Bipartisan Senate Community Development Finance Caucus will support CDFIs and MDIs.

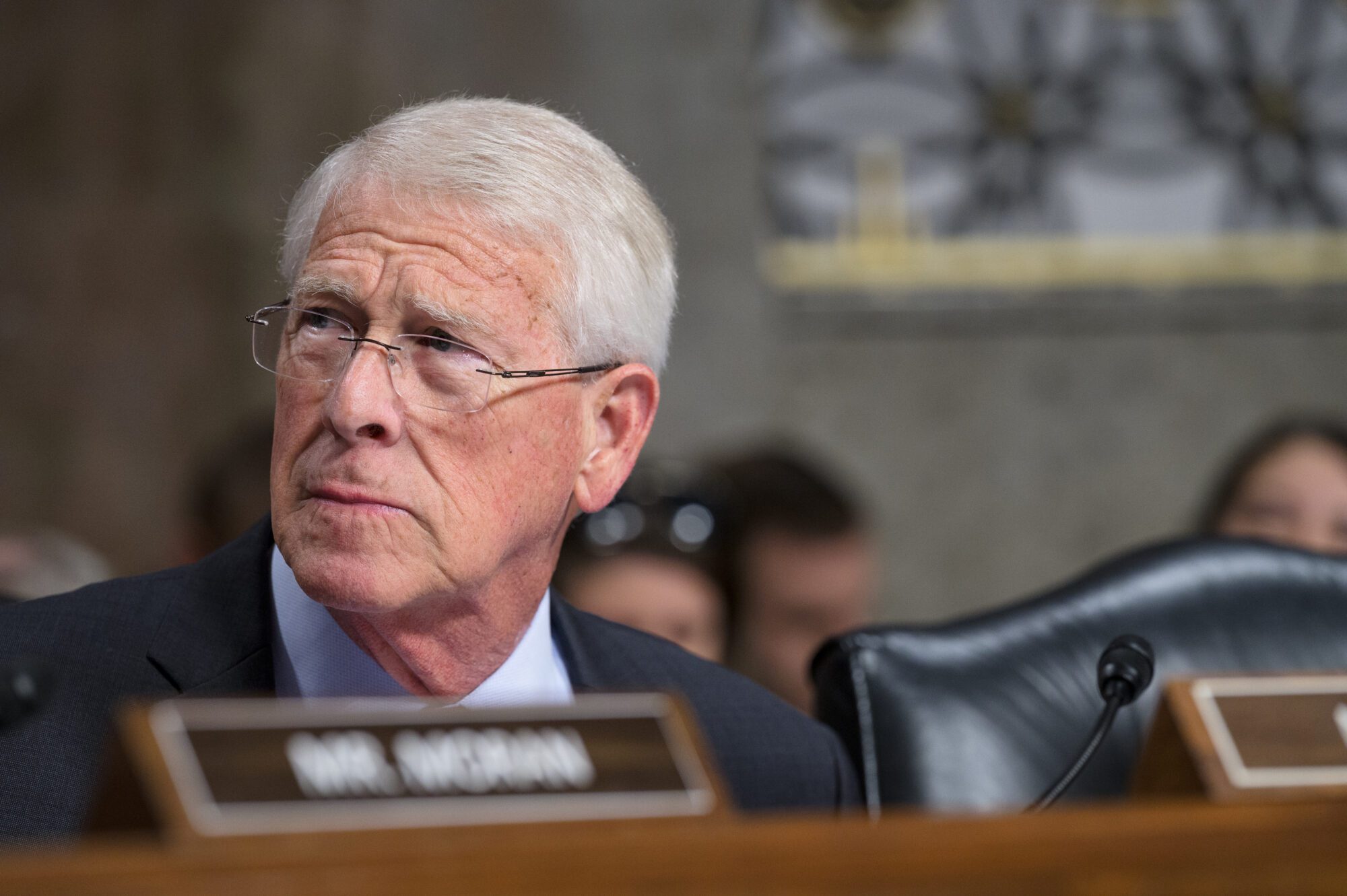

On Monday, U.S. Senator Cindy Hyde-Smith announced she is a founding member of the Senate Community Development Finance Caucus (CDFC). The new caucus is a bipartisan effort to increase opportunities in rural and low-income communities through leveraged lending.

The new caucus is dedicated to supporting the mission of Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs). CDFIs can be banks, credit unions, loan funds, or venture capital funds, all of which play a critical role in providing responsible and affordable credit to underserved communities.

Senator Hyde-Smith said that Mississippi communities use the CDFI resources to maintain and create job opportunities.

“This caucus gives us a new platform from which to increase federal support for these local activities,” Hyde-Smith said. “This is important not only as we tackle high inflation but also look to promote sustained economic growth in rural and underserved communities.”

U.S. Senators Mark Warner (D-Va.) and Mike Crapo (R-Idaho) unveiled the Senate CDFC Monday. In addition to Senator Hyde-Smith, the 14-member caucus includes Senators Amy Klobuchar (D-MN), Mike Braun (R-IN), Jon Ossoff (D-GA), Steve Daines (R-MT), Jack Reed (D-RI), Tina Smith (D-MN), Cynthia Lummis (R-WY), Chris Van Hollen (D-MD), Jerry Moran (R-KS), Rev. Raphael Warnock (D-GA), and Mike Rounds (R-SD).

Senator Warner said that he is happy to announce the creation of this caucus with Senator Crapo to improve communication between industry and policymakers and continue working in a bipartisan fashion towards robust investments in CDFIs and MDIs.

“CDFIs and MDIs play an essential role in providing access to capital in underserved communities. While Congress took significant steps to support community-based lenders over the last two years on a bipartisan basis, CDFIs continue to need more long-term patient capital, operating capital, and resources to modernize their systems and compete in an era of rapid financial innovation,” said Senator Warner.

Senator Crapo said that he has consistently heard positive news and success stories about CDFIs in Idaho and across the country, and their responsiveness to the small business community, particularly during these last few challenging years of the pandemic,

“Sen. Warner and I are proud to launch this caucus to educate members and staff about the important role CDFIs play in their communities, and to create a forum to share ideas and policy proposals that foster strong economic growth in local communities,” Crapo continued.

Numerous organizations and financial institutions support the Senate CDFC, including the Jackson-based Hope Credit Union, National Bankers Association, Community Development Bankers Association, Opportunity Finance Network, African American Credit Union Coalition, CDFI Coalition, and others.