Mississippi House Speaker Rep. Jason White, R-West, speaks about the bipartisan support in the passing of a state incentives package for a Mississippi factory that will manufacture batteries for electric vehicles — a project that promises 2,000 jobs, during a special session of the Mississippi Legislature, Thursday, Jan. 18, 2024, at the Mississippi Capitol in Jackson, Miss. (AP Photo/Rogelio V. Solis)

- Speaker Jason White is rallying support from House members for legislation that will expand Medicaid eligibility despite some state officials and health experts expressing skepticism that a work requirement can be approved by the deadline given.

Mississippi Speaker Jason White said pointedly in an interview on Tuesday there is a Medicaid coverage gap and an answer must be provided addressing it.

“Whether anybody likes it or not, there is a coverage gap of folks who are working and make too much money to qualify for any sort of benefits, but don’t make enough money to pay for private insurance or their employers don’t provide it,” White said in an exclusive interview with Magnolia Tribune prior to his bill, HB 1725, being considered by members.

Speaker White provided insight into the legislation to extend Medicaid eligibility to what he calls “Mississippi‘s working poor. White points out that his bill includes direction to the Division of Medicaid to negotiate with the Center for Medicare and Medicaid Services (CMS) to obtain approval for a work requirement that would limit participation to those actively employed or enrolled full-time in an education program.

He did not shy away from the fact that even if the work requirement is not approved by CMS, Mediciad would be directed to expand the rolls to the new eligibility group with a deadline of September of this year to obtain the work waiver.

The Affordable Care Act originally mandated states expand their Medicaid eligibility to include able-bodied adults without dependents and to raise the income threshold for all adults’ eligibility to 138 percent of the Federal Poverty Level (FPL). The Supreme Court overturned the mandate and expansion was made optional. 40 states have elected to expand to that level since 2014, Mississippi has not.

White’s program, referred to as “Healthy Mississippi Works,” creates a new class of eligible participants, all adults between 19 and 65, and raises the income eligibility threshold to 138 percent of the federal poverty level (FPL). HB 1725 does seek to limit that class with the work requirement proposal and another proposal that would prevent people with private insurance from voluntarily dropping it for a period of twelve months.

“Everyone applauded when the Governor and his Medicaid team found a way to get an enhanced reimbursement for our hospitals, money that came from the federal government and Medicaid through the enhanced reimbursement model,” said White. “Providers agreed to pay a little more tax to draw down federal dollars. Somehow we are okay with that, but folks are very skeptical of this.”

The bill passed out of the House Medicaid Committee Tuesday afternoon following the interview with White.

Currently, individuals earning between 100-138 percent of the FPL in the target population are eligible for subsidized private health plans available on the ACA exchange. Those individuals will become ineligible for the ACA exchange and instead could receive Medicaid coverage if HB 1725 takes effect.

Speaker White referred to his bill as a “pilot program” to establish data regarding this specific population. It does contain a repealer that would bring it back before lawmakers in four years.

White said if the state opts to allow this population to enroll in Medicaid it would change the funding for that portion of the program, with the share being 90 percent federal and 10 percent state.

The federal government currently pays 90 percent of the cost for the expansion population. By contrast, the federal government pays a lower match rate for existing Medicaid populations — 77 percent in Mississippi. Provisions in the bill would discontinue the program if that matching percentage ever went below 90.

The federal government is currently offering states an additional 5 percent match on its entire Medicaid population for a period of two years if they will expand. White said the increase in eligibility would draw down an additional estimated sum of $350 million annually for the two years it is in effect. Due to expiring COVID enhancements, the state’s portion of the Medicaid budget is due to increase by over $500 million in the next two years without expansion, according to testimony by Division of Medicaid Director Drew Snyder.

Speaker White indicated that for the four year “pilot program” period, the increased eligibility would not cost the state any additional money. He attributed that offset to the enhanced reimbursement and a provision to take a four percent premium, or tax, from the Managed Care Organizations (MCOs) who will be required to cover this new eligibility group.

White said they are basing much of their estimates on the anticipation that this could add roughly 220,000 individuals to the medicaid rolls.

“They will be taxed a four percent premium tax and that will fund the state’s 10 percent share,” said Speaker White. “We’re going to tax them on all services they provide to Medicaid. They already serve several other populations of current beneficiaries.”

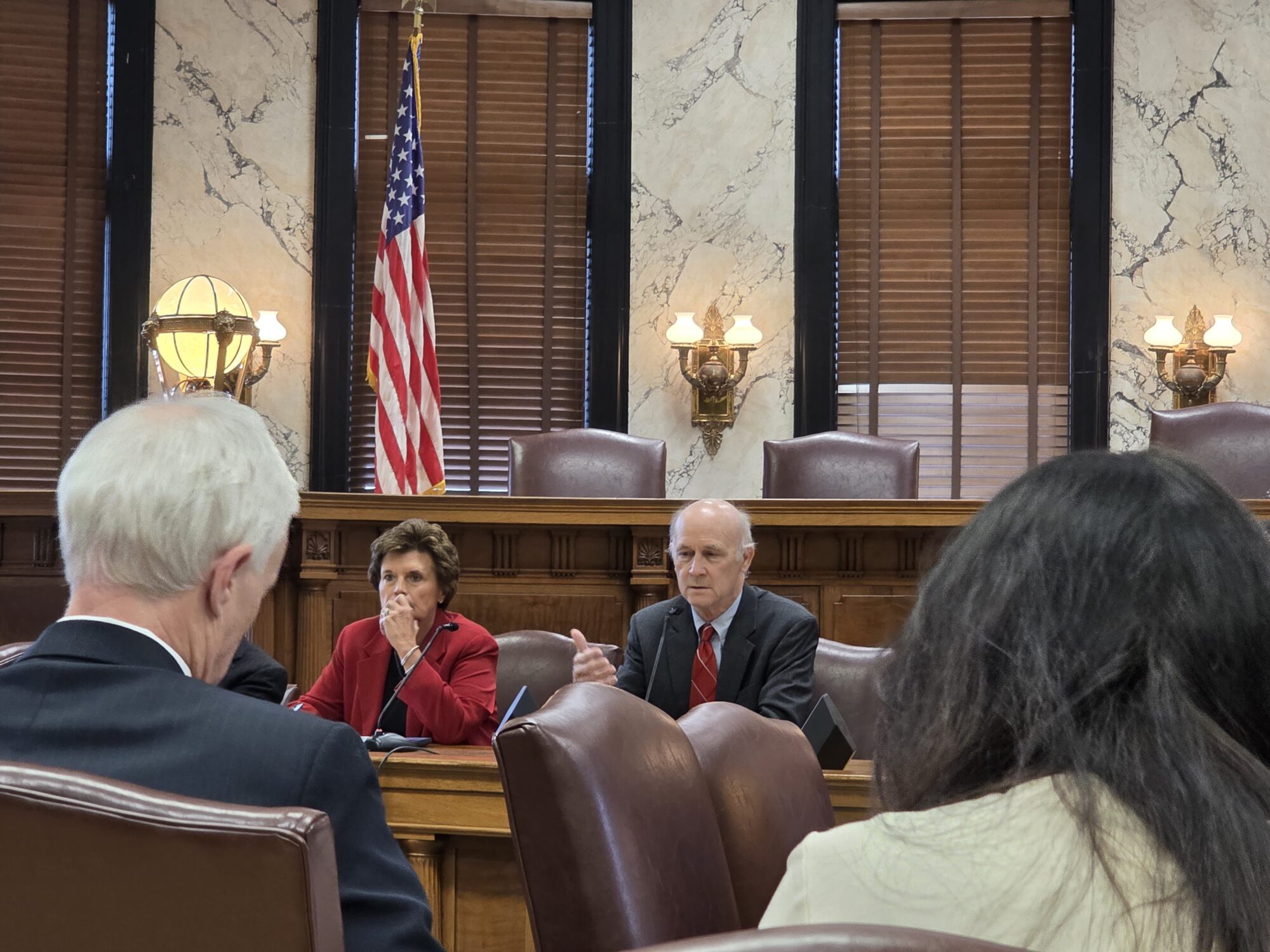

Medicaid Director Drew Snyder told Magnolia Tribune he had questions regarding the funding mechanism for the state share and its potential impact on the state’s current Medicaid population.

He also indicated that waiver requests can be subject to years long negotiations.

“Section 1115 waivers are subject to a great deal of federal discretion, and states typically must engage in a lengthy negotiation process with federal authorities that can take years,” said Snyder. “Without assurances that the state could get federal approval as soon as possible, lawmakers may essentially be passing full Medicaid expansion, which includes non-working adults up to 138% of the federal poverty line.”

He said that the Division of Medicaid will continue to monitor the legislation as it moves through the process.

Commissioner of Insurance Mike Chaney said he does not believe the four percent premium tax to MCOs will cover all of the expected costs to this new group. In conversation with Chaney, he said his recommendation for an expansion would be to allow eligibility up to 100 percent of the FPL instead of the 138 percent.

Current CMS data shows there are roughly 140,000 Mississippians enrolled in ACA exchange plans earning between 100-138 percent of the FP.

Currently, Medicaid allows adult parents and caretakers to apply for Medicaid, but unlike other classes of participants, like children and pregnant moms, the income threshold for these individuals is well below 100 percent of the FPL at 23 percent.

Chaney said this approach would not require the approval of a work requirement waiver by CMS. He also indicated he was skeptical that a work waiver would be approved by current administration.

The Biden administration has not approved any Medicaid work requirement waivers since taking office. Despite the refusal of waivers in other states, Speaker White said he was optimistic that CMS would approve Mississippi’s request.

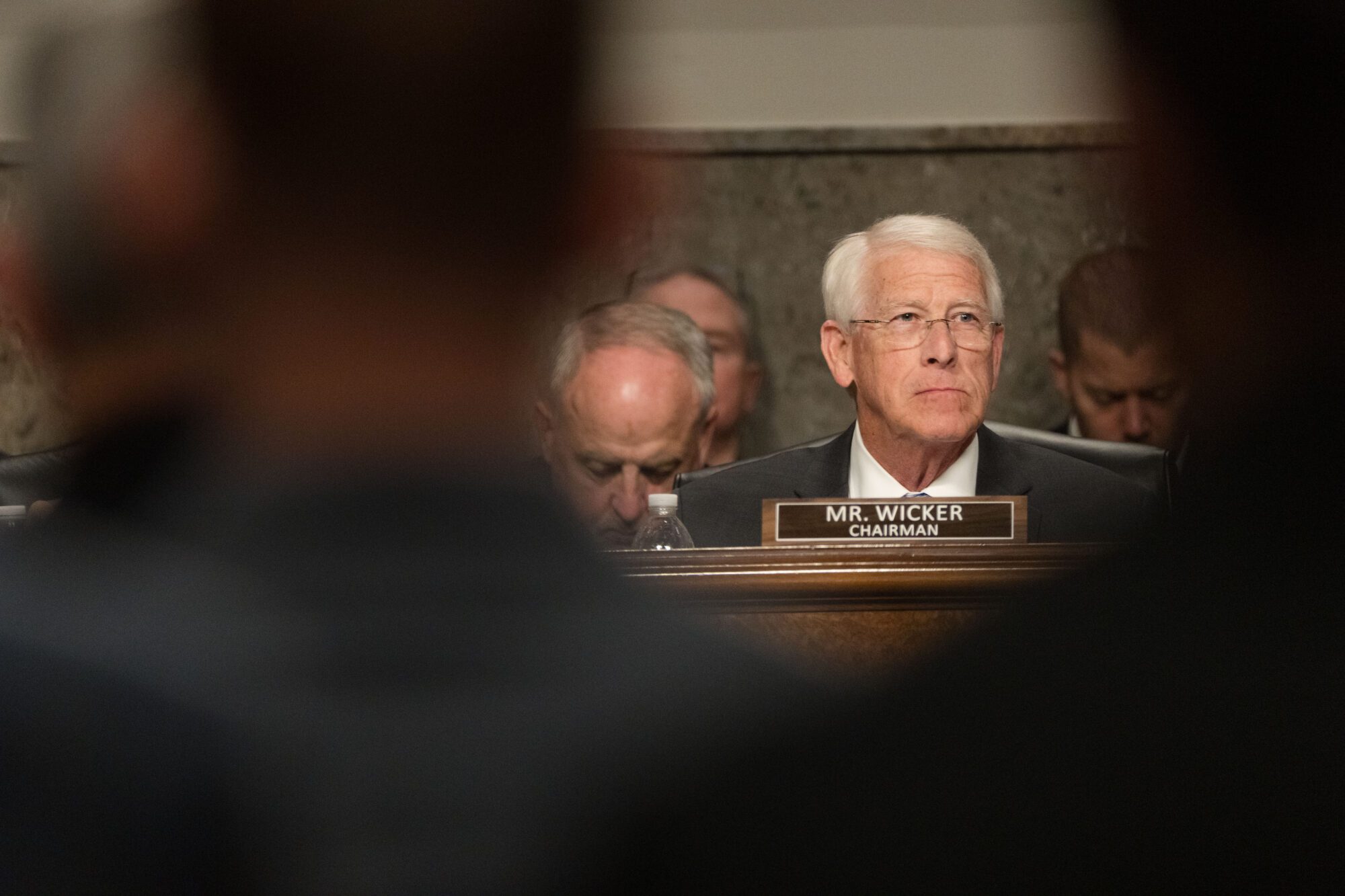

Brian Blase, former White House adviser on health policy for the Trump Administration, was emphatically skeptical that any such work waiver would be considered by the Biden Administration.

“There is no chance Mississippi will get a waiver to implement work requirements from the Biden Administration,” Blase told Magnolia Tribune. “They have spoken out against it and their allies are opposed to it. They do not think work should be a condition of receiving Medicaid.”

Blase added that while the Trump Administration did approve 15 work waiver related requests, all but one have been overturned by the courts, which has set a precedent nationwide. The courts determined that a work requirement was inconsistent with the intent of the Medicaid program.

If eligibility for Medicaid is expanded, it also brings into question whether employers will opt to end health insurance coverage to their employees in lieu of the state plan.

Under HB 1725, individuals are not allowed to voluntarily drop private insurance to enroll in Medicaid without waiting 12 months. However, the bill does not outline specific provisions that would ensure businesses keep private policies in place when their employees could then be eligible for the state plan.

The Affordable Care Act does have penalties related to a company opting out of providing health benefits. Under the ACA, businesses with more than 50 full-time employees are required by law to offer health insurance. There are penalties in place for businesses that lose covered employees to the ACA, to prevent those roll offs. Those penalties are expected to increase this year.

However, insurance benefits are not required for smaller staffed businesses.

“You’re talking about a limited segment. I would just contend that most do not provide any insurance now,” said Speaker White regarding those businesses with less than 50 employees. “For those that do, are they really going to tell their valued employees ‘You’re on your own?’”

A separate piece of legislation filed by State Representative Trey Lamar (R), Chairman of the House Ways and Means Committee, could create incentives for more options, for individuals seeking health insurance.

HB 1647 allows the Department of Insurance (MDI) to establish a state exchange program in lieu of the current federal exchange.

The bill incentivizes insurance companies through a tax credit – 20 percent off their insurance premium tax – to participate in the state exchange. A 20 percent tax deduction for healthcare providers would also be offered to work within the exchange program.

Rep. Lamar said not many providers currently participate in the federal exchange. He hopes this move would change that.

He added that federal subsidies would remain in place.

“This would scrap the federal exchange and implement a state exchange. This would immediately save us money,” said Lamar in the Ways and Means Committee meeting where the bill was passed out Tuesday afternoon.

The state currently pays a 3 percent rate for the federal exchange. If eliminated, that would decrease to 1.5 percent, saving the state $15 million annually. Rep. Lamar said those dollars would be used to run the new program.

Lamar went on to say that roughly 270,000 Mississippians are participating in the federal exchange, but the plans and rates are not top tier. He believes the state based program change could give more and better options to those individuals.

“Health insurance is really expensive,” said Lamar. “We are looking at ways to try and help working Mississippians in our current legal environment to try and gain better and more access to healthcare.”

According to Commissioner Chaney, the department’s potential state-based exchange program would benefit the population that falls between the 100 and 138 percent of the FPL. Chaney recommended that the benefits and provider reimbursements should mirror those currently being offered by qualified health plans within the Health Insurance Marketplace.

The set-up of the exchange would be government operated with rates developed by an independent actuarial firm that is chosen by the regulatory board.

With rising Medicaid costs, the MDI also recommended that current Medicaid categories of eligibility be rolled onto the Managed Care program. MDI said this will allow for budget predictability, a premium tax, lower rates of administrative costs and overall program savings.

It is expected that the change in the exchange will allow for greater competition that will positively impact participants and providers who are in the program. However, Chaney said if expansion is pursued it is unclear how the change to those eligible for Medicaid could impact the exchange as a whole.

“We want the Department of Insurance to come up with the most robust state-run exchange they possibly can, so they need the flexibility to come up with that,” said Rep. Lamar.

Regardless of if the Legislature agrees to move forward with an expansion to Medicaid, Lamar said the state exchange program would be a positive move to healthcare coverage in the state.

The changes to Medicaid are expected to be met with opposition by Governor Tate Reeves, who has been vocal about his reluctance to any expansion of Medicaid rolls.

Speaker White said he believes you can support a conservative Governor like Reeves and be in support of healthcare coverage for the “working poor.”

“I understand the Governor’s position. You won’t hear me say one bad thing about him. Because he is in the Governor’s mansion, this plan is going to be as conservative as it can be, and the guy he’s appointed to run Medicaid is going to be asked to oversee it,” said Speaker White, referring to Medicaid Director Drew Snyder.

The Speaker reiterated that at the end of four years, if his bill passes, lawmakers will have the chance to determine if it was effective or not.