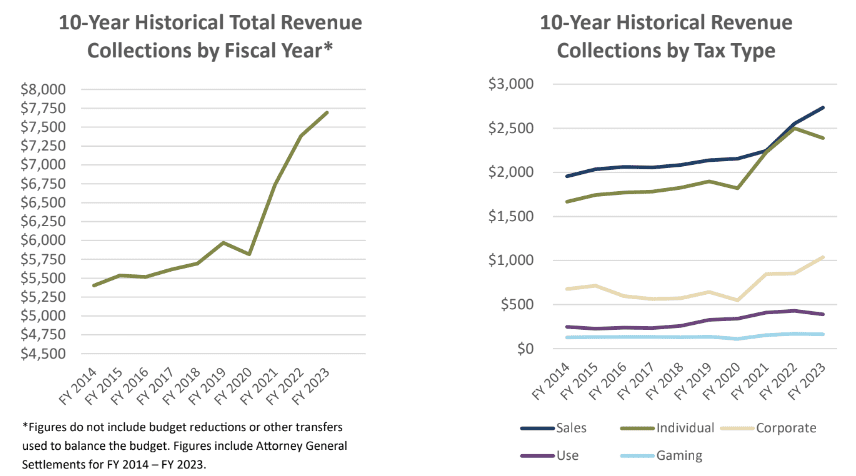

Five months into the fiscal year, the bright spot for Mississippi revenues continues to be sales tax while individual income tax collections decline. Working Mississippians are sending the state less of their paychecks after the 2022 tax cuts.

Five months into the 2024 Fiscal Year and state revenues continue to exceed revenue estimates by $75.9 million.

According to the November revenue report from the Legislative Budget Office, Mississippi brought in $571,498 or 0.11% above the sine die revenue estimate for the month, making the state $75,930,468 or 2.60% above the sine die revenue estimate for the current fiscal year.

The total Fiscal Year 2024 sine die revenue estimate is $7,523,800,000.

Overall general fund collections in November 2023 were $10.4 million or 2.01% above the prior fiscal year.

The bright spot for Mississippi revenues continues to be sales tax collection. Sales taxes in November were above the same month the prior year by $20.6 million. Sales tax collections thus far this fiscal year are outpacing the prior year by $50 million.

In addition, corporate income tax collections for the month of November were also above the same month prior year by $11.9 million.

However, total revenue collection in Mississippi through November 2023 is $42,121,576 or 1.39% below the prior year’s collections.

Revenue collections have been below estimates two of the five months in the current fiscal year.

The reduction in collections is mostly attributable to the state’s reduced income tax following the 2022 tax cuts approved by lawmakers and signed into law by Governor Tate Reeves.

Individual income tax collections for the month of November were below the same month prior year by $12 million. As for Fiscal Year-To-Date, income tax collections are down $68.6 million.

The reduction in income tax collections means working Mississippians are keeping more of their money, which lawmakers have said was the goal in passing the historic tax cut package.

Efforts to fully eliminate the income tax are once again being considered by lawmakers ahead of the 2024 legislative session. Full elimination has been at the forefront of Governor Reeves’ agenda, both during his first term and during his 2023 re-election campaign.

House leaders have repeatedly backed the move but appropriations leaders in the state Senate have thus far been reluctant to endorse the full elimination of the income tax. The Senate leadership’s budgetary approach recently resulted in the lowering of the Fiscal Year 2025 revenue estimate by $113 million.

In November, the Joint Legislative Budget Committee, comprised of Senate and House members as well as the Governor, unexpectedly did not approve the Revenue Estimating Group’s proposed total estimate for FY 2025 of $7.6 billion, choosing instead to put forward the same estimate as the current fiscal year. That action caused a disagreement between the committee and Governor Reeves.

READ MORE: Legislative Budget Committee adjourns without adopting FY 2025 budget recommendation

Reeves expressed concerns that lowering the revenue estimate would limit the Legislature’s ability to provide continued tax relief to Mississippians.

“Arbitrarily lowering the number for no apparent reason hurts our ability to justify tax cuts,” said Governor Reeves in the November meeting. “I’m a very strong proponent of cutting taxes in this legislative session, regardless of what this number is.”

The committee met again this week, yet a FY 2025 budget recommendation was not adopted, as has been the norm in the weeks leading up to the start of a new legislative session. The committee’s estimate is the number the Governor is to base his annual Executive Budget Recommendation which is due January 31st.