Mississippi State Finance Committee Chairman Josh Harkins, R-Flowood, in the Senate chamber at the Mississippi State Capitol in Jackson, Miss., Thursday, Jan. 25, 2024. (AP Photo/Rogelio V. Solis)

- If a full state-based exchange is implemented over the next two years, the Mississippi Department of Insurance estimates it could save the state over $100 million in the first five years.

Efforts to create a state-based health insurance exchange will remain under consideration by Mississippi lawmakers after the legislation gained approval in the Senate on Wednesday.

House Ways and Means Chairman Trey Lamar (R) presented the idea to lawmakers this year in a move that would create a state-based exchange for health insurance.

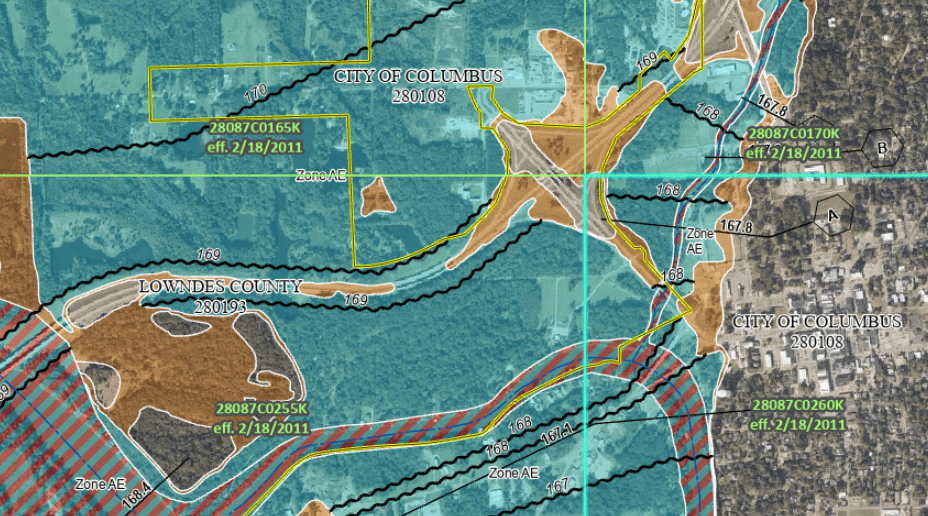

HB 1647 would move Mississippi away with the federal exchange established through the Affordable Care Act and create state exchange with the goal being to save the state additional dollars on an annual basis. Currently, Mississippi pays a 3 percent rate for the federal exchange which comes to roughly $15 million annually.

The state exchange would be operated by the state of Mississippi and rates would be developed by an independent actuarial firm that is determined by a regulatory board.

At the time the bill passed in the House, early in the 2024 session, Rep. Lamar said he believed a state exchange would give individuals better options.

“Health insurance is really expensive,” said Lamar. “We are looking at ways to try and help working Mississippians in our current legal environment to try and gain better and more access to healthcare.”

The Chairman of the Senate Finance Committee, Josh Harkins (R), offered a strike-all amendment which was adopted by the Senate following a hearing Wednesday morning with the Department of Insurance (MDI).

Senator Harkins told members that they are keeping the bill alive to continue to investigate the option of a state-based exchange.

According to MDI, there are three types of marketplace exchanges, a full state-based, a split state and federal, and a full federal marketplace. MDI officials said the main difference in a full-fledged state exchange and one that is still operated on the federal platform is that it is completely controlled by the state.

Commissioner of Insurance Mike Chaney (R) previously said the change would largely benefit individuals on the exchange between the 100 and138 percent of the federal poverty level (FPL). The Department of Insurance would be required to come up with the plan for the state exchange.

If lawmakers move forward with the plan, the enabling of the exchange would begin in July 2024, should the bill become law. However, Commissioner Chaney said it is unlikely the exchange would be implemented until at least 2025.

For the first year, Mississippi would follow in the footsteps of Georgia and Arkansas with the hybrid state-federal exchange model (SBE-FP). Chaney estimated fees collected would be roughly $56-$59 million for that first year. However, as an SBE-FP the state will only retain roughly 18 percent of those fees in the first year.

Recent numbers indicate roughly 285,000 Mississippians participate in the federal exchange which was implemented with the Affordable Care Act in 2014. For Mississippians, Ambetter from Magnolia Health and Molina Marketplace are available for health insurance coverage.

Of those 285,000, roughly 280,000 receive Advanced Premium Tax Credits (APTC) for their plans and just over 200,000 see Cost Sharing Reductions (CSR), meaning 98 percent of individuals in the marketplace are receiving a subsidy for their plan. Open enrollment for 2024 added just over 80,000 Mississippians to the marketplace.

For the first two years of the state-based exchange, the federal government would still provide some support. After that, the exchange would be totally state-based using the federal platform. Currently, 19 states operate their own exchanges separate from the federal platform, with three in a hybrid set up.

With a state-based exchange, the customer would select their coverage, in which they may qualify for a tax credit. The insurer enrolls them and sends a bill for User Fees to the federal government. Then the state exchange assesses carriers to pay for the state-based operations, and the state retains the user fee. The federal government then reimburses the insurance carriers’ premium tax credits in full.

If the state exchange is implemented, the state would reuse the assessment fee and utilize it to help run the exchange, coupled with any savings, while a portion of user fees could be reinvested into the program.

In total, MDI estimated that the state could save between $137-$196 million over five years by switching to a state-based exchange with estimated annual operation costs at $18-$27 million.

Commissioner Chaney told lawmakers his office supports providing a healthy exchange for Mississippians in lieu of federal efforts to simply move people receiving subsides off the exchange and onto Medicaid.

“The bottom line, that’s why the feds want to try and move people off the marketplace and get them on Medicaid, so they can give them free money. We are against that, I’ll just tell you upfront, so you know where I stand on it,” said Chaney. “I think it’s a bad policy to take people that are paying insurance and give them something for free.”

The Legislature continues to consider a plan aimed at expanding Medicaid. The original House bill has been replaced with Senate language which would only allow expansion in the event of a work requirement waiver approval from CMS for up to the 100 percent of the FPL. The two chambers are expected to conference on the issue in the coming days.