerns is how long people will want to work in public service, if at all, under the new plan.

“Employees choosing or not choosing to begin work, or remain working, in state government positions could impact both wage growth and the active member to retiree ratio,” PEER states.

During the 2025 legislative session, the House and Senate came to an agreement on the Tier 5 system, but the two bodies could not agree on the House’s recurring funding proposal. The House proposed adding $100 million annually of lottery proceeds as the funding source, but the Senate rejected it.

It seems the Senate is willing to consider recurring funding during the coming session.

“We will propose recurring funding in the 2026 legislative session,” Lt. Governor Hosemann said this week.

In the months leading up to the 2026 session, Speaker White tasked fellow House members to learn more about the deficiencies in the system through a select committee.

“The House remains fully committed to addressing these issues, and we will continue to explore ways to support current and future state retirees through the Select Committee on PERS, led by Hank Zuber and Randy Rushing,” White said. “The report highlights optimism about the future of PERS given HB 1’s changes, as well as several issues that still haunt the system. You can expect the Select Committee to leave no stone unturned as it seeks to continue the momentum gained in HB 1.”

Rep. Zuber (R) told Magnolia Tribune that he expects more funding will be needed to keep the system solvent, and it should occur sooner rather than later.

“We could put it off and do nothing, which would be easier, but the House and Speaker White have never shied away from tackling tough issues and we are not about to do it now,” Zuber told Magnolia Tribune. “In conclusion, let me stress that we do not have any immediate concerns, but we are simply trying to make sure our jewel of a retirement system is viable and available for our much-needed state employees and teachers 40, 50, 60 years from now.”