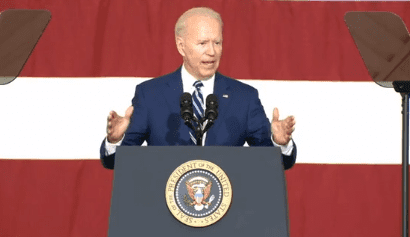

Senator Wicker says changing the definition does not take away the pain that President Biden’s economy is inflicting on Americans.

On Thursday of this week, the U.S. Department of Commerce is set to release the second-quarter gross domestic product reading.

In a statement released on July 20, the Senate Republican Policy Committee pointed out that the economy shrank by 1.6% in the first quarter of this year.

The Federal Reserve Bank of Atlanta forecasts a 1.6% decline in gross domestic product in the second quarter as well.

“Some economists are predicting a recession by the end of the year. Producer prices have increased by double digits since December, hitting 11.3% inflation in June. This reflects more price pressure in businesses’ supply chains and potentially higher consumer prices down the line,” the Senate Republican Policy Committee said.

The Committee went on to say that the labor market shrank in June by more than 350,000 people, and labor force participation still has not recovered to its pre-pandemic level.

“Initial jobless claims have edged higher in recent weeks. To try to control runaway inflation, the Federal Reserve is expected to implement another interest rate hike of 0.75% later this month, which will make borrowing more expensive and further tamp down demand. The rapid increase in rates adds to the likelihood of a recession,” the Senate Republican Policy Committee continued.

Last week, members of the White House Council of Economic Advisors wrote in a blog post that it is “unlikely” that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.

The organization asks the question, “What is a recession?” and defines it as a significant decline in economic activity that is spread across the economy and lasts more than a few months.

“While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle,” the organization wrote.

Yet, two quarters has been the standard in government and within the media, that is until this White House has seemingly redefined it.

“Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession,” the White House Council of Economic Advisors continued.

On NBC News’ “Meet the Press,” Treasury Secretary Janet Yellen acknowledged high inflation and slowing job growth but said the economy is not in a recession. She said the nation is in a period of transition where growth is slowing.

On the possibility of a recession in the future, the Treasury Secretary said that she believes there is a path to keep the job market up and inflation down.

“The labor market is now extremely strong,” Yellen said. “This is not an economy that’s in recession, but we’re in a period of transition in which growth is slowing. And that’s necessary and appropriate, and we need to be growing at a steady and sustainable pace. So there is a slowdown, and businesses can see that and that’s appropriate, given that people now have jobs, and we have a strong labor market.”

“But you don’t see any of the signs now – a recession is a broad-based contraction that affects many sectors of the economy. We just don’t have that,” Yellen added. “I would say that we’re seeing a slowdown.”

U.S. Senator Roger Wicker (R-MS) said that changing the definition of a recession does not take away the pain that President Biden’s economy is inflicting on the American people.

Changing the definition of a recession does not take away the pain @POTUS’s economy is inflicting on the American people. https://t.co/8FNB2Jn8Yd

— Senator Roger Wicker (@SenatorWicker) July 25, 2022

U.S. Senator Cindy Hyde-Smith (R-MS) said noted that “if you ever took a high school economics class, you probably learned that if inflation is at a 40-yr high and an economic recession is a real possibility, then raising taxes and piling on more spending is a no good, very bad idea.”

If you ever took a high school economics class, you probably learned that if inflation is at a 40-yr high and an economic recession is a real possibility, then raising taxes and piling on more spending is a no good, very bad idea…https://t.co/EYIxvoEBjP

— U.S. Senator Cindy Hyde-Smith (@SenHydeSmith) July 11, 2022

It was also reported on Friday that the labor market is cooling, with unemployment filings rising to the highest weekly level since November 2021.