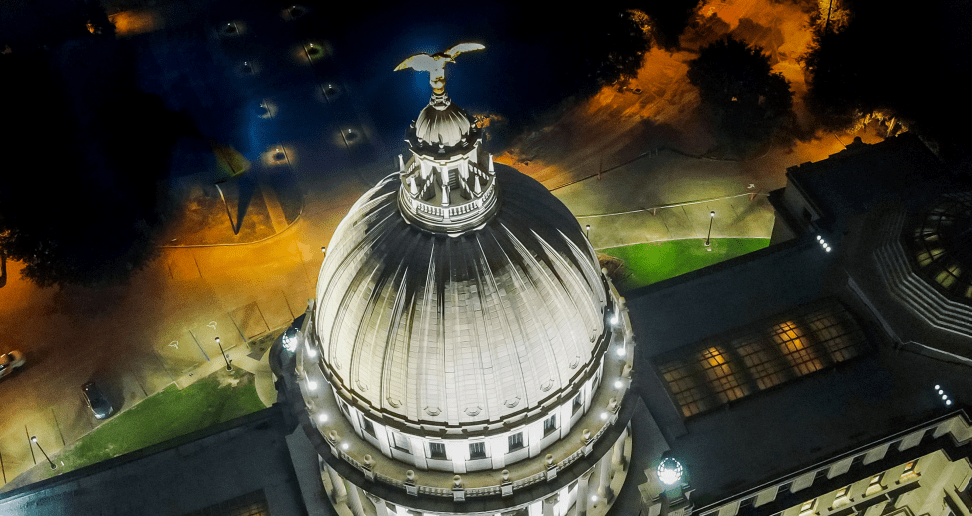

(Photo from Governor's 2024 EBR)

- Revenues for January exceeded legislative estimates by nearly $56 million, bringing total year-to-date collections more in line with overall projections.

The latest revenue report from the Mississippi Legislative Budget Office shows tax collections in the Magnolia State rebounded in January after a significant decline in December.

Collections in December raised eyebrows when revenues came in $106 million below legislative estimates, sending the current fiscal year’s total collections off by $80 million. Much of the underperformance came by way of corporate income tax collections that came in $146.6 million under monthly estimates.

However, according to the LBO report on Tuesday, total revenue collections for the month of January – the seventh month in the fiscal year – moved the needle closer to overall projections, as revenues were $55,917,799, or 10.26 percent above legislative estimates. This brings the year-to-date collections up from being $80 million under projections to $24,606,730, or 0.59 percent below the annual estimate.

Sales tax and corporate income taxes exceeded estimates in January, coming in $3.8 million and $38.6 million, respectively, above the same month in the prior year.

As expected, individual income tax collections for the month of January were below the prior year by $21.1 million. Mississippi continues to phase-down the income tax to a flat 4 percent as passed in 2022, with expectations that it be fully implemented by 2026.

Lawmakers continue to debate whether to add another round of income tax cuts in hopes of reaching full elimination on the tax on work in the years ahead. However, after the House passed a tax reform package to that extent early in the 2025 legislative session, the Senate has yet to take the measure up nor have Senators rolled out their own tax reform plan.

Governor Tate Reeves (R) has made income tax elimination the single highest priority for his administration this term, as stated during his recent State of the State address where he implored lawmakers to send such a bill to his desk.

The annual estimate for the fiscal year that began on July 1 was for $7.6 billion in general fund revenue.